Editor’s note: The following story is used with permission from Hot Copper, which – like Stockhouse – is a corporate brand from The Market Limited.

Let’s get straight into the point of this article: of all the small-caps in the Telecommunications index, The Market Ltd. (ASX:MKT) (“The Market”) could be one of the most overlooked.

Case in point: it owns the two largest online investment communities in Australia and Canada.

In fact: its well-known Australian forum, HotCopper – through being a centralized hub for Australian traders to discuss their investments, and company announcements – regularly helps to make or break mining juniors.

In this way, HotCopper shapes our local share market. The same is true for its counterpart Canadian offering, Stockhouse.

And HotCopper, it can’t be ignored, is miles ahead of all competition.

In fact, it’s ahead of multiple competitors combined.

Quick disclaimer here: I write for HotCopper, but I thought it was about time I looked closely at the company that pays my bills.

HotCopper’s stats are mind-boggling

And this is what first caught my attention when I took the job.

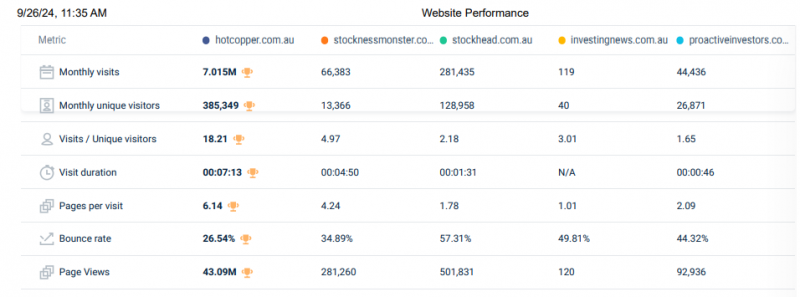

Get this: according to data from web analytics company Similarweb pulled in late September, HotCopper clocks in 7.015 million monthly visits.

Nationally recognized finance media brand Stockhead, meanwhile, only pulls in 281,400 visits per the Similarweb analysis this finance journalist has seen.

And that’s just visits. When it comes to page views, HotCopper is raking in 43.09 million views – driven in large part by its collaborative chat-forum design.

Stockhead, not to be too disparaging, pulls in only 501,000 per month.

The Market’s Capital Markets division owns HotCopper, Stockhouse, The Market Online (formerly known as The Market Herald) and The Market Link, which is the investor relations operator.

But The Market offers far more than stock market forums and services.

The Market Ltd. is truly a diversified communications company – you may or may not know that it owns Australian e-classifieds success story Gumtree. The Market Ltd. also owns Carsguide and Autotrader – together, these three entities form the Gumtree Group arm of the business.

Let’s take a look at each of the brands that make up Gumtree Group.

Inspecting Gumtree, Carsguide & Autotrader

Gumtree Group, as all three companies put together, collectively see more than 5 million unique users interact each month – that means 20 per cent of the Australian population visits its three sites on a monthly basis.

Last financial year, the classifieds website Gumtree alone received more than 350 million page views per month. Like MKT’s capital markets division, Gumtree Group clearly boasts some of Australia’s most high-traffic websites, period.

According to The Market’s most recent annual report, Gumtree’s annual listed gross merchandise value equalled an eye-catching AU$30 billion. Key categories of cars, jobs, pets, home & garden and real estate attained some 2 million listings.

As technology evolves, so the nature of Gumtree Group is changing.

Over the past year Gumtree launched its first transactional offerings with the roll-out of an instant cash offer product and a car inspection service.

The Market’s CEO Tommy Logtenberg promises additional transactional products are on the cards – with launches in coming months with a focus on payments and shipping.

“This will provide us with a sound monetization opportunity and further strengthens our trust and safety capabilities,” Logtenberg said.

Vehicle sales are an important component of the overall brand. More than 2,500 car dealers nationally use Gumtree Group – Gumtree itself, as well as Carsguide and Autotrader – to market their products to the Australian populace at large.

Carsguide ranked the No. 1 website in Australia for automotive editorial, which combines listings, advice, reviews and auto news, per Nielsen ratings (January-August 2024).

Monthly page views amount to 18 million for Carsguide alone.

And Gumtree Group’s activities in the real estate sector are also on an upward trajectory.

Gumtree recently announced a partnership with the Homely Group in its real estate category, which is anticipated to go live in November.

“Through this partnership, the total number of real estate listings on Gumtree across both for sale and rentals will grow significantly, from nearly 11,000 to around 200,000 nationwide,” Logtenberg said.

Given this impressive portfolio of online brands – and the untouchable superiority of HotCopper as a magnet for finance-media-hungry web traffic – it’s perhaps surprising, then, that the stock remains highly illiquid. It’s tightly held.

But with RBA rate cuts on the relatively immediate horizon and a slowly recovering US IPO market – the megatrend of private equity be damned – are investors missing a good opportunity while shares are cheap?

Telecomms lacks ‘sex appeal’ for many

Of all the sectors on the ASX, Telecommunications – which includes media companies – is one of the most esoteric.

You already know the big market cap names – mainly Telstra – but I’m willing to bet, aside from one or two little darlings, you can’t name many others.

But it’s well worth recognizing the sector is far more than a national phone service provider and a few TV stations.

It’s a rich and often overlooked segment of the Australian share market’s overall composition – at least compared to mining, property, healthcare and finance – which is perhaps strange given it’s one of the most important sectors for Australian society.

Or any society. Consider this.

Our national broadcasters sway public opinions and help to evolve the current political mood(s) of our time.

Telstra, meanwhile, connects vast swathes of the country – in many cases, providing the infrastructure required for that media to be broadcast onto phones.

Telecomms matter – but, from time to time, it can feel like many share market traders overlook the sector in favour of sectors that might come more obviously to the forefront of the mind, given Australia is a country of ore and expensive houses.

But in that binary way of thinking, a lot of potential value could possibly be missed.

Join the discussion: Find out what everybody’s saying about public companies at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: HotCopper)