- Royal Helium (RHC) has signed a term sheet for a three-year US$20 million credit facility

- Proceeds will go toward production and development of the Steveville Helium Field in Alberta, as well as initial purchases for production facilities at the Climax Project in Saskatchewan

- The financing will allow Steveville to begin helium deliveries to offtake partners by April 2023

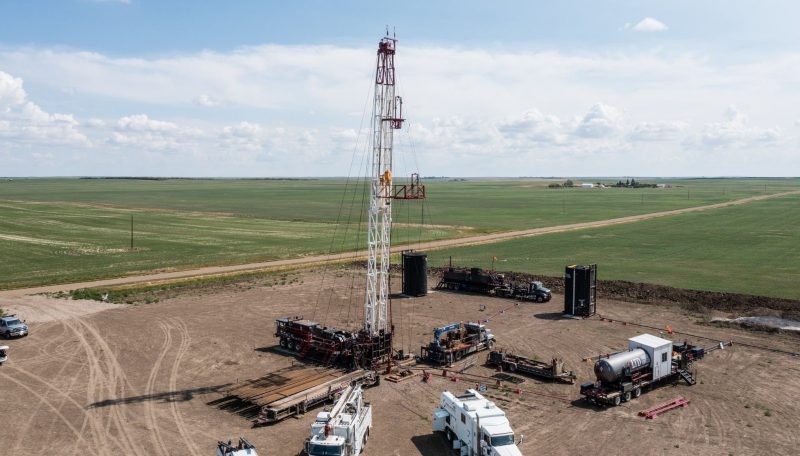

- Royal Helium is developing over 1,000,000 acres of prospective helium land across southern Saskatchewan and southeastern Alberta

- Royal Helium (RHC) is unchanged, trading at $0.235 per share

Royal Helium (RHC) has signed a term sheet for a three-year US$20 million credit facility.

Amounts drawn are subject to annual interest of 14 per cent.

The company will pay the arm’s length lender a 5-per-cent structuring fee and issue share purchase warrants equal to 9.90 per cent of its issued share capital.

Each warrant is exercisable into one common share priced at C$0.35 for a three-year period.

US$10 million will be advanced to the company upon closing on or about December 12, 2022.

Proceeds will be allocated toward:

- Development and production facilities at the Steveville Helium Field in Alberta

- Initial purchases for production facilities at the Climax Project in Saskatchewan

- General corporate purposes

The credit facility will be secured by a first charge on the company’s assets.

“This project financing, once closed, covers the remaining costs for the Alberta processing plant, allowing Steveville to begin helium deliveries to our offtake partners by April 2023,” stated Jeff Sheppard, Royal Helium’s CFO. “The credit facility further allows us to begin procurement for our Saskatchewan processing plants at Climax.”

Royal Helium is developing over 1,000,000 acres of prospective helium land across southern Saskatchewan and southeastern Alberta. Helium extracted from wells in these provinces can be up to 99-per-cent less carbon intensive than helium extraction in other jurisdictions.

Royal Helium (RHC) is unchanged, trading at $0.235 per share as of 2:48 pm ET.