- Homerun Resources (HMR) has announced a non-brokered private placement for gross proceeds of up to $750,000

- The offering will consist of up to five million units priced at 15 cents per unit

- Proceeds raised from the financing will be used for exploration and working capital

- Homerun Resources is a Canadian exploration company that holds a 100 per cent interest in the 30,970-hectare Homathko Gold Project in B.C.

- Homerun Resources Inc. (HMR) opened trading at C$0.18

Homerun Resources (HMR) has announced a non-brokered private placement for gross proceeds of up to $750,000.

The offering will consist of up to five million units priced at 15 cents per unit. Each unit will include one common share and one share purchase warrant. Each warrant will be exercisable for an additional share at a price of 25 cents for 12 months. Warrants are subject to an acceleration clause.

Proceeds raised from the financing will be used for exploration and working capital. All securities issued will be subject to a statutory four-month hold period.

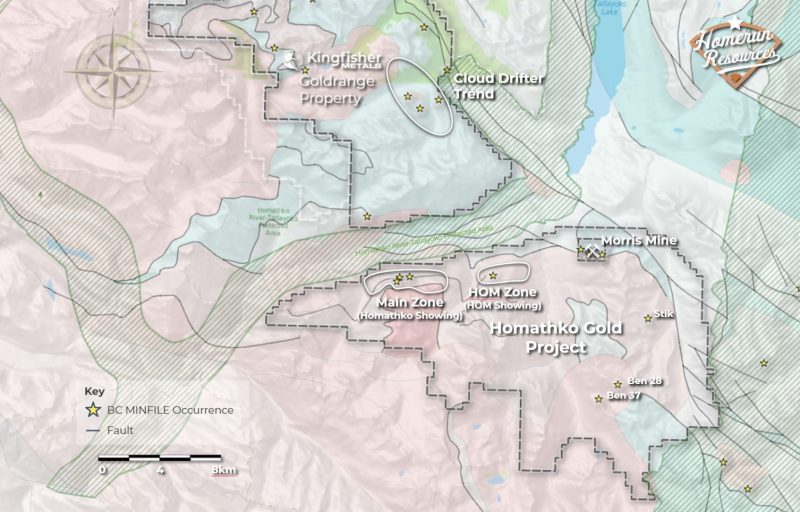

Homerun Resources is a Canadian exploration company that holds a 100 per cent interest in the 30,970-hectare Homathko Gold Project located 190 kilometres southwest of Williams Lake, British Columbia. The property lies directly south of the Kingfisher Metals (KFR.V) Goldrange Property.

Homerun Resources Inc. (HMR) opened trading at C$0.18.