- The offering of units and flow-through units generated gross proceeds of $954,396

- The offering was led by Research Capital Corporation as the sole agent and sole bookrunner

- Net proceeds will be directed to the company’s ongoing exploration drilling program, working capital requirements and other general corporate purposes

- Proceeds from the flow-through units will be allocated to the company’s Doc and Snip North projects

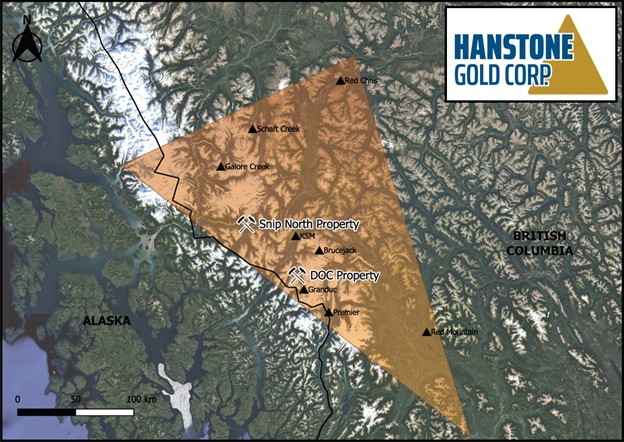

- Hanstone Gold is a precious and base metals explorer focused on the Doc and Snip North Projects located in the Golden Triangle of BC

- Hanstone Gold Corp. (HANS) opened trading at C$0.40 per share

Hanstone Gold (HANS) has closed its brokered private placement offering.

The offering consisted of units priced at a price of $0.40 and flow-through units at a price of $0.44 per unit, for aggregate gross proceeds of $954,396.

The offering was led by Research Capital Corporation as the sole agent and sole bookrunner.

Each unit consists of one common share and one common share purchase warrant. Each flow-through unit consists of one common share which qualifies as a flow-through share and one warrant. Each warrant is exercisable to acquire one common share at a price of $0.47 for a period of 24 months from the closing date.

Net proceeds will be directed to the company’s ongoing exploration drilling program, working capital requirements and other general corporate purposes. The gross proceeds from the sale of the flow-through units will be used to incur eligible “Canadian exploration expenses” related to the company’s Doc and Snip North projects.

The agent received an aggregate cash fee of $59,887 and 142,844 non-transferable compensation options. Each compensation option entitles the holder to purchase one unit at an exercise price equal to $0.40 for a period of 24 months.

Hanstone Gold is a precious and base metals explorer focused on the Doc and Snip North Projects located in the Golden Triangle of BC. The Golden Triangle is an area that hosts numerous producing and past-producing mines and several large deposits that are approaching potential development.

The company holds a 100% earn-in option in the 1,704-hectare Doc Project and owns a 100% interest in the 3,336-hectare Snip North Project.

Hanstone Gold Corp. (HANS) opened trading at C$0.40 per share.