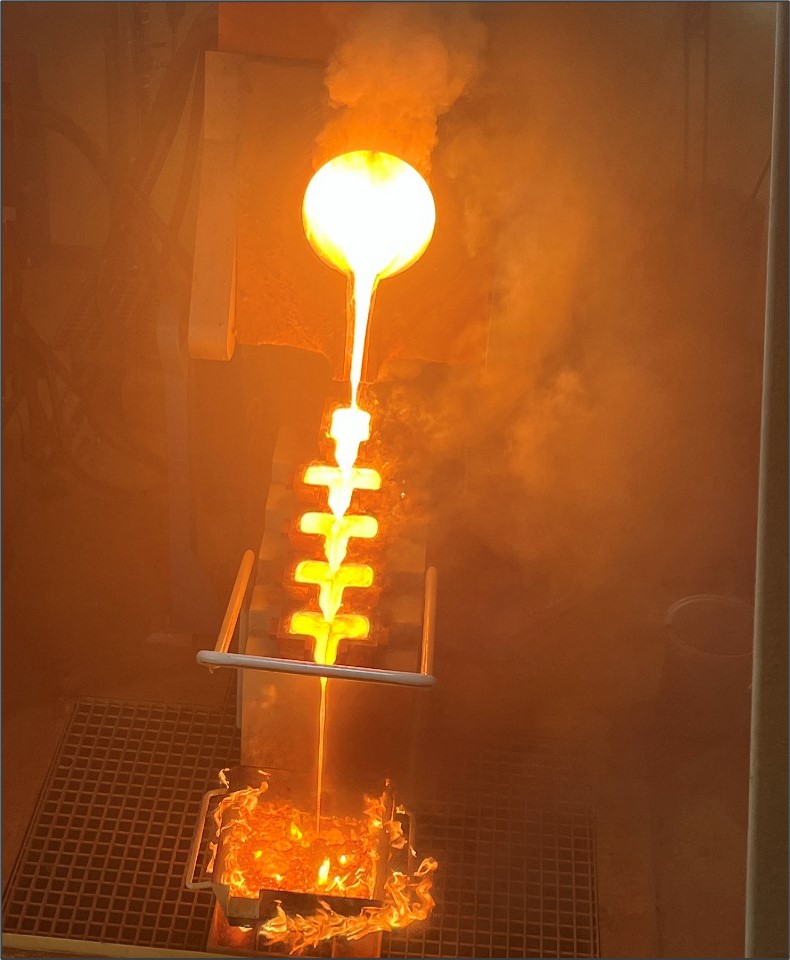

- Endeavour Mining (TSX:EDV) achieved its first gold pour from its 80%-owned Lafigué mine in Côte d’Ivoire on Friday on budget, a quarter ahead of schedule and only 21 months after construction

- The project is expected to produce between 90,000-110,000 ounces of gold in FY 2024

- Endeavour is a senior gold producer and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso

- Endeavour Mining stock has given back 9.46% year-over-year, but has gained 34.48% since 2019

Endeavour Mining (TSX:EDV) achieved its first gold pour from its 80%-owned Lafigué mine in Côte d’Ivoire on Friday on budget, a quarter ahead of schedule and only 21 months after construction.

Since the start of wet commissioning on May 30, 2024, Lafigué has processed about 77,000 tonnes of ore, with the first gold pour yielding about 380 ounces of gold. The project is expected to produce between 90,000-110,000 ounces of gold in FY 2024 at industry leading all-in sustaining costs of between US$900-US$975 per ounce, with production increasing to about 200,000 ounces in FY 2025.

The company intends to ramp up to nameplate plant capacity of 4 million tonnes per year (Mtpa) by Q3 2024 supported by more than 1.8 Mtpa of ore at 1.37 grams per tonne of gold totaling more than 80,000 ounces mined and stockpiled. The project boasts more than 2.7 million ounces (Moz) of gold proven and probable, in addition to an estimated 1.2 Moz of indicated resources still to be discovered by 2025.

Lafigué is Endeavour’s fifth project in West Africa over the past decade, all of which it has delivered on budget and on or ahead of schedule in two years or less. The company will now turn its attention to the 4.7-million-ounce Assafou deposit on its Tanda-Iguela property, also in Côte d’Ivoire, where it sees the potential for a cornerstone asset to drive long-term growth.

Leadership insights

“We are proud to have achieved our first gold pour at Lafigué, which, alongside the first gold pour at the Sabodala-Massawa BIOX expansion that we achieved in April, marks the successful completion of the recent phase of investment and growth that we started in Q2 2022,” Ian Cockerill, Endeavour Mining’s chief executive officer, said in a statement. “We now begin a new phase of increased free cash flow generation, de-levering and enhanced shareholder returns. The Lafigué project is the fifth project that we have successfully built in West Africa in the last decade, which is a testament to the strength of our in-house project construction team and is a demonstration of our competitive advantage in West Africa, the world’s most prospective and largest gold producing region.”

“Lafigué is an excellent example of our ability to leverage this advantage by self-generating a project pipeline,” he added. “We discovered Lafigué for a cost of US$31 million, equivalent to an industry-low discovery cost of just US$12 per ounce of measured and indicated (M&I) resources. The project was quickly advanced through technical studies and permitting, before construction was launched in Q4 2022, and first gold was delivered only 21 months later for a low capital intensity of approximately US$150 per ounce of M&I resources. In less than eight years we have transformed Lafigué from a discovery to production, creating a cornerstone asset that has the potential to produce over 200,000 ounces of gold per year, at an industry leading all-in sustaining cost of approximately US$900 per ounce for at least 13 years, improving the quality of our existing portfolio.”

About Endeavour Mining

Endeavour is a senior gold producer and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso, in addition to a strong portfolio of advanced development projects and exploration assets across West Africa.

Endeavour Mining stock (TSX:EDV) last traded at C$28.90 per share. The stock has given back 9.46% year-over-year but has gained 34.48% since 2019.

Join the discussion: Find out what everybody’s saying about this gold stock on the Endeavour Mining plc Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Endeavour Mining’s Lafigué project in Côte d’Ivoire: Endeavour Mining)