- MEG Energy (TSX:MEG) has implemented additional cuts to its previously announced capital budget for 2020

- The original plan anticipated C$250 million in capital expenditures, which the company has now cut down to $150 million

- The cutback comes after prolonged commodity price volatility as a result of COVID-19 and the OPEC oil price war

- In addition, the company will implement salary and fee reductions for senior executives and the Board of Directors

- MEG Energy (MEG) is up 13.75 per cent to $3.31 per share, with a market cap of $991.68 million

MEG Energy (TSX:MEG) has implemented additional cuts to its previously announced capital budget for 2020.

Both bitumen production and sales for the March quarter represented an increase over the same period last year. Unfortunately, total revenue fell from C$919 million to $665 million.

The company gave no specific reason regarding the revenue drop. However, many energy companies have struggled with critically low oil prices and an over-saturated market.

In light of these current economic conditions, MEG Energy has further reduced its capital budget to $150 million. This number is a reduction on the revised budget of $200 million, which the company announced on March 10, 2020. That in turn was a reduction on the original budget of $250 million, announced on November 21, 2019.

Of the revised amount, $125 million is expected to go towards various sustaining and maintenance activities. This includes roughly $25 million related to major plant turnaround requirements at MEG’s Phase 1 and 2 facilities.

The remaining amount will facilitate regulatory and corporate affairs, as well as general working capital expenses.

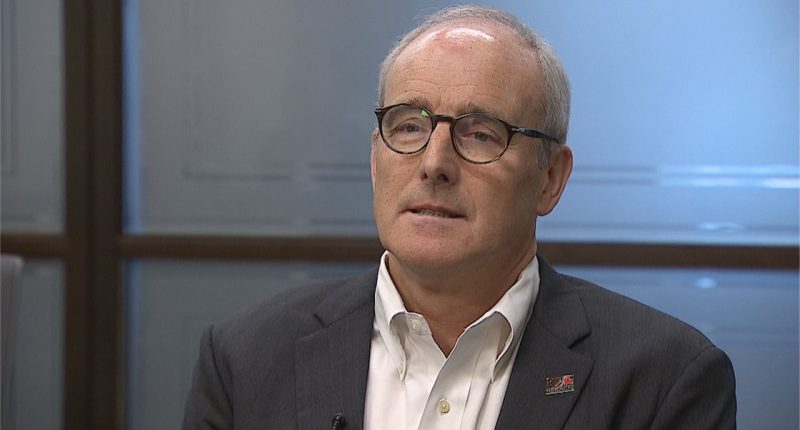

MEG Energy’s CEO, Derek Evans, said the company is committed to ensuring its staff’s health and safety, and reliable operations at its Christina Lake Facility.

“The current business environment demands swift, decisive actions to enhance MEG’s already strong financial liquidity position.

“To that end, we are reducing production to minimum levels and advancing the planned plant turnaround, cutting capital by $100 million versus original guidance, and reducing non-energy operating cost and G&A guidance by $20 million and $10 million, respectively,” he concluded.

Furthermore, MEG Energy has implemented cuts to the salaries and fees of its senior executives, Board of Directors, and other employees.

Effective June 1, 2020, board members will be subject to a 25 per cent cash payment reduction. Derek will have his own salary cut by 25 per cent, while the company’s Chief Operating Officer and Chief Financial Officer will take a 15 per cent cut.

All Vice Presidents will receive a 12 per cent reduction to their salaries, while the company’s remaining employees will see a 7.5 per cent cut.

In addition, the value of the company’s 2020 long-term incentive awards issued to employees and directors on April 1 this year was subject to a 20 per cent reduction, compared to the awards distributed in 2019.

MEG Energy (MEG) is up 13.75 per cent and trading for $3.31 per share at 2:52pm EDT.