- Quadro Resources (QRO) will conduct a non-brokered private placement of up to 8,333,333 units and up to 7,142,857 flow-through units for aggregate proceeds of up to $1,000,000

- Each unit consists of 1 common share and 1 common share purchase warrant

- Each flow-through unit consists of 1 flow-through share and one half common share purchase warrant

- Proceeds from the financing will be used to explore and develop the company’s properties and for working capital purposes

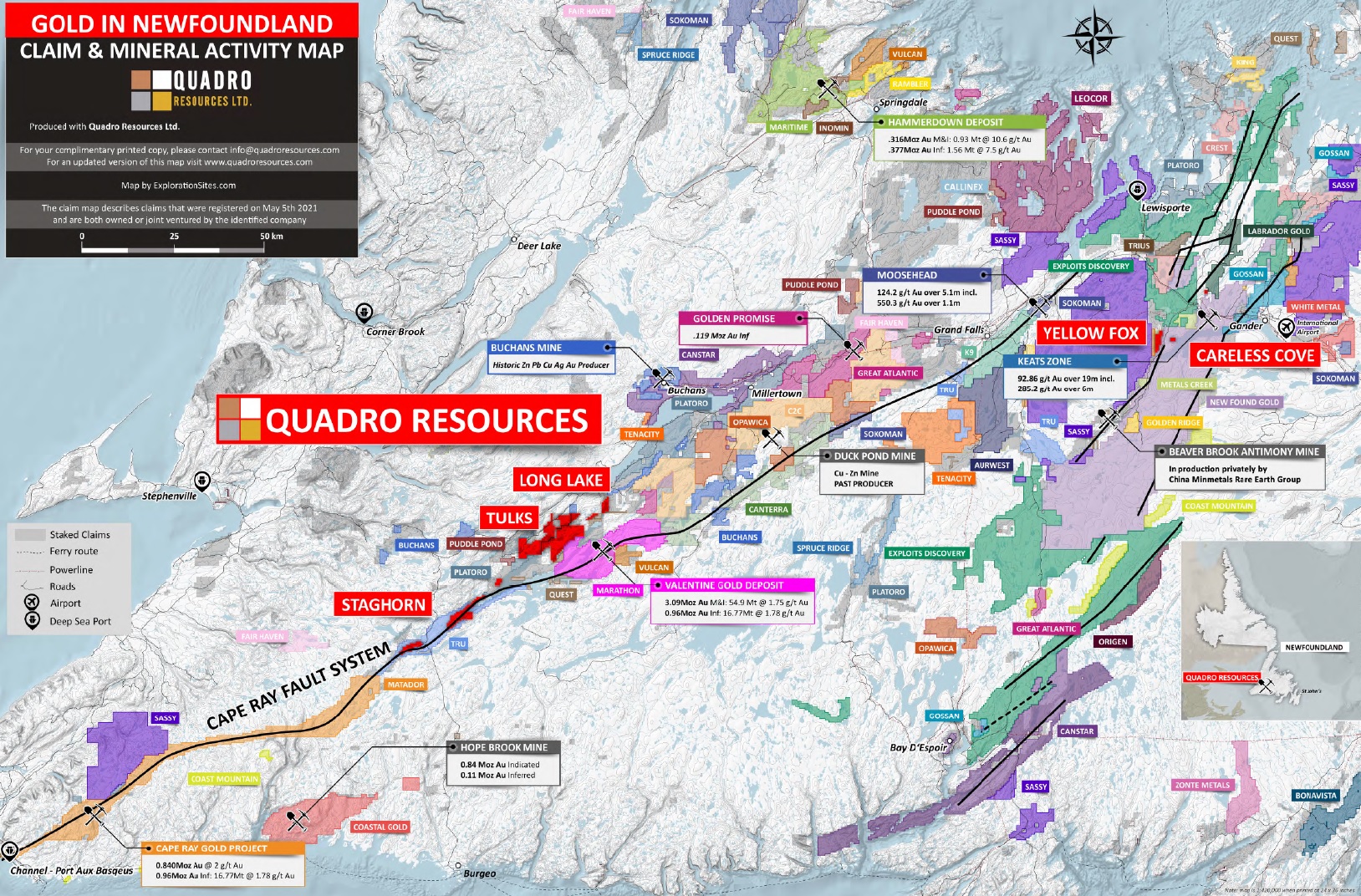

- Quadro Resources is a mineral exploration company focused on exploring for gold in North America

- Quadro Resources Ltd. (QRO) opened trading at C$0.06 per share

Quadro Resources (QRO) will conduct a non-brokered private placement of units and flow-through units for proceeds of up to $1,000,000.

The company will issue up to 8,333,333 units priced at $0.06 and up to 7,142,857 flow-through units priced at $0.07.

Each unit consists of 1 common share and 1 common share purchase warrant.

Each purchase warrant is exercisable for an additional common share at $0.13 for 12 months from closing.

Each flow-through unit consists of one flow-through share and one-half share purchase warrant. each whole flow-through unit is exercisable for a common share at $0.13 for 12 months from closing.

Proceeds from the financing will be used to explore and develop the Staghorn, Long Lake, Tulks South, and Careless Cove properties in Newfoundland and for working capital purposes.

Quadro Resources is a mineral exploration company focused on exploring for gold in North America.

Quadro Resources Ltd. (QRO) opened trading at C$0.06 per share.