- Icanic Brands (ICAN) has raised US$2 million from the sale of its interest in a California cultivation facility

- The company sold its interest to Crowco Management, a California-based cannabis company informed by scientific growing procedures

- Pursuant to the agreement, Icanic will receive discounted purchase rights to supply its infused pre-roll products, Taylor’s and GanjaGold

- Icanic Brands is a cannabis branded products manufacturer based in California and Nevada

- Icanic Brands (ICAN) is up by 6.25 per cent and is currently trading at $0.34 per share

Icanic Brands (ICAN) has raised US$2 million from the sale of its interest in a California cultivation facility.

The company sold its interest to Crowco Management, a California-based cannabis company informed by scientific growing procedures.

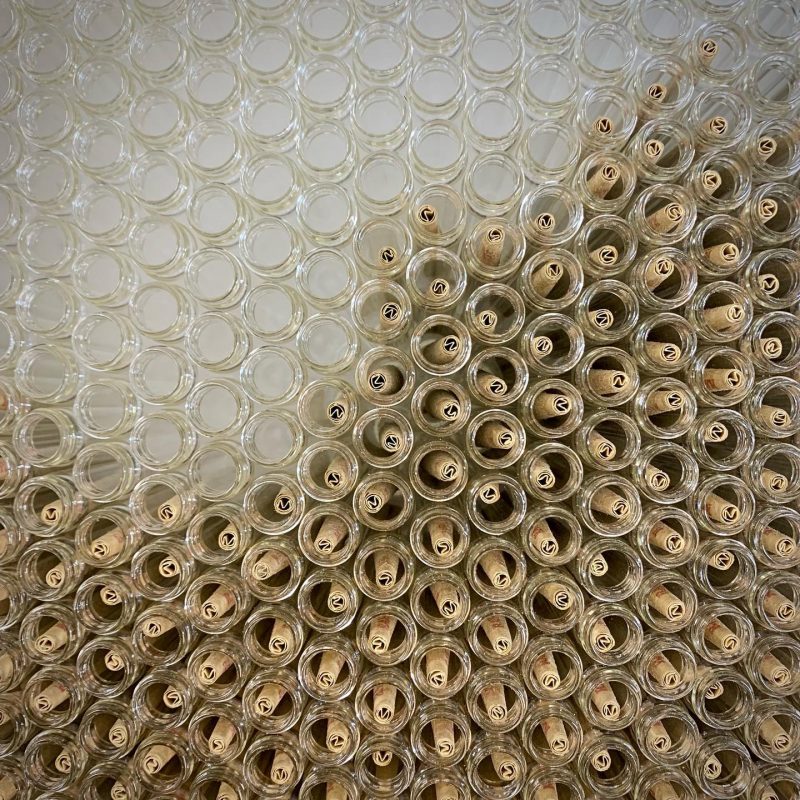

The interest pertains to management and purchase rights to a 180-light indoor cannabis cultivation facility in operation since 2019.

In addition to the monetary consideration, Icanic will receive discounted purchase rights to supply its California-based infused pre-roll products, Taylor’s and GanjaGold.

Brandon Kou, CEO of Icanic Brands, remarked,

“Our ability to unlock value by selling our interest in our Sacramento cultivation facility while still maintaining similar cost of raw inputs through our below-market contractual offtake agreement was a big win for Icanic.

Our biggest priority was to maintain the integrity of our gross margins and we were able to accomplish that goal by entering into an offtake agreement that closely mirrors our prior internal cost of cannabis inputs.

This transaction also adds a significant non-dilutive cash infusion that we can use to strategically grow our business as the California market continues to evolve.”

Icanic Brands is a cannabis branded products manufacturer based in California and Nevada.

Icanic Brands (ICAN) is up by 6.25 per cent and is currently trading at $0.34 per share as of 12:14 pm ET.