- Nortec Minerals Corp. (NVT) has announced a five-to-one share consolidation and a non-brokered private placement

- Post-consolidation, the company’s common shares will drop from 232,266,479 to 46,453,296 common shares issued and outstanding prior to rounding for fractional shares

- Also, Nortec has arranged a private placement to raise aggregate gross proceeds of up to $350,000 through the issuance of up to 4,666,667 units at a price of $0.075 per unit

- Nortec Minerals Corp. is a mineral exploration company that holds 100-per-cent interests in two exploration-stage critical mineral (zinc) projects

- Nortec Minerals Corp. opened trading at $0.005

Nortec Minerals Corp. (NVT) has announced a five-to-one share consolidation and a non-brokered private placement.

Under the consolidation plan, Nortec intends to reduce the issued common shares in the authorized share structure of the company by converting every five common shares to one common share.

The company currently has 232,266,479 common shares issued and outstanding. After the consolidation and before considering the private placement, the company will have approximately 46,453,296 common shares issued and outstanding prior to rounding for fractional shares.

Nortec is undertaking the consolidation to increase the trading price of the common shares in order to enhance the marketability of the common shares as an investment and attract investors.

The consolidation will not involve a change of the name of the company.

Furthermore, the company has arranged a private placement to raise aggregate gross proceeds of up to $350,000 through the issuance of up to 4,666,667 units of the company at a price of $0.075 per unit.

Each unit shall consist of one common share, post-consolidation, which will be issued as a “flow-through share” (as defined in subsection 66(15) of the Income Tax Act (Canada)) (the “Tax Act”) and one-half (½) of one post-consolidation common share purchase warrant.

Each warrant will entitle the holder to purchase one non-flow-through post-consolidation common share at an exercise price of $0.10 until the date that is twenty-four months following the date of issuance of the warrants.

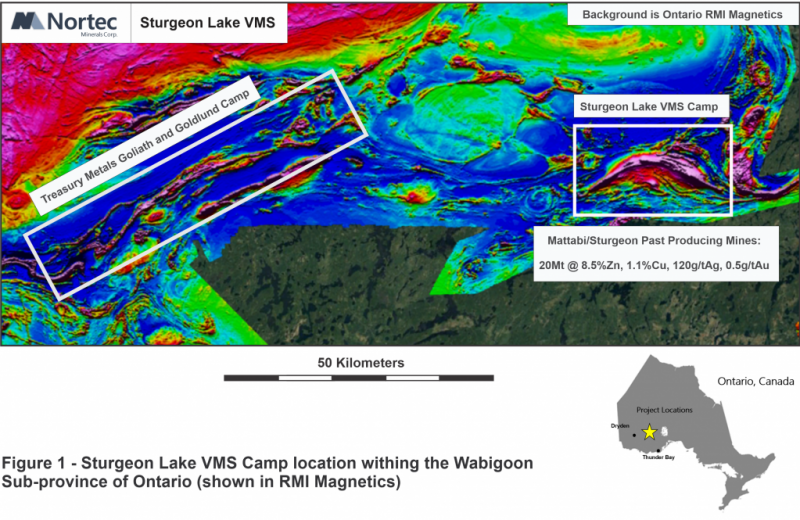

Nortec Minerals Corp. is a mineral exploration company that holds 100-per-cent interests in two exploration-stage critical mineral (zinc) projects, namely the Mattagami River Zinc properties and the Sturgeon Lake VMS, both located in Ontario, Canada.

Nortec Minerals Corp. (NVT) opened trading at $0.005.