Molybdenum is not a metal that tends to capture a lot of headlines. So why should astute mining investors have this metal on their radar today?

As the saying goes, a picture is worth a thousand words.

What this picture says to investors is “bull market.” Since bottoming in the second half of 2020, molybdenum has been on a tear, nearly quintupling in price, all the way to USD$96 per kilogram.

Investors looking for exposure to molybdenum will probably want to have a close look at Multi-Metal Development Limited (TSXV:MLY/OTC:MLYCF), currently advancing “the largest un-mined open-pit molybdenum project in the world.”

First, however, most mining investors could probably use some education on the molybdenum market and the metal itself. If one were to use two words to describe molybdenum, those words would very likely be “tough” and “versatile.”

Molybdenum is a refractory metal, meaning metals that are extraordinarily resistant to heat and wear. With a melting point of 2620⁰C, few substances are as resistant to heat as moly. But that’s not its only attractive property.

Molybdenum has “a small expansion coefficient” (stable even under extreme conditions), high conductivity, and also good thermal conductivity. As an additional indication of its toughness, molybdenum is non-reactive to hydrochloric acid, hydrofluoric acid, and alkali solutions.

Despite its impressive properties, molybdenum isn’t generally used as a material in its pure form. Rather, moly is added to a wide array of materials and products to make them better.

The #1 material for which molybdenum is required to lend its superior properties is steel. Molybdenum is used broadly across the massive, global steel industry: in alloy steel (43% of steel demand), stainless steel (23% of demand), “high-speed steel” (~8% of demand), and cast iron and rolls (~6%).

Molybdenum is important as a lubricant, and molybdenum dioxide is widely used for this purpose. Other applications in the chemical industry include as a catalyst in a long list of chemical processes (petroleum, plastics, textiles), and “molybdenum yellow” is a widely used pigment.

Molybdenum also plays an important role in more hi-tech applications. In electronics, moly is an ideal electrode wire and is also commonly used in core wire, lead wire and spiral filament.

Its good electrical conductivity and high-temperature resistance also make molybdenum very useful in semiconductors. Indeed, “monolayer molybdenite materials” have properties that are superior not only to silicon but even graphene – and are likely to be featured in the next generation of semiconductor materials.

Molybdenum is an essential trace element in the human body and a component of many enzymes. For these reasons, moly has potential medical applications such as promoting human development, inhibiting tumours, and protecting the heart.

For all the reasons above, a strong argument could be made that molybdenum should be added to the United States’ list of “critical minerals.”

Many metals markets have suddenly turned higher in recent weeks as China “reopens” its economy following severe Covid restrictions. However, the price of molybdenum was powering higher the entire time that China’s economy was largely closed.

Savvy investors understand what that means. This is a very tight metals market, as indicated by this January 31st headline.

Molybdenum Prices Hit a 17-year High with Persistent Tight Supply

As the supply deficit of molybdenum extends, molybdenum prices at home and [a]broad both hit new highs.

A growing supply deficit. Prices quintupling.

It sounds like the molybdenum market could really benefit from the world’s largest un-mined open-pit molybdenum project being moved to production.

Enter Vancouver-based Multi-Metal Development.

The Company’s CuMo Project is located in Boise County, Idaho. Multi-Metal Development (formerly American CuMo Mining Corporation) has held title to this property since 2004.

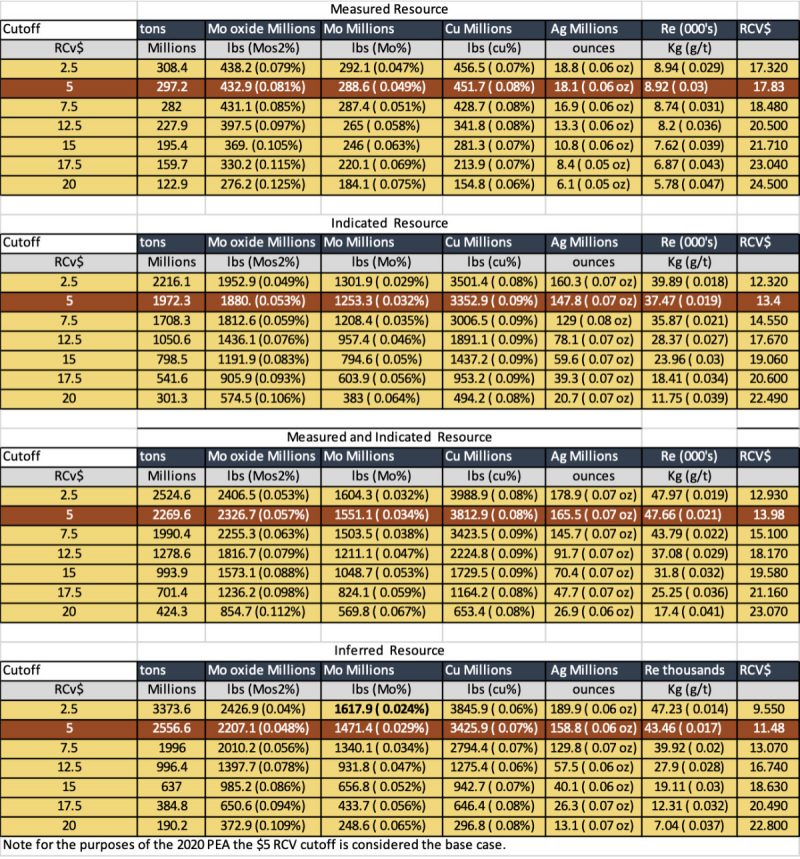

Just 15 miles northeast of Idaho City, the CuMo property is comprised of 344 claims, covering an area of 28.7 sq. km. The Project’s huge resources are detailed below.

In addition to the above noted resources (Measured, Indicated, and Inferred), the Project also boasts substantial copper, silver and rhenium mineralization.

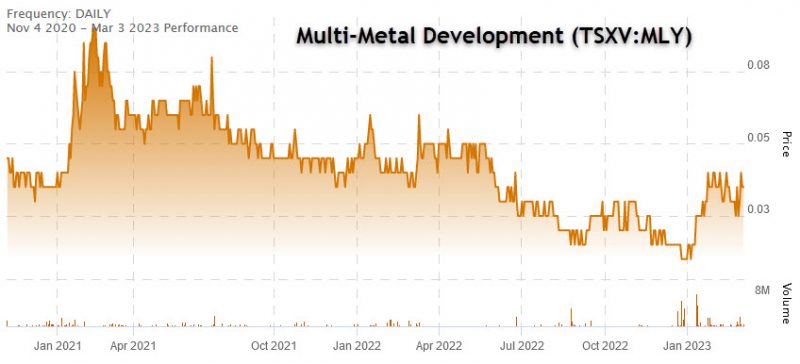

As the price chart above indicates, molybdenum prices were depressed for a considerable period of time before erupting as this new bull market began. Traders call that “building a base.”

Yet in today’s dysfunctional markets, despite the quintupling in the price of moly and continued strong market momentum, Multi-Metal Development has traded sideways.

With a current market cap of only CAD$8.79 million, this is a Company that practically screams “acquisition target.”

As China-based demand for molybdenum heats up (in a market that is already in deficit), larger mining companies are likely to take an interest in this Project sooner rather than later – either to acquire the CuMo Project or develop it in partnership with Multi-Metal Development.

The Company’s 2020 PEA for the CuMo Project modelled life-of-mine production of 43 million pounds of molybdenum per year, 84 million pounds of copper, and 3.5 million ounces of silver.

At a 5% discount, the PEA assigned the Project an NPV of roughly $2.5 billion. But that was before the price of molybdenum exploded higher.

Multi-Metal Development’s goal is to produce a bankable feasibility study for the CuMo Project. With the current outlook for the molybdenum market, Project economics can be expected to improve enormously.

The molybdenum market has been on an extended bull run with no end in sight. Yet MLY has been flat.

Value investors will want to grab a piece of the action here in anticipation of a sharp upward revaluation.

DISCLOSURE: This is a paid article by The Market Herald.