- G Mining Ventures (TSX:GMIN) posted a profitable 2024 after only four months of commercial production from its flagship Tocantinzinho gold mine in Brazil

- The company is actively exploring and developing two other mining projects in Brazil and Guyana, the latter expected to reach the feasibility stage in April

- G Mining Ventures acquires, explores and develops precious metal projects and is positioned to grow into a mid-tier producer

- G Mining Ventures stock has added 140.08 per cent year-over-year and over 400 per cent since adopting the G Mining Ventures name in October 2020

G Mining Ventures (TSX:GMIN) posted a profitable 2024 after only four months of commercial production from its flagship Tocantinzinho gold mine in Brazil. Here are the highlights, reported in US$:

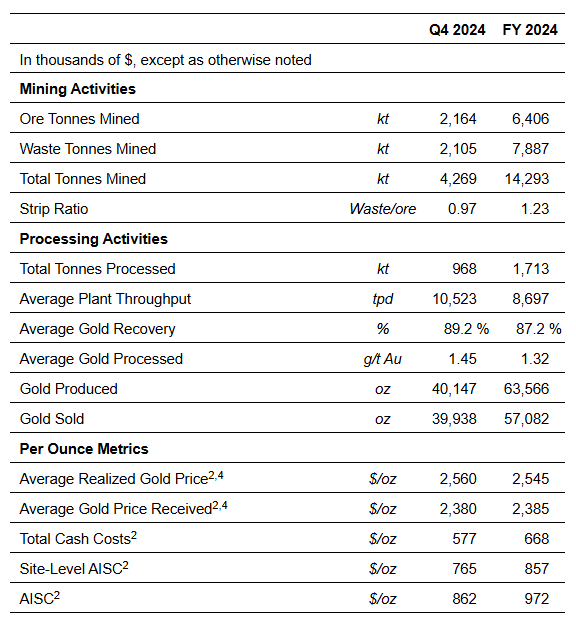

Operational results

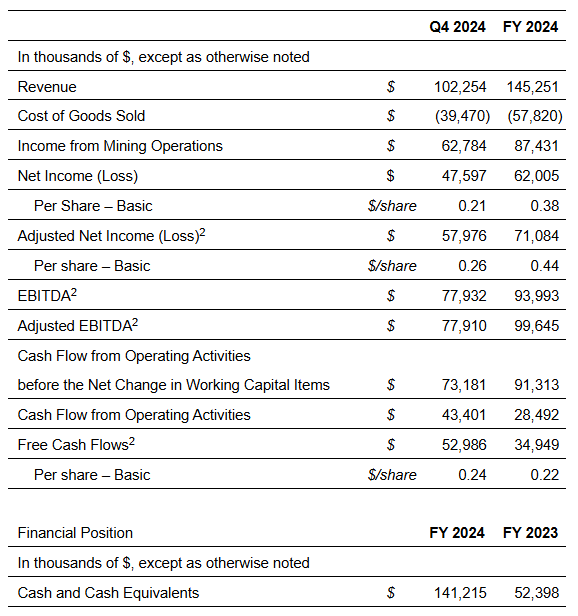

Financial results

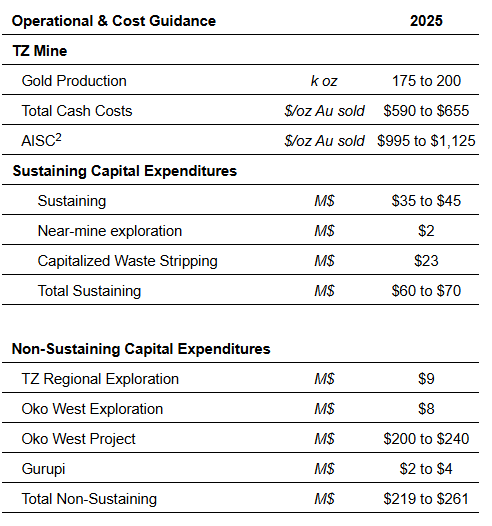

2025 outlook

G Mining’s 2025 guidance, originally released in January, includes a feasibility study for its Oko West project in Guyana scheduled for April, followed by a construction decision, contingent on financing, in the second half of the year. Oko West’s 2024 PEA substantiates an after-tax net present value (5 per cent) of US$1.4 billion.

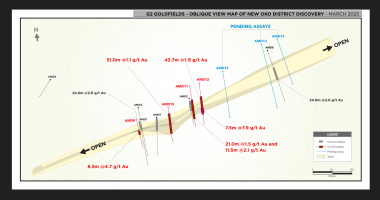

The company will also continue to evaluate the prospectivity of its recently acquired Gurupi project in Brazil, where in February it established an updated NI 43-101 resource of 1.83 million ounces of gold indicated and 0.77 million ounces inferred.

Leadership insights

“2024 marked a transformational year for G Mining Ventures as we executed all phases of our Buy, Build and Operate strategy,” Louis-Pierre Gignac, president and chief executive officer, said in a statement. “With just four months of commercial production, Tocantinzinho is already generating significant free cash flow, giving us the financial flexibility to fund our next phase of growth. The acquisition of Oko West, recognized as one of the top undeveloped gold projects globally, positions us to surpass 500,000 ounces of annual production. Combined with the high-potential Gurupi project acquired from BHP, G Mining is firmly established as a low-cost, high-growth gold producer with a clear path to long-term value creation.”

“With a full year of production coming out of Tocantinzinho in 2025, we expect strong cash flow to support disciplined investment in Oko West and strategic exploration across our portfolio,” Gignac continued. “Key milestones—Oko West’s feasibility study, permitting and funding—are on track to unlock our next phase of growth. G Mining remains focused on low-cost production, project execution and advancing our multi-asset platform.”

About G Mining Ventures

G Mining Ventures acquires, explores and develops precious metal projects and is positioned to grow into a mid-tier producer. The company’s flagship and producing Tocantinzinho gold mine in Brazil is supported by the Oko West gold project in Guyana and the Gurupi gold project in Brazil.

G Mining Ventures stock (TSX:GMIN) last traded at C$18.15 per share. The stock has added 140.08 per cent year-over-year and over 400 per cent since adopting the G Mining Ventures name in October 2020.

Join the discussion: Find out what everybody’s saying about this gold stock on the G Mining Ventures Corp. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of bars from the first gold pour from the Tocantinzinho mine in Brazil in July 2024: G Mining Ventures)