- The cannabis market offers attractive potential for investors and is projected to grow to $US444.34 billion by 2030

- Investing in Canopy Growth Corp. offers an opportunity to participate in the rapidly growing cannabis industry

- Canopy Growth stock has experienced significant fluctuations over the years, driven by various industry-related factors, evolving regulations and market sentiment

- Canopy Growth has traded between $0.73 to just over $1 from mid-November to mid-December 2023

The cannabis market offers attractive potential for investors and is projected to grow to $US444.34 billion by 2030, according to fortunebusinessinsights.com.

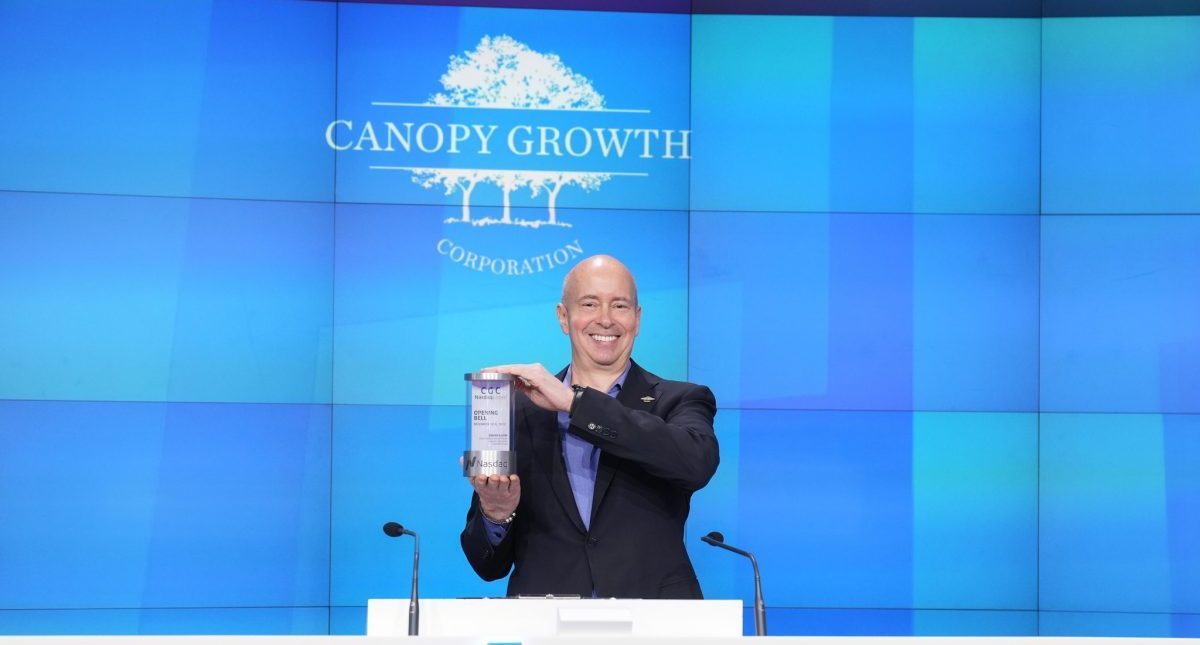

One of the top names in this space is Canopy Growth (TSX:WEED), a Canadian multinational cannabis company, widely recognized as a market leader in the global cannabis industry. With a focus on innovation, expansion, and partnership collaborations, Canopy Growth offers investment opportunities for those seeking exposure to this sector.

This article will delve into the steps to invest in Canopy Growth stocks, provide a brief background on the company and highlight its stock performance history.

Background on Canopy Growth Corp.

Established in 2013, Canopy Growth emerged as a pioneer in the cannabis industry, holding a significant market share across various cannabis product segments. The company operates through its subsidiaries, including Tweed Inc., Spectrum Therapeutics and Tokyo Smoke, offering a diverse range of products to medical and recreational customers. Canopy Growth has built a solid reputation for its commitment to quality, innovation, and sustainability, making it an attractive investment choice.

Canopy Growth has a wide range of premium and mainstream brands under its belt, including Doja, 7ACRES, Tweed and Deep Space. Canopy Growth’s CPG portfolio features targeted 24-hour skincare and wellness solutions from This Works, gourmet wellness products by Martha Stewart CBD, and vaporizer technology made in Germany by Storz & Bickel.

Canopy Growth’s stock performance history

Understanding the historical performance of a stock is crucial before making any investment decision. Canopy Growth stock has experienced significant fluctuations over the years, driven by various industry-related factors, evolving regulations and market sentiment. Here are some key highlights of the stock’s performance history:

1. Early growth: Canopy Growth’s journey began with its initial public offering (IPO) on the TSX in 2014, where it raised significant capital. The stock experienced exponential growth during the early stages of the cannabis industry’s expansion, benefitting from increasing legalization and changing consumer perceptions.

2. Market volatility: After initial market enthusiasm, the cannabis sector experienced a significant correction in 2019 because of regulatory challenges, slower-than-expected market growth, and increased competition. Canopy Growth’s stock price reflected this volatility and saw a decline during this period.

After reaching its all-time high closing price of C$56.89 on Oct. 15, 2018, the company’s stock has seen a significant decline, down more than 97 per cent in the past five years.

In an effort to change its unprofitable ways of late, the company has moved to consolidate its shares on a 10-for-1 basis to reach the NASDAQ’s minimum US$1 bid requirement. Under the consolidation, fractional shares have been tendered for cancellation by the registered owners for no consideration, while its trading symbols remain unchanged.

Canopy Growth has traded between $0.73 to just over $1 from mid-November to mid-December 2023.

3. Strategic partnerships: Canopy Growth attracted investments from global beverage giants, such as Constellation Brands Inc. (NYSE:STZ), further boosting investor confidence and demonstrating the company’s ability to form strategic partnerships to accelerate growth. This led to a series of positive movements in the stock’s value.

4. Regulatory developments: As various jurisdictions worldwide continue to legalize cannabis for medical and/or recreational use, Canopy Growth has seized opportunities to expand its global footprint. News surrounding regulatory changes, such as new market openings or potential federal legalization, has historically influenced the stock’s performance.

Steps to invest in Canopy Growth stocks

1. Research and educate yourself: Before investing, conduct thorough research on Canopy Growth, studying its financial reports, management team, competitive positioning and growth strategies. Educate yourself about the overall cannabis industry landscape and the key drivers impacting its growth.

To start, check out some of Stockhouse’s previous coverage on Canopy Growth including:

2. Choose a brokerage account: Select a reputable brokerage platform that offers access to the TSX, where Canopy Growth is listed. Compare fees, trading tools and customer service to make an informed decision.

Brokers charge a fee for their services, such as purchases, stock trades or options, account maintenance, data costs, etc. These fees can be incorporated as an annual expense ratio into your funds, added on as a stock trading commission when you buy or sell, charged as a brokerage fee on your investment account, or levied by an advisor.

Popular broker firms include:

Wealthsimple Inc. has more than 1.5 million clients in Canada and offers a number of services including an automated investing service, a peer-to-peer cash transfer platform, as well as cryptocurrency and tax services.

InteractiveBrokers has clients in more than 200 countries and territories and trades stocks, options, futures, currencies, bonds, funds and more on 150 global markets from a single unified platform.

TD Direct Investing is much like the other two and offers a range of products and account types to suit the needs and goals of its clients, as well as an educational tool to help novices understand the investing game.

3. Open a trading account: Follow the brokerage’s instructions to complete the account opening process, providing the necessary personal and financial information required.

4. Fund your account: Transfer funds into your trading account to have the necessary capital available for investment purposes.

5. Place an order: Once your account is funded, search for Canopy Growth using its ticker symbol, WEED, and place a buy order specifying the number of shares you wish to purchase.

6. Monitor and review: Regularly monitor your investment, keeping an eye on relevant news, financial statements and market trends that might impact Canopy Growth and the cannabis industry. Consider setting stop-loss orders to protect your investment from unforeseen downturns.

If you want some help and have an expert to manage the process for you, a robo-advisor service offers low-cost investment management.

In summary

Investing in Canopy Growth Corp. offers an opportunity to participate in the rapidly growing cannabis industry. However, it’s important to recognize the inherent risks associated with investing in a volatile sector. Despite the challenges faced in recent years, Canopy Growth has shown resilience, strategic vision and a commitment to long-term growth. Investors should carefully analyze their risk tolerance, diversify their portfolios and consider seeking advice from financial professionals before making any investment decisions.

As with any investment, thorough research, due diligence and a comprehensive understanding of the company, its market, and potential risks are vital to maximize the chances of a successful investment experience.

Join the discussion: Find out what everybody’s saying about this cannabis stock on the Canopy Growth Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.