- Rokmaster (RKR) has closed the first tranche of its $500,000 non-brokered financing

- The company will use the funds for exploration, economic studies and general working capital purposes

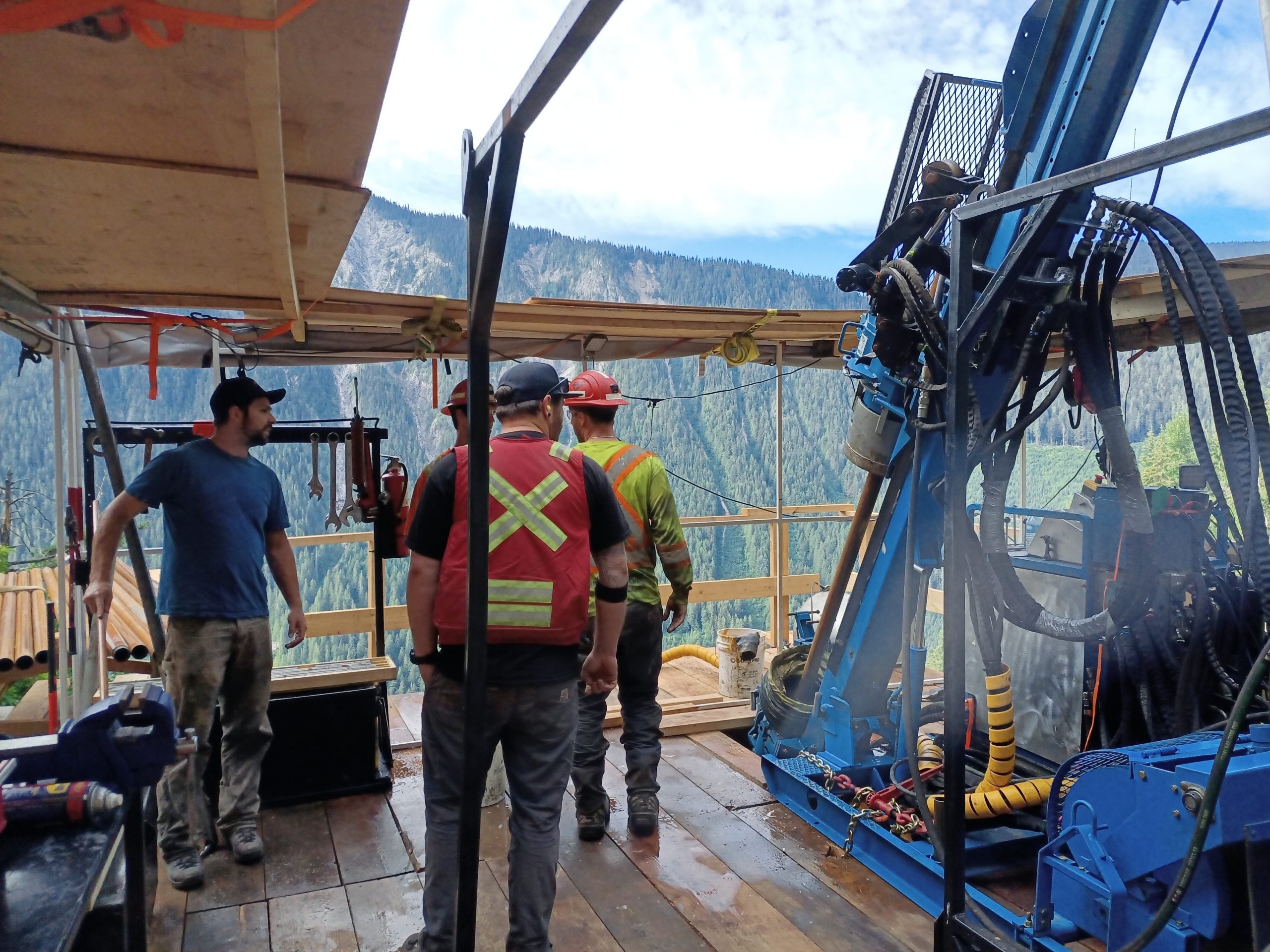

- It is currently developing its massive sulphide gold and polymetallic Revel Ridge Project in British Columbia

- Rokmaster Resources is a Canadian mineral exploration company

- Rokmaster (RKR) opened with a loss of 5.26 per cent trading at $0.09 per share

Rokmaster (RKR) has closed the first tranche of its $500,000 non-brokered financing for gross proceeds of $400,000.

Under the first tranche, the company issued 4,000,000 units priced at $0.10 per unit. Each unit is comprised of one common share and one-half of one non-transferable common share purchase warrant. Each warrant entitles the holder to purchase one additional common share priced at $0.175 for one year, expiring on February 16, 2024. This timeline is subject to acceleration, with 30 days’ notice, if the shares trade at or above $0.25 for 10 consecutive trading days beginning after their four-month statutory hold period.

The company will use the funds for exploration, economic studies and general working capital purposes.

Rokmaster Resources is a Canadian mineral exploration company focused on developing its massive sulphide gold and polymetallic Revel Ridge Project in British Columbia.

Rokmaster (RKR) opened with a loss of 5.26 per cent, trading at $0.09 per share.