- Reports claim Microsoft (NASDAQ:MSFT) may cut 11,000–22,000 jobs in January 2026, especially in Azure, Xbox, and sales, though Microsoft’s CCO has denied the claims as “100 per cent made up”

- Microsoft’s massive US$80B+ AI investments and soaring data‑centre costs are fuelling expectations of continued workforce trimming and a shift away from middle management

- Even amid Xbox’s 25th anniversary and new Cloud Gaming TV integrations, the gaming unit remains among the teams reportedly at higher risk in potential layoffs

- Microsoft stock (NASDAQ:MSFT) opened trading at US$480.96

As the tech industry enters the first quarter of 2026, the spectre of new Microsoft (NASDAQ:MSFT) layoffs is rapidly becoming one of the year’s most closely watched developments. After a turbulent 2025 that saw more than 15,000 jobs eliminated across multiple divisions, reports of another sweeping round of cuts have intensified—though Microsoft leadership is now publicly disputing them.

According to TipRanks, Microsoft is reportedly preparing to announce layoffs in the third week of January, with anywhere between 11,000 and 22,000 roles potentially on the chopping block. The cuts are said to be concentrated in Azure cloud, Xbox gaming, and global sales, aligning with a broader multi‑year restructuring strategy aimed at flattening organizational hierarchies and reallocating resources toward artificial intelligence and data‑centre expansion.

Microsoft leadership pushes back

However, Microsoft’s Chief Communications Officer Frank X. Shaw sharply rejected these reports on Wednesday to the very not-biased website Windows Central, calling the claims “100 per cent made up / speculative / wrong,” after stories circulating on social platforms Bluesky and X suggested the company was finalizing tens of thousands of layoffs. Shaw emphasized that the TipRanks report was not grounded in reality.

Despite Shaw’s rebuttal, analysts note that the company’s recent history leaves the door open to the possibility of further cuts. Microsoft laid off thousands in 2023, then again in 2024, and most notably in multiple rounds throughout 2025, including a 9,000-person reduction in July. Past layoffs have frequently been timed in January, making the current speculation consistent with long‑standing patterns.

AI spending at historic highs

Driving much of the speculation is Microsoft’s unprecedented investment in AI infrastructure. The company spent more than US$80 billion on AI last year alone, much of which went toward data centres, chips, and advanced model development. In Q1 FY2026, capital expenditures surged to US$34.9 billion—an indicator of the company’s long‑term strategic priorities shifting sharply toward AI.

Industry analysts have suggested that such an expenditure profile could necessitate annual job reductions of 10,000 employees or more to offset rising capital depreciation costs associated with rapid expansion of data‑centre infrastructure—though these projections remain speculative.

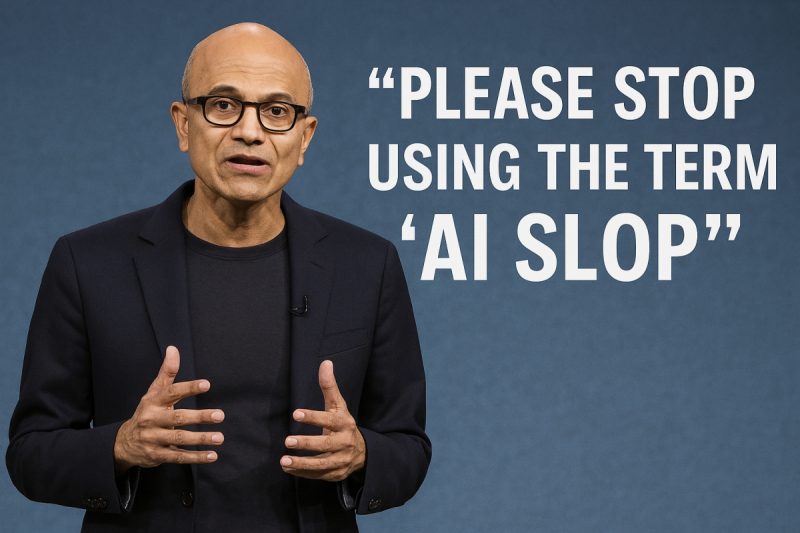

CEO Satya Nadella has repeatedly framed AI as the company’s central growth engine, arguing in recent statements that society must move beyond the debate over “AI slop versus sophistication” and accept AI as a new equilibrium of modern life. Nadella emphasized that Microsoft is now adept at “riding the exponentials of model capabilities” while managing the unpredictable “jagged edges” of emerging AI systems.

Fun fact: “Slop” was voted by the editors at Merriam-Webster Dictionary as the “2025 Word of the Year.”

Employee concerns: Structure, stability, AI, and you

Anonymous insiders and verified employee forums report that middle managers, older product teams, and non‑core engineering roles may be particularly vulnerable in any future restructuring, as Microsoft continues to trim layers of management to boost operational efficiency. By contrast, workers associated with core cloud services and AI research are considered relatively insulated.

Some employees also point to Microsoft’s recent return‑to‑office requirement—mandating at least three days per week on‑site for anyone within 50 miles of an office—as a potential vector for indirect attrition.

Gaming division in the spotlight

The Xbox division, which celebrated its 25th anniversary this week, remains a focal point of both innovation and uncertainty. Even as Microsoft expands Xbox Cloud Gaming support to Hisense and other V‑homeOS televisions, the division remains among those rumored to face cuts should layoffs materialize.

Meanwhile, investor enthusiasm surged earlier this week after Microsoft’s Copilot AI unexpectedly produced a “prediction” of Super Bowl LX’s outcome—an unprompted stunt that drew widespread attention. The incident, while controversial, briefly boosted Microsoft’s stock momentum heading into Wednesday’s close, though much of those gains were eroded in after-market trading.

What comes next?

With conflicting information swirling and Microsoft leadership adamantly denying the most extreme reports, the situation remains fluid. Still, the company’s long‑term trend of focusing investment on AI while streamlining legacy organizations continues to shape expectations for 2026.

Whether the rumored 11,000–22,000 job cuts will materialize remains to be seen. But with Microsoft’s historical pattern of January restructuring and the broader tech sector undergoing its largest transformation since the cloud revolution, employees and industry watchers alike are bracing for what could become one of the most consequential workforce realignments of the year.

About Microsoft

Microsoft Corp. develops and supports software, services, devices, and solutions. The company’s segments include productivity and business processes, intelligent cloud, and more personal computing.

Microsoft stock (NASDAQ:MSFT) opened trading nearly 1.5 per cent lower at US$480.96 but has risen over 12 per cent since this time last year.

Join the discussion: Find out what the Bullboards are saying about Microsoft and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.