- Nvidia (NASDAQ:NVDA) reported record financial results for its Q4 and fiscal year 2025, with many developments, some positive, some negative, across multiple segments

- Nvidia achieved a record quarterly revenue of US$39.3 billion, a 12 per cent increase from the previous quarter and a 78 per cent rise from the same period last year

- The company’s full-year revenue also reached an unprecedented US$130.5 billion, up 114 per cent year-over-year.

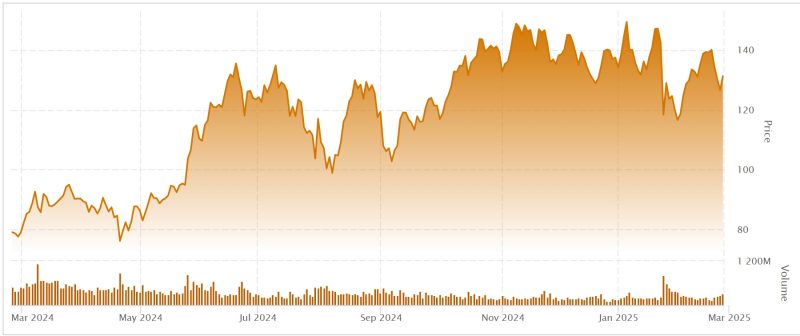

- Nvidia stock (NASDAQ:NVDA) opened trading at US$135.00

Nvidia (NASDAQ:NVDA) reported record financial results for its Q4 and fiscal year 2025, with many developments, some positive, some negative, across multiple segments.

Record-breaking financial performance

Nvidia achieved a record quarterly revenue of US$39.3 billion, marking a 12 per cent increase from the previous quarter and a 78 per cent rise from the same period last year. The company’s full-year revenue also reached an unprecedented US$130.5 billion, up 114 per cent year-over-year.

The Data Center segment was a standout performer, with quarterly revenue hitting US$35.6 billion, up 16 per cent from Q3 and an impressive 93 per cent increase from a year ago. This growth underscores the escalating demand for Nvidia’s AI and cloud computing solutions.

Gaming and AI PC

In the Gaming segment, Nvidia reported Q4 revenue of US$2.5 billion, reflecting a 22 per cent decline from the previous quarter and an 11 per cent decrease from the same period last year. Despite this, the full-year gaming revenue rose by 9 per cent to US$11.4 billion.

NVIDIA also announced the launch of its new GeForce RTX 50 Series graphics cards and laptops, powered by the cutting-edge Nvidia Blackwell architecture. These new products deliver groundbreaking AI-driven rendering capabilities, offering gamers, creators, and developers unprecedented performance. The newly launched GeForce RTX 5090 and 5080 graphics cards boast up to a 2x performance improvement over the previous generation.

Automotive and robotics

The Automotive segment saw growth, with Q4 revenue reaching US$570 million, up 27 per cent from the previous quarter and a staggering 103 per cent increase from a year ago. For the full year, automotive revenue surged by 55 per cent to US$1.7 billion.

Nvidia also announced a significant partnership with Toyota, the world’s largest automaker, which will build its next-generation vehicles on the Nvidia Drive AGX Orin platform, running the safety-certified Nvidia DriveOS operating system. This collaboration highlights Nvidia’s expanding footprint in the automotive and robotics sectors.

About Nvidia Corp.

Nvidia Corp. accelerates computing to help solve computational problems. The company has two segments. The computer and networking segment includes its data centre accelerated computing platform, networking, automotive AI cockpit, autonomous driving development agreements and autonomous vehicle solutions, as well as electric vehicle computing platforms, Jetson for robotics and other embedded platforms, along with Nvidia AI Enterprise and other software and cryptocurrency mining processors. The graphics segment includes GeForce GPUs for gaming and personal computers.

Nvidia stock (NASDAQ:NVDA) opened Thursday trading at US$135.00 and has risen 60.08 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Nvidia Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Nvidia Corp.)