- EV stock First Hydrogen (TSXV:FHYD) has signed a non-binding letter-of-intent to source e-vans from a large German multinational automotive manufacturer

- The letter enables near-term sales of a hydrogen-powered-fuel-cell light commercial vehicle in the North American market

- First Hydrogen specializes in zero-emission vehicles and green hydrogen production and distribution

- First Hydrogen stock has given back 65.07 per cent year-over-year, but has gained 216.67 per cent since 2020

EV stock First Hydrogen (TSXV:FHYD) has signed a non-binding letter-of-intent to source e-vans from a large German multinational automotive manufacturer, enabling near-term sales of a hydrogen-powered-fuel-cell light commercial vehicle (FCEV) in the North American market.

The company will integrate its hydrogen-fuel-cell powertrain into the e-vans supported by its partner’s engineering, technicians and certifications, as well as a series of milestones that substantiate the FCEV’s strong market potential, including:

- a peak range of 630 kilometres (400 miles) on a single refueling

- successful trials with a large multinational logistics company in London, U.K., where the EV operated for more than 8 hours per day and completed multiple deliveries per hour

- an output of 60 kW in transient accelerations, offering drivers power on demand when traversing hilly terrain, carrying heavier payloads, or traveling with onboard equipment

The company’s latest prospect, an industrial fleet operator in Mexico, could lead to fleet upgrades to FCEVs and the deployment of countrywide hydrogen refueling station infrastructure. According to the Asociación Mexicana de Hidrógeno, at least 15 hydrogen projects are under development in the country, representing about 7 gigawatts of green hydrogen or US$20 billion in capital expenditures.

Leadership insights

“This collaboration will provide us access to acquire vehicles, integration capabilities and technical support to bring our FCEVs to the North American market,” Balraj Mann, First Hydrogen’s chief executive officer, said in a statement. “We were the first to the market with our two original FCEVs, which now have completed four successful trials in the U.K. The company continues to receive interest to trial the FCEVs with strong interest from North America.”

About First Hydrogen

First Hydrogen specializes in zero-emission vehicles and green hydrogen production and distribution. The company has designed and built hydrogen-fuel-cell-powered light commercial vehicles in partnership with AVL Powertrain and Ballard Power Systems. It is also developing a 35 MW green hydrogen production facility and vehicle assembly factory in Quebec.

First Hydrogen stock (TSXV:FHYD) last traded at C$0.95 per share. The stock has given back 65.07 per cent year-over-year, but has gained 216.67 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this EV stock on the First Hydrogen Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

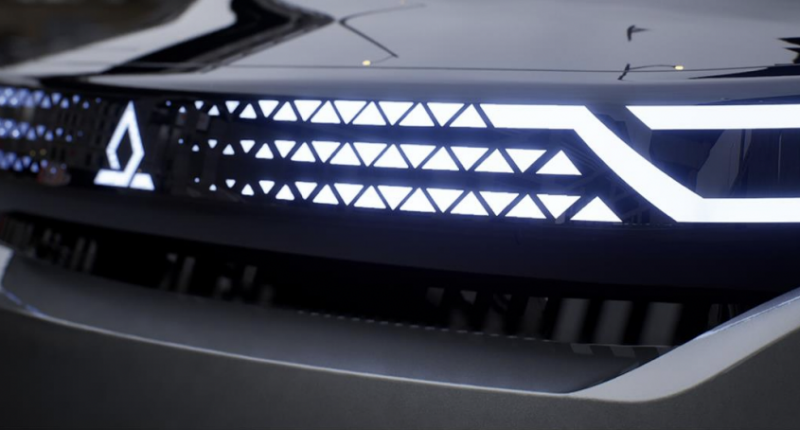

(Top photo of hydrogen-powered-fuel-cell vehicle: First Hydrogen)