- Beginning in May, multi-bagger copper and gold stock American Eagle Gold will break ground on a fully funded 15,000-metre drill program at its flagship NAK porphyry project in British Columbia

- The company will drill twice the meterage it has completed to date to follow up on two years of high-grade results

- American Eagle Gold is a gold and copper exploration company active in west-central British Columbia

- American Eagle Gold stock has added 577.78 per cent year-over-year, and 125.93 per cent since inception in 2021

Beginning in May, multi-bagger copper and gold stock American Eagle Gold (TSXV:AE) will break ground on a fully funded 15,000-metre drill program at its flagship NAK porphyry project in British Columbia.

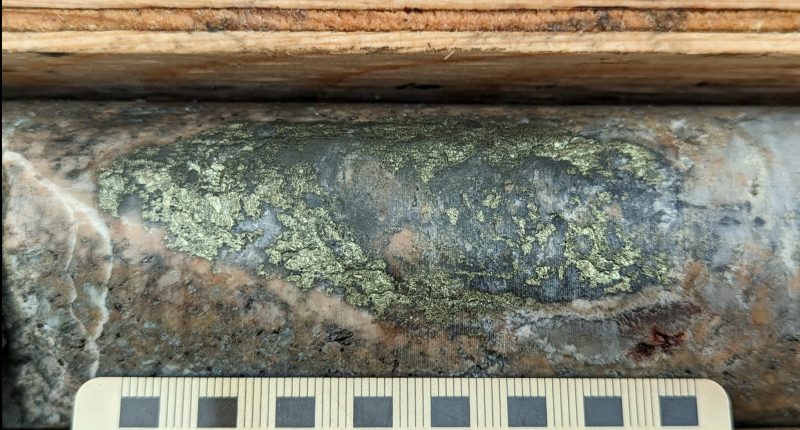

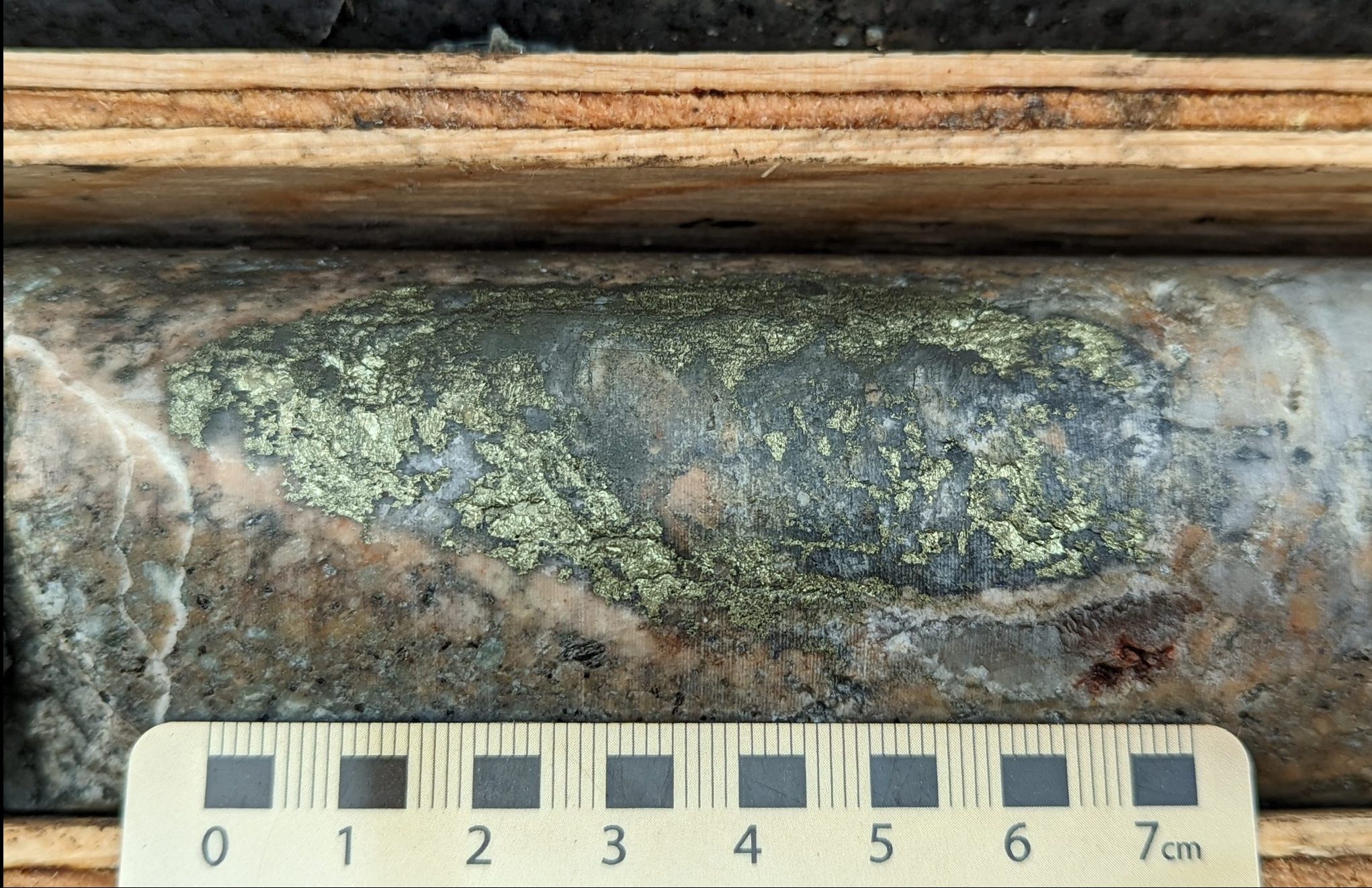

The 2024 program aims to expand and better define the high-grade North and South zones through further drilling, as well as an induced polarization (IP) survey scheduled for April. IP surveying led the company to NAK-2317, its best drill hole to date, which intersected 302 m of 1.09 per cent copper equivalent.

The meterage – more than twice what the company has drilled on NAK to date – seeks to delineate a large near-surface copper-gold system previously revealed through historical work. The company drilled in and around this system in 2022 and 2023, revealing multiple zones of high-grade copper-gold mineralization across the property that justify further exploration.

The company will now focus on refining drill targets guided by incoming hyperspectral data, new age dates, final notes on a property-wide relog, and the upcoming IP survey, in addition to a recently completed geological review with economic geologist and porphyry specialist Alan Wilson, who brings more than 30 years of experience with porphyry copper-gold systems.

A stock on the rise

American Eagle Gold is one of the few junior mining stocks delivering leverage above gold and copper‘s gains since the pandemic, which come to 28 per cent and 47 per cent, respectively, since March 2020.

At the moment, with high interest rates favouring cash preservation, mineral explorers are receiving little to no market recognition for their assets, regardless of quality, development or commodity price appreciation.

American Eagle Gold has managed to break through this barrier with consistent positive news flow, posting a 577.78 per cent return year-over-year, and a 125.93 per cent return since inception in 2021, with multiple prospective targets at NAK likely to continue the climb upward contingent on strong gold and copper prices.

About American Eagle Gold

American Eagle Gold is a gold and copper exploration company active in west-central British Columbia. The company is supported by a 19.9 per cent investment from Teck Resources.

American Eagle Gold (TSXV:AE) last traded at C$0.61 per share.

Join the discussion: Learn what other investors are saying about this multi-bagger gold and copper stock on the American Eagle Gold Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.