- The Netcoins crypto exchange, a subsidiary of BIGG Digital Assets, is broadening its reach to 48 U.S. states after a new partnership with Zero Hash, a crypto infrastructure provider

- According to Coinbase, 52 per cent of the Fortune 100 have pursued crypto, blockchain or Web 3.0 initiatives since the start of 2020

- BIGG Digital Assets invests in cryptocurrency ventures that promote a safe, compliant and regulated environment

- BIGG Digital Assets stock has given back 31.82 per cent year-over-year, but it has gained 150 per cent since 2019

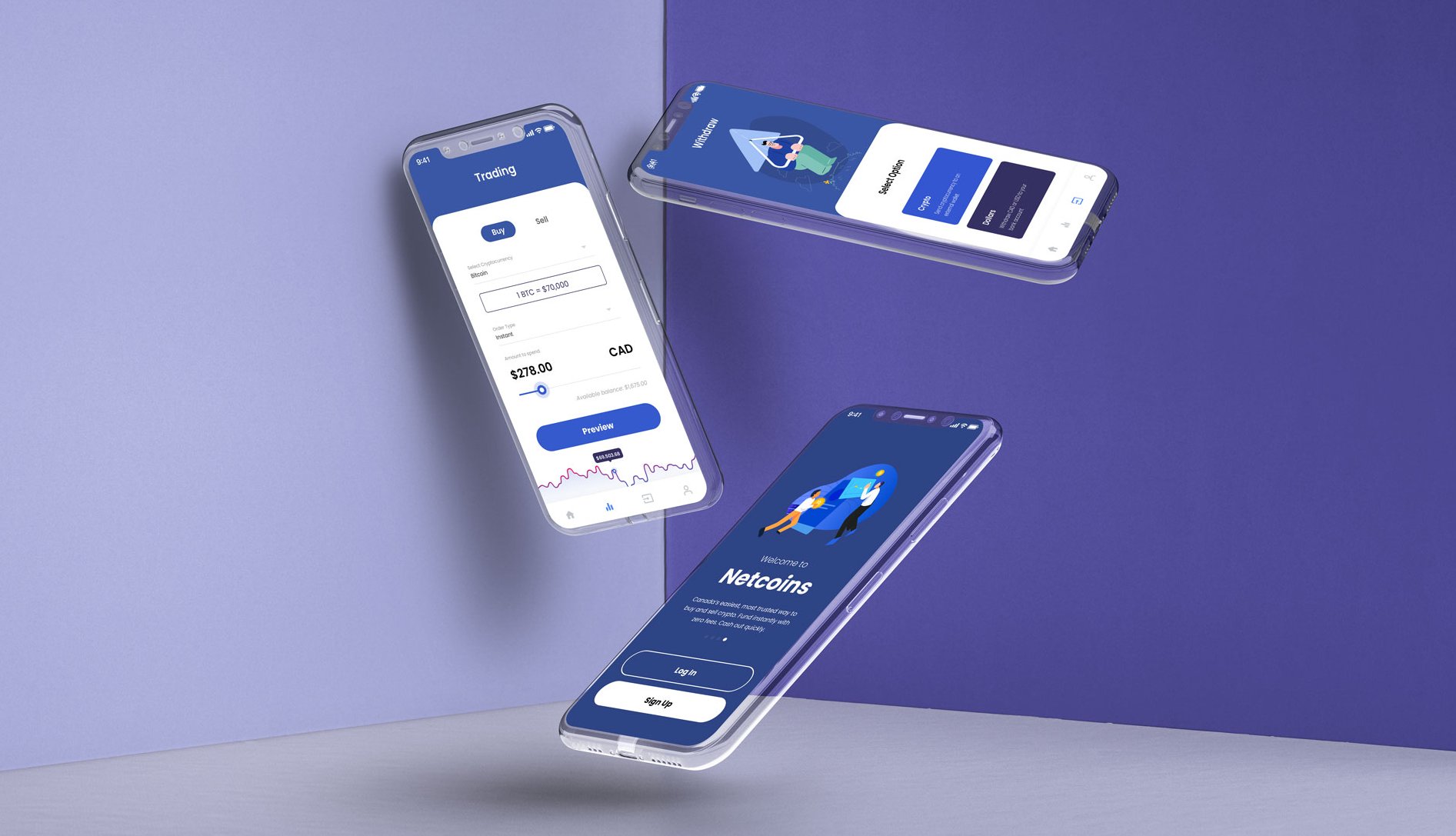

The Netcoins crypto exchange, a subsidiary of BIGG Digital Assets (CSE:BIGG), is broadening its reach to 48 U.S. states after a new partnership with Zero Hash, a crypto infrastructure provider.

The partnership will offer up to 60 digital assets and 29 fiat currencies beginning in Q2 2024, after Netcoins’ integration into Zero Hash’s API infrastructure.

Zero Hash – which is backed by Point72 Ventures, Bain Capital Ventures and NYCA – helps platforms embed digital assets into their customer experiences, overseeing backend complexity, regulatory licensing, and any other obstacles businesses might have about adopting the new technology. The company’s services include trading and custody, crypto-backed rewards and round-up programs, while its customers include neo-banks, broker-dealers, payment groups and a growing number of non-financial brands.

Netcoins’ sales team will focus on onboarding corporate, institutional, small-business and high-net-worth retail clients, with eyes on capitalizing on how 52 per cent of the Fortune 100 have pursued crypto, blockchain or Web 3.0 initiatives since the start of 2020, according to a report from Coinbase in Q2 2023, with 83 per cent of surveyed Fortune 500

executives familiar with cryptocurrency or blockchain confirming initiatives in place or in progress.

Netcoins’ U.S. expansion coincides with significant growth across the crypto industry over the past year, including a 195 per cent year-over-year increase in the price of Bitcoin, with Ethereum not too far behind at 132 per cent. Key drivers include:

- The approval of spot Bitcoin exchange-traded funds, pushing crypto exchange-traded products past US$80 billion in assets under management

- An increasing number of collaborations with major industry players such as Visa and Amazon

- The removal of bad actors such as Sam Bankman-Fried, the former founder and chief executive officer of the FTX crypto exchange, and Alex Mashinsky, the former CEO of the Celsius exchange, both of whom were charged with fraud

Investors interested in learning more about cryptocurrency and blockchain technology can read my previous coverage on the 2023 bull market and how to invest in the space.

Management insights

“We see a distinct opportunity to create a differentiated experience for corporate clients that want to gain access to the crypto market in a meaningful way,” Fraser Matthews, chief executive officer of Netcoins USA, said in a statement. “Whether it’s adding Bitcoin to your balance sheet or starting to infuse crypto assets into your day-to-day operations, Netcoins’ goal is to provide its clients with hands-on service that is tailored to their specific needs. We do not want our clients to feel like just another number – we will provide direct access to our team and ensure that we are only an email or a phone call away.”

“Zero Hash is a tremendous infrastructure partner with a proven track record of high regulatory standards and enabling companies to scale successfully in the U.S. market,” Matthews added. “They also provide Netcoins with the ability to partner with them in other global markets as we look to expand our team and services beyond North America.”

“We are delighted that Netcoins has partnered with Zero Hash to enhance and scale their crypto trading across the USA,” said Adam Leaman, chief client officer at Zero Hash. “Netcoins USA’s decision to leverage Zero Hash’s full-stack API and regulatory infrastructure proves as validation that industry leaders want to build on our trusted infrastructure.”

About BIGG Digital Assets

BIGG Digital Assets invests in cryptocurrency ventures that promote a safe, compliant and regulated environment. Its portfolio companies include Netcoins, TerraZero and Blockchain Intelligence Group.

BIGG Digital Assets (CSE:BIGG) is up by 7.14 per cent, trading at C$0.22 per share as of 11:01 am ET. The stock has given back 31.82 per cent year-over-year but has gained 150 per cent since 2019.

Join the discussion: Learn what other investors are saying about the Netcoins crypto exchange on the BIGG Digital Assets Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.