- First Helium (TSXV:HELI) has successfully completed its field survey activities and selected the surface location for its Leduc anomaly test well, set to be drilled this winter

- To date, First Helium has drilled two successful Leduc oil wells at Worsley, including the notable 1-30 and 4-29 discoveries

- Together, these wells have produced over 113,000 barrels of light oil, generating more than $13 million in revenue and contributing $8 million in cash flow to the company

- First Helium stock (TSXV:HELI) opened trading at $0.045 per share

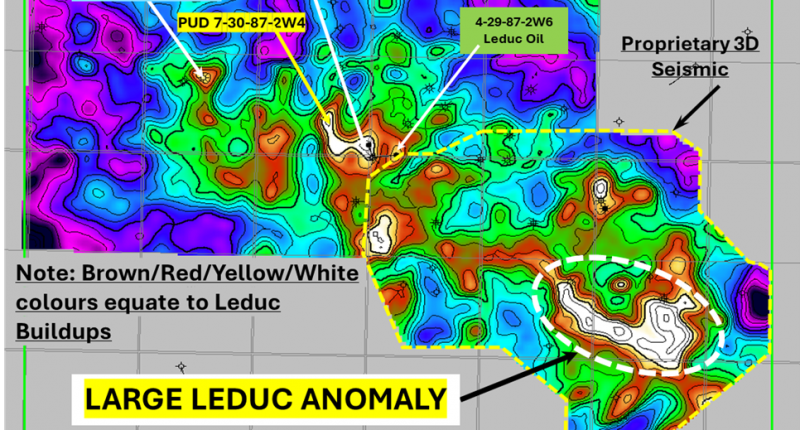

First Helium (TSXV:HELI) has successfully completed its field survey activities and selected the surface location for its Leduc anomaly test well, set to be drilled this winter. This move follows a comprehensive evaluation of proprietary 3D seismic data, which revealed a significant anomaly in the Leduc Formation, believed to be prospective for oil.

To date, First Helium has drilled two successful Leduc oil wells at Worsley, including the notable 1-30 and 4-29 discoveries. Together, these wells have produced over 113,000 barrels of light oil, generating more than $13 million in revenue and contributing $8 million in cash flow to the company.

Worsley Winter Program highlights

This winter, First Helium plans to undertake several key operations at Worsley, focusing on the Leduc Formation:

- Drilling of a transformational structure: The company aims to drill a potentially game-changing structural feature in the Leduc Formation, targeting oil with the added potential for helium-enriched natural gas. If successful, this well could be brought into production within two to three months. The anomaly is significantly larger than previous discoveries, with an aerial extent more than five times that of the 1-30 pool.

- Additional drilling targets: First Helium has also identified three additional Leduc drill targets based on its seismic data. Notably, one of these locations, designated “7-30,” has been assigned 196,700 barrels of “proved plus probable undeveloped” oil reserves by Sproule, the company’s independent evaluator. Depending on capital availability and timing, First Helium may pursue these additional targets.

- Completion of blue ridge formation well: The company plans to complete and test the previously drilled 5-27 horizontal Blue Ridge Formation well. This initiative aims to establish a repeatable, high-margin helium-enriched natural gas play, potentially delivering significant volumes of helium gas production. The scale and profitability of this project are expected to attract partnership opportunities.

Management commentary

“The completion of our recent financing will allow us to proceed with a number of operations this winter, which include testing the large 3D seismic anomaly targeting Leduc oil, and completing the previously drilled Blue Ridge horizontal well targeting helium-enriched natural gas,” First Helium’s president and CEO, Ed Bereznicki said in a news release. “If successful, these operations will set the stage for immediate cash flow for the Company, coupled with the accelerated development of oil and helium enriched natural gas at Worsley, executed alone or with larger partners.”

First Helium Inc. is an independent provider of helium gas in North America. The company is focused on exploring for and developing helium reserves in the Western Canadian Sedimentary Basin.

First Helium stock (TSXV:HELI) opened trading 12.50 per cent higher at $0.045 per share and has lost 43.75 per cent since the year began.

Join the discussion: Find out what everybody’s saying about this stock on the First Helium Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image First Helium Inc.)