- Ur-Energy Inc (TSX:URE) is hoping new recommendations to the US government could revitalise a floundering national uranium industry

- The United States Nuclear Fuel Working Group released its advice to the US government, regarding the impact of uranium imports on national security

- The recommendations include developing a 17 to 19 million-pound uranium reserve, directly supporting US-based mining companies like Ur-Energy

- Ur-Energy owns one of the few remaining uranium mines in the US, the Lost Creek mine in Wyoming, and said operations at the site could ramp up quickly if US demand increases

- Ur-Energy Inc (URE) is up 4.82 per cent, with shares trading at C$0.87 and a market cap of $139 million

Ur-Energy Inc (TSX:URE) is hoping new recommendations to the US government could revitalise a floundering national uranium industry.

Ur-Energy owns one of the few remaining uranium mines in the US, the Lost Creek mine in Wyoming. Due to a poor uranium prices, US producers have been struggling to profitably operate in recent years.

This has been largely caused by cheap uranium imports from China and Russia, making US production unviable at the current price.

As a result, in 2018 Ur-Energy brought a petition to the US government. The petition asked the government to look into the impact of uranium imports on national security.

Consequently, earlier this year the US government outlined plans to develop a national uranium reserve on the recommendation of the United States Nuclear Fuel Working Group.

Ur-Energy has greeted the group’s recommendations positively, as it could revitalise US-based uranium production after years of a depressed national industry.

The group’s recommendations include developing a 17- to 19 million-pound uranium reserve, directly supporting US-based mines.

Furthermore, the group recommended restarting domestic conversion and enrichment plants over the next three years.

The group also proposed heightening restrictions on Chinese and Russian imports, to help protect against uranium dumping in the future.

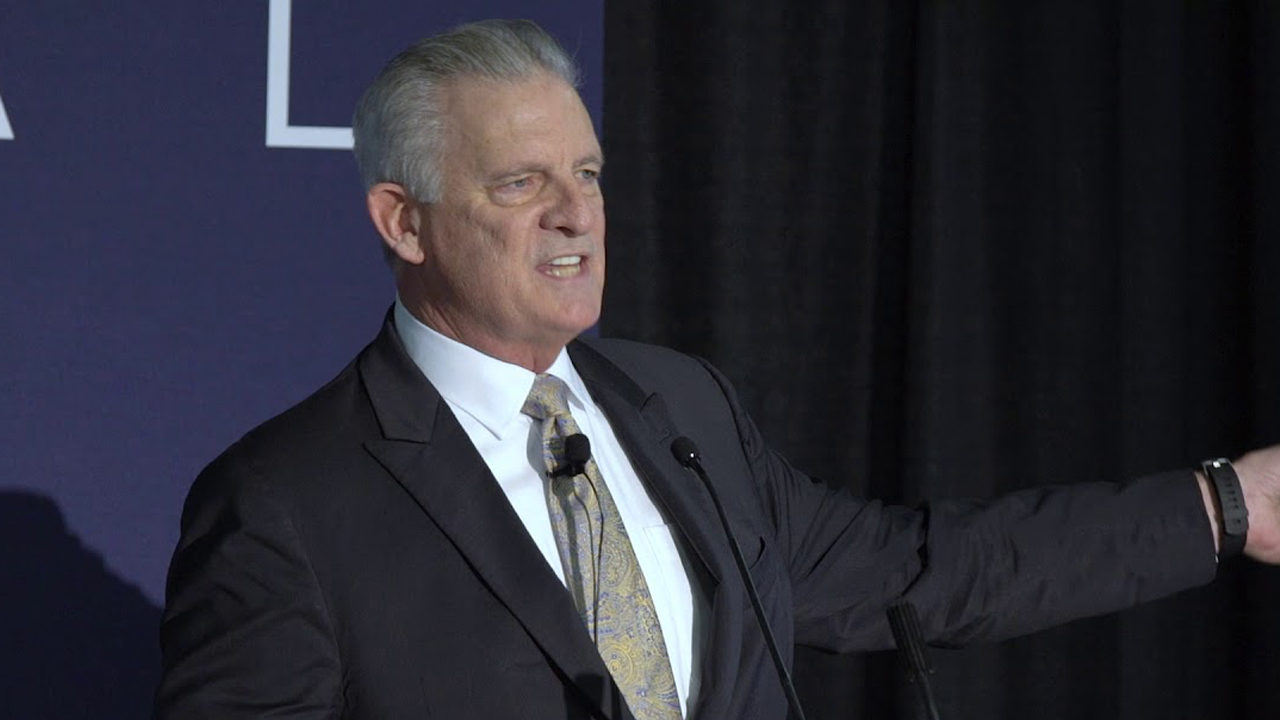

Chairman and CEO of Ur-Energy, Jeff Klenda is excited to see the recommendations positively impact the US uranium industry.

“As the recommendations are implemented, we will enjoy a revitalized nuclear industry and, consequently, a reduced reliance on nuclear imports from our nation’s geostrategic rivals.

“While awaiting today’s report, we have maintained operational readiness at our fully-permitted Lost Creek Mine with experienced technical and operational staff and a well-maintained plant,” he said.

Jeff went on to say that the company is ready to rapidly expand operations at Lost Creek, if demand in the US increases.

Ur-Energy Inc (URE) is up 4.82 per cent, with shares trading for C$0.87 at 11:15am EST.