- Radisson Mining Resources (RDS) has increased its private placement from $5 million to $6 million

- The company will issue Class A shares priced at $0.32, Quebec flow-through Class A shares priced at $0.35 and Quebec Charity flow-through shares priced at $0.45

- The agents, led by Eight Capital, have been granted an over-allotment option for additional flow-through shares representing up to 15 per cent of the gross proceeds

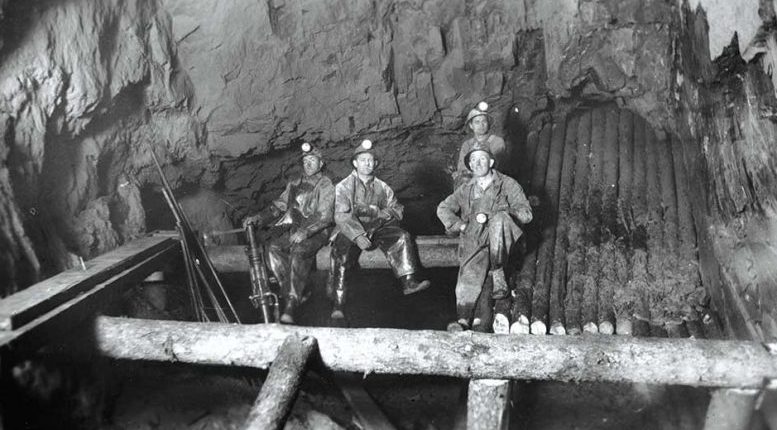

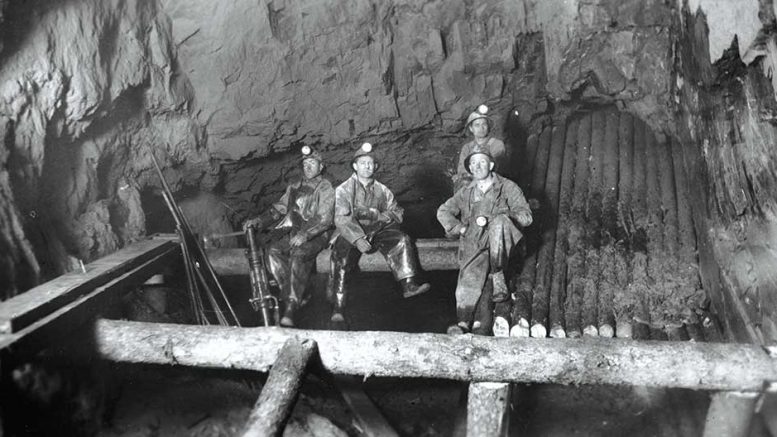

- The gross proceeds will be allocated to ongoing work at the historic O’Brien Gold Project in Quebec

- Radisson Mining is a gold mining company

- Radisson Mining Resources Inc. (RDS) is down 4 per cent on the day, trading at C$0.24 per share at 12 pm ET

Radisson Mining Resources (RDS) has increased its previously announced private placement to $6 million.

The company has entered into an agreement with Eight Capital as lead agent and sole bookrunner, on behalf of a syndicate of agents to increase the proposed private placement for aggregate gross proceeds from $5M to $6M of Class A shares, Quebec flow-through Class A shares and Quebec Charity flow-through shares.

The agents have been granted an over-allotment option for additional flow-through shares representing up to 15 per cent of the gross proceeds, exercisable at any time until 48 hours prior to closing.

The gross proceeds will be allocated to ongoing work at the O’Brien Gold Project in Quebec.

The offering is scheduled to close on or about December 9, 2021, and is subject to the receipt of all necessary regulatory and TSXV approvals.

Radisson Mining is a gold mining company focused on its 100 per cent owned O’Brien project, located in the Bousquet-Cadillac mining camp in Abitibi, Quebec.

Radisson Mining Resources Inc. (RDS) is down 4 per cent on the day, trading at C$0.24 per share at 12 pm ET.