You probably can’t go a single day without hearing about Amazon (NASDAQ:AMZN) in one way or another.

It goes without saying, then, that the company is the world’s largest e-commerce platform where you can buy almost anything you can think of and have it delivered straight to your door.

That being said, Amazon hasn’t always been a one-stop-shop everything platform: its founder, Jeffrey Bezos, kickstarted the company in July 1994 from his garage in Bellevue, Washington, and began solely as a website that sold books.

Fast-forward 30 years, Amazon has completely transformed into the biggest e-commerce company that has transformed how we shop, and so much more.

In addition to its longevity as a company that has evolved over time to meet the growing demands of consumers, Amazon went public back in 1997 and has outperformed many other stocks on the market since then.

So, how exactly do you buy an Amazon stock?

We’ll get into that, but first, we’ll examine the history of Amazon’s stock, where it is today, how to buy Amazon stock, and anything else you might want to know about the global e-commerce giant.

Amazon stock history

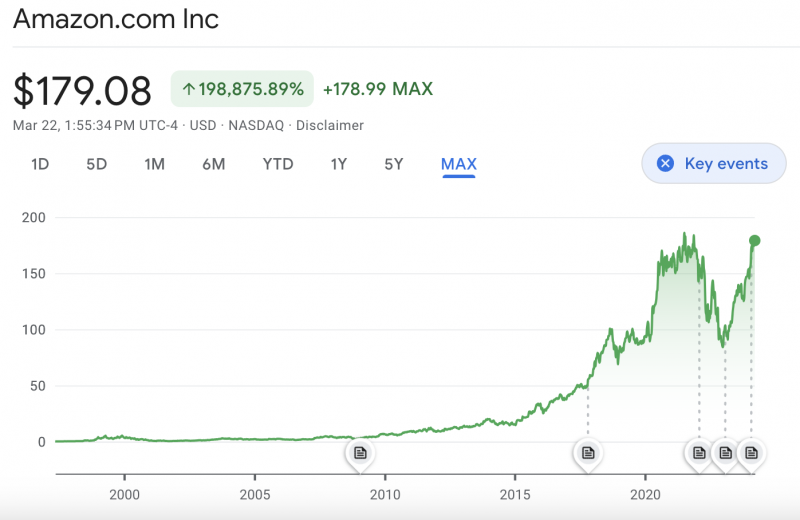

Amazon launched its initial public offering (IPO) on May 15, 1997, under the ticker symbol “AMZN” on the Nasdaq at US$18 per share, giving it a valuation of $300 million.

However, according to CNN, after adjusting for three subsequent stock splits its closing price on its first day of trading was just $1.96.

In an archived article from The Los Angeles Times published on Amazon’s first day of trading, its stock rose $5.50 to $23.50, representing a 41 per cent increase. According to the newspaper, Amazon’s stock was the most actively traded on the Nasdaq that day with more than 6 million shares exchanged.

“It has great revenue growth and a great name,” Kathleen Smith, portfolio manager at Renaissance Capital, said at the time. “Investors seem to feel that the story is strong enough that they can wait for earnings.”

Perhaps one of Amazon’s biggest milestones was when it reached a $1 trillion market cap for the first time in 2018, however by 2022 it had wiped off $1 trillion in its valuation.

As per data from Google Finance, Amazon’s stock reached an all-time high of $182.83 on July 23, 2021.

Its 52-week high stock price is $181.41, while its 52-week low is $96.29, and its average stock price for the last 52-week period is $137.11.

By 2022, the company had roughly 300 million active subscribers shipping to more than 100 countries and earned $485 billion in revenue.

With that in mind, since its IPO, shares of Amazon have rallied 198,875.89 per cent to $179.08 as of March 22. The company also has a valuation of $1.86 trillion.

How to buy Amazon stock

Buying shares of the largest e-commerce platform is just like any other stock, but we’ll go through the details – especially because Amazon is a publicly traded company in the United States.

In Canada, Amazon trades from most brokerages and can be held in retirement accounts, including a TFSA and an RRSP. The process, however, will be slightly different than a Canadian stock.

Open a brokerage account

Just like any other stock, investors will want to ensure they have a brokerage account, which is an account that allows you to buy stocks, bonds and mutual funds. Funds are added to the account from your personal bank account and then used to buy investments, such as an Amazon stock.

Because Amazon is a U.S.-listed stock, Canadian investors will want to be mindful of the cost it will be to exchange from Canadian dollars to U.S. dollars. As such, Amazon stocks can be purchased only in U.S. dollars.

Online brokerages include:

- Established in 1999, Questrade offers Canadian citizens an alternative for trading with big banks. Users can register for an account and transfer their funds from their Canadian broker or bank account to begin trading within the Questrade trading platform.

- Wealth Simple launched in 2014 and has a $0 minimum account fee. Wealth Simple allows clients to transfer taxable and retirement accounts, or deposit funds directly into new accounts.

Investors can also invest directly from their Canadian banking institution, including:

- TD Bank, including its TD Easy Trade platform where users can sign up for an account and begin investing. Users can hold funds in Canadian and U.S. currencies.

- RBC (Royal Bank of Canada), through its RBC Direct Investing platform. Investors can open an account online and use its tools and research to find the right investments for their portfolios.

Place your order

At its current price of roughly $179 – in U.S. dollars, remember – investors will first want to budget how much they can spend and convert their Canadian dollars into U.S. ones to ensure it fits within their budget.

From there, investors can buy an Amazon stock like any other and an order can be placed through a brokerage account of their choice. In Canada, there are two order types for buying an Amazon stock, including:

- Market order, which allows investors to buy Amazon shares at its current price; and

- Limit order, which sets a price limit on how much you want to spend on an Amazon stock

Monitor your Amazon stocks

Just like other investments, Amazon shares should be monitored periodically to see how they are performing and whether they still fit into an investor’s portfolio.

Keep in mind that a portfolio should be as diverse as possible and that other investments should be included for a balanced portfolio.

The bottom line

Amazon continues to be one of the most successful businesses and has in fact, generated cash flow growth of 25.53 per cent. Throughout 2024, it is expected Amazon will report cash flow expansion of 59.4 per cent during the year.

According to TipRanks.com, Amazon is considered a “strong buy” from 41 analysts with a projected average stock price of $209.59 over 12 months.

It has a high forecast of $230 and a low forecast of $175, while its average price target represents a 17.01 per cent change from its last price of $179.12.

That being said, investors should always do their due diligence when it comes to investing in stocks – including Amazon – and remember it is subject to market volatility just like any other stock.

Join the discussion: Find out what everybody’s saying about this stock on the Amazon Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.