- NXT Energy Solutions (SFD) has raised an additional $1,600,950 under the second tranche of a private placement financing

- Under the second tranche, the company issued 8,210,000 common shares at C$0.195 per share

- Mr. Michael P. Mork and MCAPM, LP, have purchased a total of 8,750,000 common shares

- NXT Energy Solutions is a Canadian company that provides geophysical services to the upstream oil and gas industry

- NXT Energy Solutions Inc. (SFD) opened trading at C$0.24

NXT Energy Solutions (SFD) has raised an additional $1,600,950 under the second tranche of a previously-announced private placement.

Under the second tranche, the company issued 8,210,000 common shares.

A total of 9,358,282 common shares have been issued at a purchase price of $0.195 per common share.

Common shares issued will be subject to a statutory four-month hold period.

With the closing of the second tranche, Mr. Michael P. Mork and MCAPM, LP, have purchased a total of 8,750,000 common shares. Mork Capital now owns approximately 19.3 per cent of the outstanding common shares of the company. Two members of the company’s Board of Directors participated in the first tranche of the offering for a total of $83,515.

The company intends to complete the private placement by January 27, 2023.

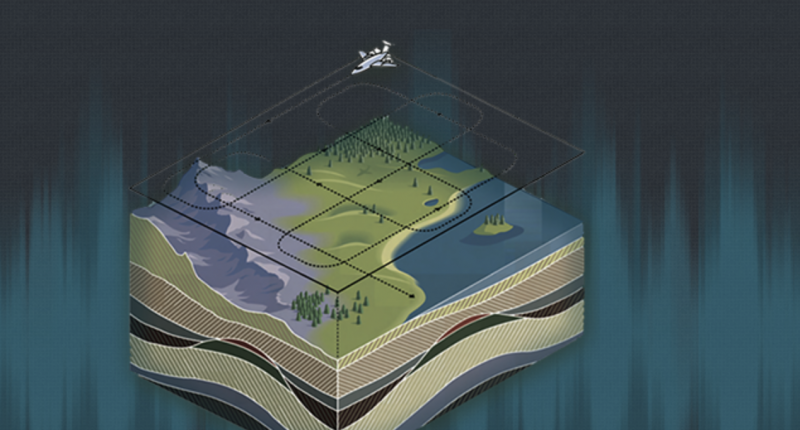

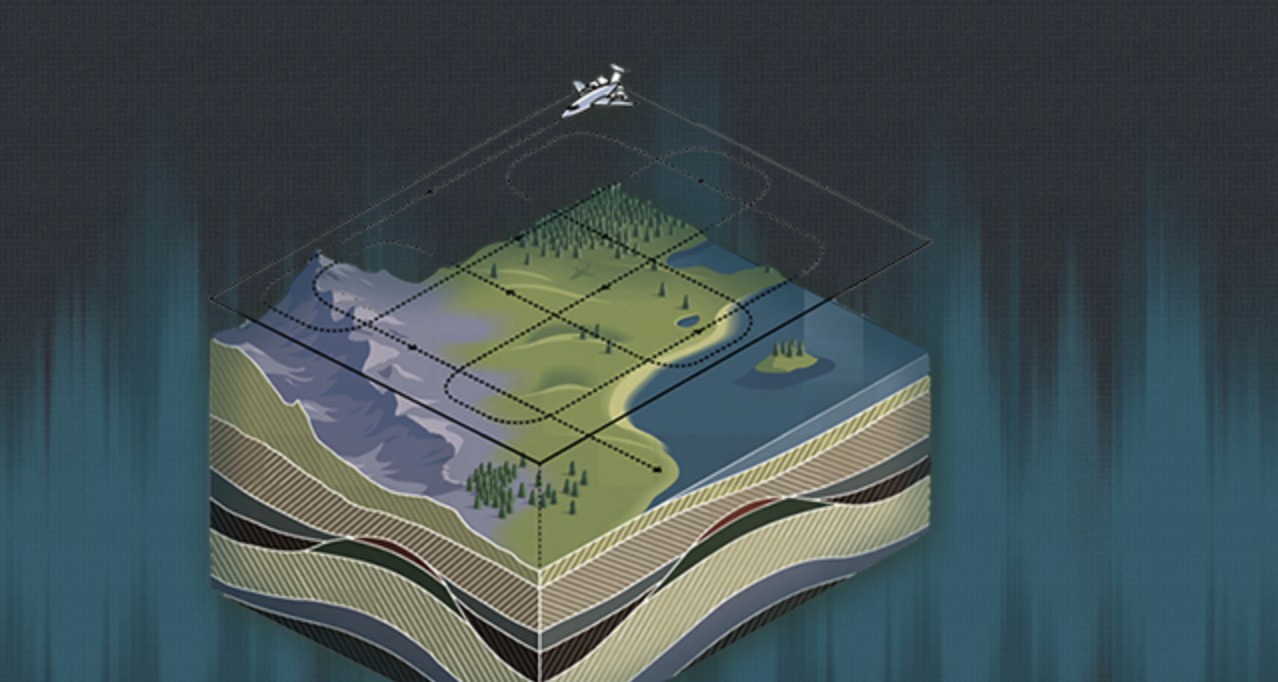

NXT Energy Solutions is a Canadian company that provides geophysical services to the upstream oil and gas industry using its gravity-based Stress Field Detection (SFD) remote-sensing survey system.

NXT Energy Solutions Inc. (SFD) opened trading at C$0.24.