The Canada Pension Plan (CPP) is a monthly, taxable benefit to partially replace your income after you retire and for the rest of your life. To qualify, you must be a minimum of 60 years old and have made at least one valid contribution to the pension, most likely as a percentage of your paycheck.

CPP payments are calculated by the age you start to receive your pension, how much and for how long you contributed for, and your average earnings across your working life. For context, the average monthly amount paid for a new pension at age 65 in January 2024 was C$831.92 out of a maximum of C$1,364.60.

CPP Investments, the Crown Corporation in charge of running the CPP, is tasked with building and sustaining an investment portfolio to meet the needs of approximately 21 million contributors and beneficiaries. Its investment strategy, geared towards generational growth and wealth preservation, has yielded a 9.3 per cent return over the past decade ending in 2023 – comfortably ahead of the TSX’s 6.7 per cent – having accumulated approximately C$590.8 billion in assets under management as of Dec. 31.

While institutional portfolios are vastly different in scope compared with individual investors, CPP’s strategy offers key lessons for Stockhouse readers when it comes to financial planning, portfolio construction and risk management on the road to fulfilling their financial goals.

1. Global diversification

CPP Investments structures its portfolio to thrive in up and down markets, without having to depend on the performance of any one country, currency or region. In this way, it minimizes risk and establishes long-term resiliency so your monthly cheques keep rolling in uninterrupted.

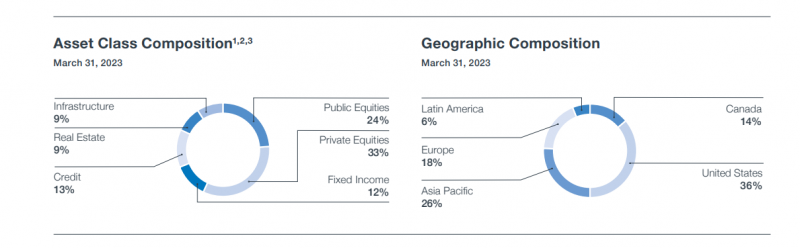

To this end, the Crown Corporation holds positions in all major asset classes, including public equities, private equities, fixed income, credit, real estate and infrastructure, as well as across 55 developed and emerging countries, with individual weightings determined by risk-return analysis from the institution’s many boots on the ground around the world. Here’s a snapshot of the CPP portfolio as of March 31, 2023:

The portfolio, rebalanced yearly to right-size risk, is a testament to how investors can benefit from owning a little bit of everything, contingent on risk tolerance and risk capacity, to ensure a smoother ride over an investment lifetime. When a certain sector or section of the world endures harsher economic conditions, leading to downward price pressure, other portfolio holdings will be thriving and carrying most of the weight, eventually resulting in positive long-term returns in line with market history.

Without counting private equity, which requires investors to be accredited to participate, you can replicate the CPP’s portfolio by investing in a market capitalization-weighted portfolio of index funds. Supposing you are multiple decades away from retirement, and don’t need any bonds to preserve value and smooth out volatility, you could pick up units in Vanguard’s all-stock index fund portfolio, VEQT, whose current allocation stands at 45.69 per cent U.S., 29.12 per cent Canada, 18.57 per cent Developed ex-North America, and 6.62 per cent Emerging Markets.

Sharp readers will note that Canada’s global market capitalization is closer to 3 per cent than 30, pointing to VEQT’s and CPP Investments’ home-country bias. This common and controversial feature, which is often justified for psychological reasons, is one many would like to see expanded within CPP to foster innovation and bolster economic resiliency.

2. Time in the market beats timing the market

The CPP must serve Canadians over multiple generations, requiring a time horizon well beyond that of average individual investors, who may save more than 30 or 40 years in the workforce before retiring and relying on their portfolios for income. The most recent report by the Chief Actuary of Canada demonstrates the CPP to be sustainable over the next 75 years.

The fund can hold on to its investments and capitalize on buying opportunities during market downturns thanks to its large scale and predictable cash flows from contributions, which expose it to deal flow smaller players wouldn’t have access to. In this way, CPP Investments can absorb short-term volatility and meet redemption requests, while taking full advantage of long-term compound interest.

Individual investors would be wise to follow CPP’s lead and sock money away they don’t need for at least 20 years, the minimum holding period to ensure you earn a return on stocks, according to an Oppenheimer study on the S&P 500’s performance since 1950. From a broader perspective, a portfolio of globally diversified stocks has generated about 5 per cent above inflation going back to 1900.

When we compare these returns to those of day traders, more than 80 per cent of which will lose money by this time next year, it becomes clear that, when it comes to your financial future, the slow and steady approach is the only rational way forward.

3. Biting off what you can chew

The team at CPP Investments, like any prudent allocator, knows to take only enough risk to meet its objectives, which are to let its holdings grow, meet redemption requests, and generate enough dry powder to make new value-accretive investments. Expressed as a portfolio, this level of risk translates into 85 per cent global stocks and 15 per cent Canadian government bonds, an aggressive allocation positioned to maximize long-term returns.

According to historical data from Canadian Portfolio Manager, a portfolio in the 80/20 range could swing by an average of 9.35 per cent in either direction in any given year, and might experience a maximum drawdown of a third or more, with the owner having to wait almost four years for their investments to recover.

If you believe yourself able to withstand these fluctuations, you stand to reap an annualized return of about 7 per cent, based on the past 20 years of performance data, in the wheelhouse of what CPP has been able to achieve over the past decade.

Conversely, if the thought of losing a third of your money would keep you up at night, or if 7 per cent won’t quite cut it in terms of meeting your financial goals, you can use CPP as a guide to finetune your asset allocation using Portfolio Visualizer’s back-testing tool. Simply input the ticker symbols for stocks or funds you’d like to test, with the aim of building a portfolio aligned with what you’re investing for, how long you have to invest, and how you react during periods of market volatility.

4. A research process tailored to your needs

Backed by billions in yearly contributions, CPP has the capital to hire hundreds of specialists, whose sole job is to research and allocate into prospective investments based on current market conditions. This means identifying undervalued investments to buy, overvalued investments to sell, as well as opportunities to use leverage, with eyes on generating as high of a return as possible without putting pension recipients at undue risk.

The CPP portfolio also directly owns real estate, infrastructure and controlling interests in businesses, allowing managers to play an active role in day-to-day operations, and build on the institution’s legacy of promoting enhanced governance, environmental, social and operational corporate practices.

As an individual investor, the question to ask here is, how do your skills and temperament match up with someone who makes investing and building businesses their livelihood?

Are you among the less than 30 per cent of do-it-yourself investors who make money by discovering mispriced stocks, buying them against the herd, and holding them through volatility to come out ahead? Or are you better suited to passively investing in broad-market index funds, a proven rinse-and-repeat strategy, and using the extra time for passions and family?

If you decide to go the stock-picking route, you should have a clear sense of why you’re positioned to beat the odds and shoot for the moon, when the portfolios of so many flounder at the task.

5. Playing your game

CPP’s billions in predictable annual contributions allow it to participate in large transactions capable of moving the needle on its growing asset base. These include the US$1.6 billion acquisition of the 99¢ Only Stores franchise in 2012, the US$20 billion acquisition of data and financial technology platform Refinitiv in 2018, a C$7.1 billion investment in a 50 per cent stake in the Highway 407 Express Toll Route, billions put to work with leading investment managers, and interests in numerous real estate properties across the world.

The institution thinks big with its investments because it has no other choice, having to dip its toes across the investable universe using sophisticated tools, systems and analytics to ensure a more stable retirement for millions of Canadians. To leave a stone unturned could mean reduced long-term returns, and the difference between financial independence and someone’s golden years shimmering less than they should.

The scope of an individual investor’s potential allocations requires far less exoticism, in comparison, for the simple reason that what counts as a meaningful amount of money for you or me has little to do with the high-magnitude decisions CPP Investments makes every day.

For a portfolio to make a difference in an average person’s life, like enabling part-time instead of full-time work, the purchase of a house, or taking care of a loved one’s expenses, its value will have to grow into, at minimum, the hundreds of thousands of dollars. And the only way to get there, knowing what we know about the state of most day traders’ bank accounts, is to invest in stocks – the asset class with the highest historical long-term returns – ideally over a few decades.

Instead of pursuing investment growth by playing the role of multi-asset ninja, and running the risk of losing money in an attempt to get rich quick, individual investors owe it to their future selves to stick with established sources of stock market returns, and gain exposure to them either through index funds or a highly refined due diligence process.

Do you invest actively, passively, or both? How does your approach translate into an asset allocation? Join the discussion: Learn what other investors are saying about investment fundamentals and the Canada Pension Plan on Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.