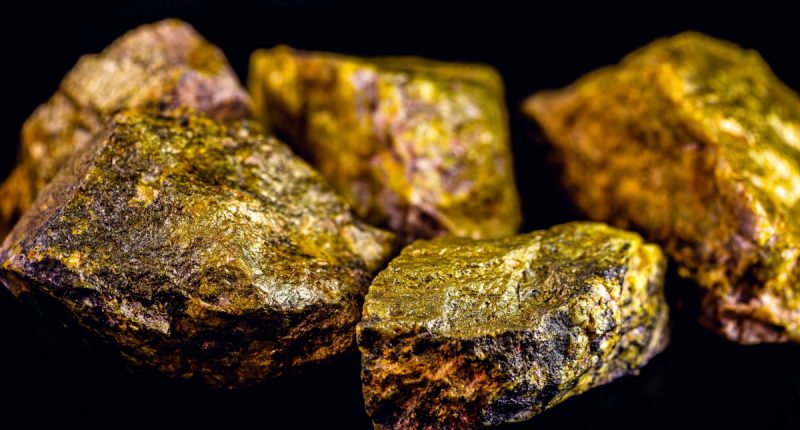

- Namibia is the world’s second-largest uranium-producing country and holds the world’s fifth-largest uranium total resource

- Uranium prices extended a rally to above C$70 per pound at the end of April, a high not seen in nearly six months in the face of lower supply and higher demand

- Uranium production has been negatively impacted by continued water supply disruptions

- Forsys Metals Corp. (TSX:FSY) opened trading at $0.42 and Madison Metals Inc. (CSE:GREN) opened trading at $0.38

Namibia is the world’s second-largest uranium-producing country and is home to the world’s fifth-largest uranium total resource.

Uranium’s current run has seen prices reach above C$70 per pound at the end of April, a high not seen in nearly six months, but in the face of lower supply and higher demand, anything is possible.

With boots on the ground in the country, Forsys Metals Corp. (TSX:FSY) has been advancing its Norasa Uranium Project.

Forsys’ team recently began a 4,100 metre drilling program at the project that aims to retrieve fresh samples at depths of up to 420 metres from the slope areas for both the planned mining pits at Valencia and Namibplaas.

The project is wholly-owned by the company’s subsidiary Valencia Uranium (Pty) Ltd. and comprises the Valencia Uranium Project (ML149) and the Namibplaas Uranium Project (EPL3638) in the Erongo region.

The focus of the drilling program aims for:

- Geotechnical logging and sampling for geo-mechanical testing for optimizing pit designs

- Testing the continuity of mineralization for optimized resource modelling

- Sampling for metallurgical test work and for optimized processing design and resource block modelling of the orebodies

FSY stock has risen 2.4 per cent since this news came out and opened trading at $0.42.

Another Canadian miner operating in Namibia, Madison Metals Inc. (CSE:GREN) recently agreed to extend the closing of its Khan Project with an arm’s length vendor.

Khan covers Mining Licence 86A and Exclusive Prospecting Licence 8905 in Namibia. ML86A and EPL-8905 are key licences to expand Madison’s land holdings around producing uranium mines in the province of Erongo. Together, they form a contiguous land package of 7.86 km2 immediately southwest of the Rössing Mine.

The company’s Executive Chairman and CEO, Duane Parnham called the results from the initial ground prospecting survey “extremely encouraging” and will be released once all the data has been fully analyzed.

Madison has made advanced payments of C$170,000 towards the final closing price of the Khan Project transaction.

GREN opened trading at $0.38 per share and has risen 20.3 per cent year-to-date.

The mining sector significantly increased its contribution to the country’s GDP from 9.2 per cent in 2021 to 12.2 per cent last year, according to Namibia’s Chamber of Mines 2022 Annual Review. However, the review also found that uranium production sustained a negative impact from continued water supply disruptions.

Namibia’s mining sector just recorded a year of strong growth in 2022 of 21.6 per cent, compared to 11 per cent in 2021.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.