- Mundoro Capital (MUN) has signed an MOU to option two of its exploration licenses in Timok, Serbia, to Vale Canada

- To wholly acquire the licenses, Vale will assume C$2.63 million in exploration expenses over a two-year period and make annual payments of around $263,000

- Mundoro will also retain a two per cent royalty on the licenses, half of which may be acquired by Vale

- Once the option has been exercised, Vale will make advance royalty payments of roughly $263,000 each year until production begins, as well as milestone payments totalling $11.83 million

- Mundoro Capital (MUN) is currently up 3.23 per cent to $0.16 per share at 3:25pm EDT

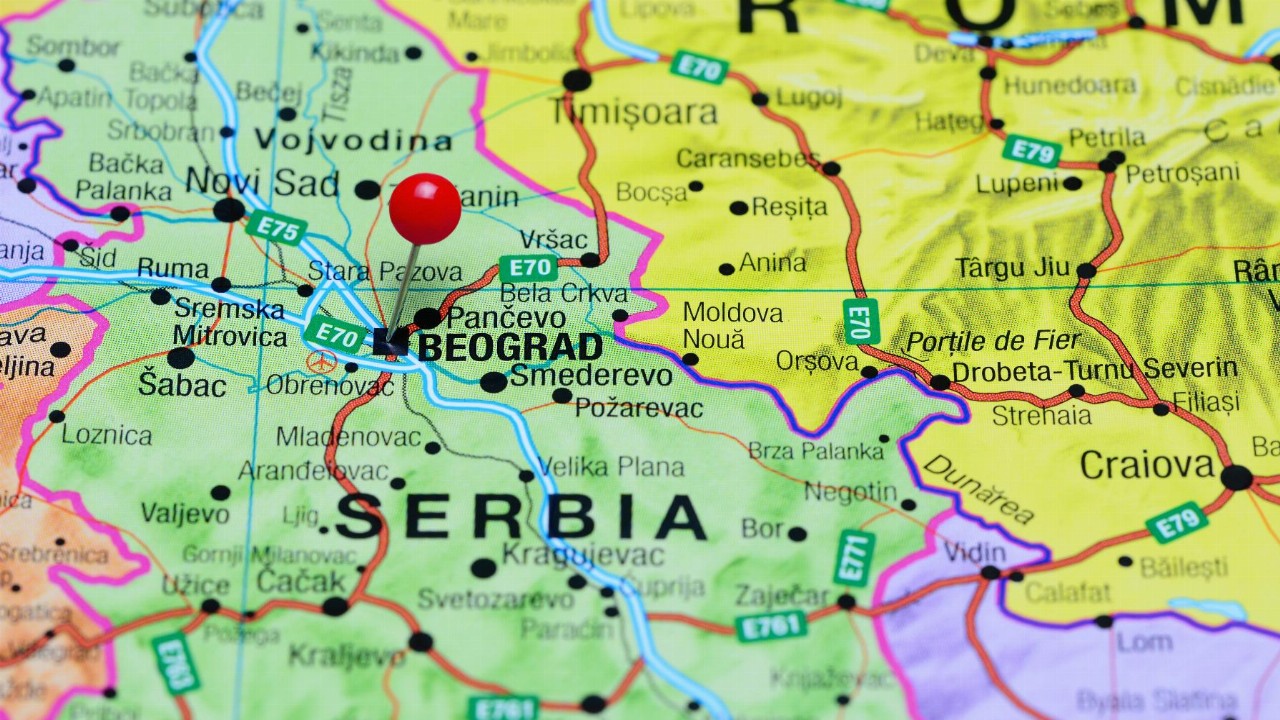

Mundoro Capital (MUN) has signed an MOU to option two of its exploration licenses in Timok, Serbia, to Vale Canada.

The licenses, referred to as Savinac and Bacevica, are located within the prolific Tethyan Belt, which extends from eastern Europe, through Turkey to Iran and Pakistan.

As one of the most significant metallogenic regions in the belt, Timok also hosts the recently discovered Cukaru-Peki deposit, as well as the past-producing underground Bor copper mine, and the Majdanpek and Veliki Krivelj copper-gold open-pit mines.

Under the terms of the agreement, Vale may acquire 100 per cent of the license by assuming C$2.63 million in exploration expenses over a two-year period. Mundoro will act as the operator of the properties during the option period, for which it will receive an operator fee.

Vale will also make annual option payments of $263,000 over the course of the option period.

Once the option has been fully exercised, Mundoro will retain a two per cent royalty on the licenses, half of which – or one per cent – may be acquired by Vale. The purchase price will be tied to the price of gold at the time; at the current gold value, the purchase price would be roughly $12.09 million.

Vale will also be required to make annual advance royalty payments to Mundoro worth $263,000 per year until the commencement of production, as well as certain milestone payments totalling $11.83 million. These milestones will begin with the filing of a resource estimate and will end with the receipt of a development permit.

Teo Dechev, CEO of Mundoro Capital, said she is pleased to be expanding the company’s relationship with Vale.

“Mundoro’s business strategy has raised US$13.6 million in partner funded exploration expenditures invested in the local mineral industries where we operate and has generated revenues of US$1.3 million for Mundoro shareholders,” she added.

Mundoro Capital (MUN) is currently up 3.23 per cent to $0.16 per share at 3:25pm EDT.