- Happy Belly Food Group (CSE:HBFG), a stock providing exposure to emerging food brands, has signed a national distribution agreement with Sysco (NYSE:SYY), a global leader in food product distribution that generated US$78 billion in sales in fiscal 2024

- The deal, applicable to all Happy Belly brands, will allow the company to reduce costs as it continues its scorching pace of franchising and restaurant openings

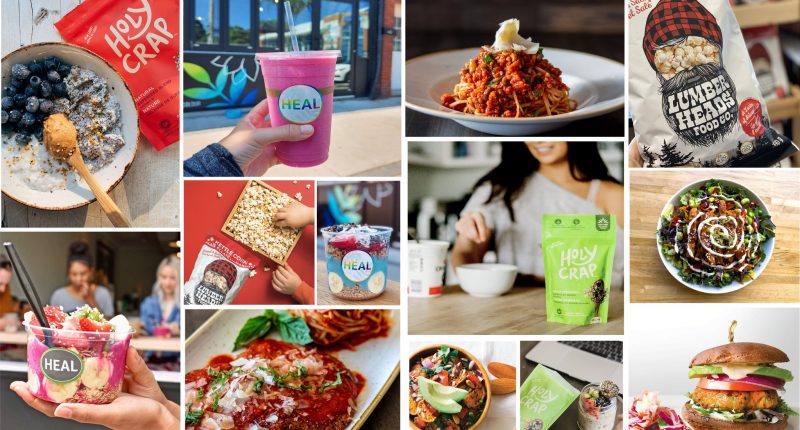

- Happy Belly Food Group is the parent company of a growing number of food brands, including Rosie’s Burgers, Holy Crap, Lumber Heads Food Co., Yolks, Lettuce Love Café, Pirho Fresh Greek Grill, Joey Turks Island Grill and Via Cibo

- Happy Belly stock has added 350 per cent year-over-year

Happy Belly Food Group (CSE:HBFG), a stock providing exposure to emerging food brands, has signed a national distribution agreement with Sysco (NYSE:SYY), a global leader in food product distribution that generated US$78 billion in sales in fiscal 2024.

The deal, applicable to all Happy Belly brands, will allow the company to reduce costs as it continues its scorching pace of franchising and restaurant openings. Management has acquired over 10 food brands and signed contracts for hundreds of new locations since 2021, as recently highlighted by Smile Tiger Coffee Roasters in January and SALUS Fresh Foods in November.

The company’s flurry of activity propelled revenue from C$1.25 million in 2021 to C$5.07 million in 2023, with C$6.72 million already earned in 2024 through Q3, a quarter that marked Happy Belly’s first net gain in its history while posting a 265 per cent increase in normalized adjusted EBITDA to C$198,219.

Having recently raised its sixth consecutive above-market financing, the company is well-positioned to supply the market with more evidence of profitable growth as it scans the restaurant and food brand landscape for its next acquisition.

Leadership insights

“Partnering with Sysco, a world-class logistics company with expertise in the restaurant industry, allows us to benefit from their buying power combining the size and reach of their distribution network. This partnership ensures that both our corporate and franchised locations can take full advantage of the service and cost-saving benefits of a national account as we consolidate our purchasing,” Sean Black, Happy Belly Food Group’s chief executive officer, said in a statement.

“Through our national account with Sysco, we will have consistent access to high-quality products at competitive prices, leveraging the purchasing power and economies of scale inherent in national agreements,” Black added. “This will help reduce food costs and streamline inventory management across multiple locations. Additionally, Sysco’s reliable supply chain support will minimize the risk of stock shortages and enable more accurate forecasting and planning. With a single point of contact for ordering, billing and customer service, operational efficiency will be enhanced, allowing our management teams to focus on driving excellence and revenue growth in the business.”

About Happy Belly Food Group

Happy Belly Food Group is the parent company of a growing number of food brands, including Rosie’s Burgers, Holy Crap, Lumber Heads Food Co., Yolks, Lettuce Love Café, Pirho Fresh Greek Grill, Joey Turks Island Grill and Via Cibo.

Happy Belly stock (CSE:HBFG) last traded at C$1.26 per share. The stock has added 350 per cent year-over-year.

Join the discussion: Find out what everybody’s saying about this restaurant stock’s distribution deal with Sysco on the Happy Belly Food Group Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image of Happy Belly Food Group products: Happy Belly Food Group)