- Rome Resources (RMR) has closed its previously announced $2 million private placement

- The non-brokered private placement included 10 million common shares for a price of $0.20 per share

- Proceeds will support exploration work on its Bisie North Tin Project and working capital

- An insider of the company also participated in the offering, for a total investment of $445,000

- The transaction is still subject to the final approval of the TSX Venture Exchange

- Rome Resources (RMR) is unchanged, trading at $0.34 per share as of 12:32 p.m. EST

Rome Resources (RMR) has closed its previously announced $2 million private placement.

The non-brokered private placement included 10 million common shares in the capital of the company for a price of $0.20 per share.

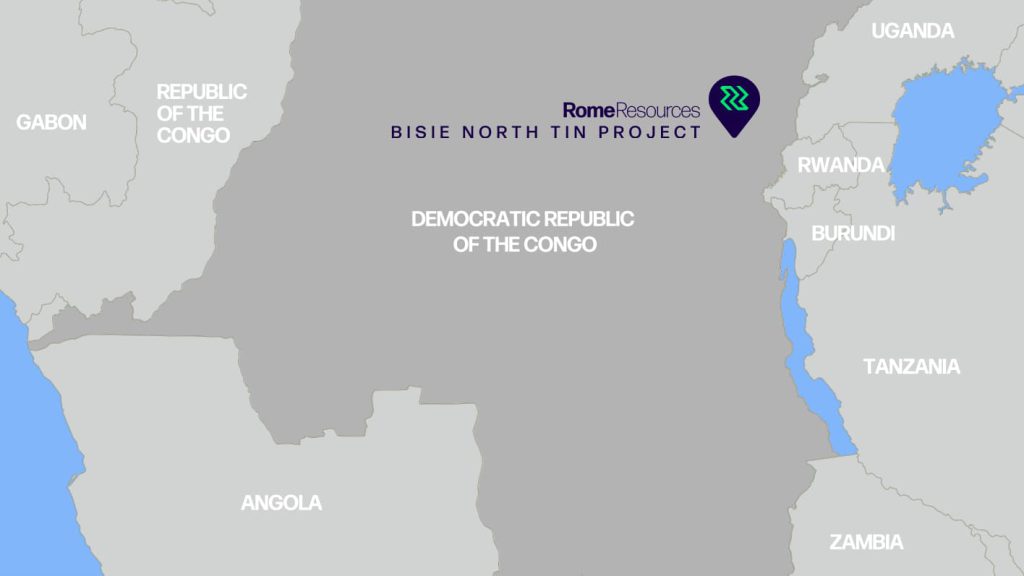

Rome Resources shared that it will use the transaction’s proceeds for exploration work on its Bisie North Tin Project in the Democratic Republic of the Congo and for working capital. However, the private placement is still subject to the final approval of the TSX Venture Exchange

Additionally, an insider of the company participated in the private placement and purchased a total of 2.22 million shares also at $0.20 apiece for a total investment of $445,000.

Rome Resources is a mineral exploration company which has signed two option agreements to acquire a collective 51 per cent in direct and indirect interests in two connecting properties.

These properties make up the Bisie North Tin Project located in the Walikale District. Rome intends to fund exploration work on the project until it completes a definitive feasibility study.

Rome Resources (RMR) is unchanged, trading at $0.34 per share as of 12:32 p.m. EST.