- Macarthur Minerals (MMS) has reflected on a busy second quarter as it progresses its Lake Giles Iron Project in Western Australia

- Last week, the company updated its mineral resource for the project and has been working on a rail link to transport high-grade magnetite to the Port of Esperance

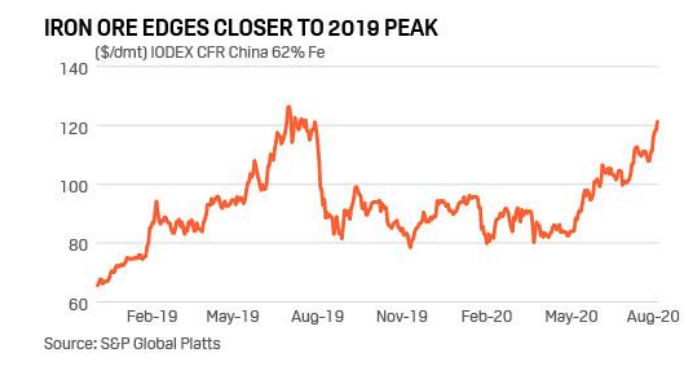

- The price of iron ore has continued to remain strong during this quarter, despite the global pandemic and is starting to get back to peak 2019’s price

- Macarthur is now planning on finalising the rail link and continuing to advance the Feasibility Study on Lake Giles

- Company shares are up 1.11 per cent on the market today and is trading for 45.5 cents per share

Macarthur Minerals (MMS) has reflected on a busy second quarter as it progresses its Lake Giles Iron Project in Western Australia.

As the pandemic continues, the company has continued with its “business as usual” strategy over the last quarter.

Activity report

Last week, the company updated its mineral resource at Lake Giles. The mineral resource is now estimated to include a measured mineral resource of approximately 53.9 million tonnes and an indicated mineral resource of 218.7 million tonnes.

Also this month, Macarthur appointed Jonghyun (Richard) Moon as the company’s new General Manager, International Sales and Marketing.

In July, the company appointed RCR Mining Technologies to design a ‘Helix Dumper’ transport solution for Lake Giles. This will assist in transporting magnetite concentrate.

During the quarter, Macarthur received a proposal from Arc Infrastructure for its planned rail link. Through this agreement, the companies will develop a commercial track agreement to transport high-grade magnetite from the project to the Port of Esperance.

The market has responded well to the company’s progress. Over the past three months, on the TSX Venture Exchange (TSX-V) in Canada, trading has ranged between C$0.15 to C$0.46 per share.

Meanwhile, on the Australian Securities Exchange (ASX), MIO shares traded between A$0.13 and $0.44 over the same period, reaching a new 52-week high.

Iron ore market

The price of iron ore has continued to remain strong during this quarter, despite the global pandemic.

Macarthur will advance its core iron ore assets in WA. This will include advancing negotiations with key stakeholder to finalise the route to the Esperance Port and continuing to advance the Feasibility Study.

“The company’s core focus will remain on delivering a high-grade, low-impurity magnetite fines product at its Lake Giles Iron Project which will target Asian steel mills that are focused on producing high-quality steel products, enhanced furnace efficiencies, reduced consumption of coking coal and improved environment emissions standard,” Executive Chairman Cameron McCall said.

“Lake Giles will aim to be very much at the fore of a new global iron ore future that values more sustainable steel products that are derived from responsible mining practices, with the highest focus on safety and with a commitment to respecting the environment and indigenous interests,” he added.

Company shares are up 1.11 per cent on the market today and is trading for 45.5 cents per share at 12:10 pm AEST.