- Sierra Metals (TSX:SMT) is considering an unsolicited takeover bid from Alpayana for C$0.85 per share in which it alleges that Sierra’s management team has left shareholder value on the table

- The potential acquiree produced over 30 million pounds of copper through the first nine months of 2024

- Sierra Metals is a Canadian mining company focused on copper production and polymetallic exploration in Peru and Mexico

- Sierra Metals stock has added 15.07 per cent year-over-year but remains down by 56.48 per cent since 2019

Sierra Metals (TSX:SMT) is considering an unsolicited takeover bid from Alpayana for C$0.85 per share in which it alleges that Sierra’s management team has left shareholder value on the table.

Alpayana is a Peruvian mining group with 38 years of history in zinc, lead, copper and silver production. The company processes about 310 tons of ore per month from its four mines and generates annual revenue over US$500 million.

Sierra has yet to receive a formal acquisition offer but has formed a special committee of independent directors to advise its board should it materialize. Management’s ultimate goal for the proceedings, according to its response on Tuesday, is to deliver “superior long-term value to all its shareholders and stakeholders.”

The response goes on to state that the offer price represents “a very low … premium, appearing to be highly opportunistic in light of Sierra Metals’ high-quality asset base and future growth plans.”

Sierra’s Yauricocha mine in Peru produced 10.4 million pounds of copper through the first nine months of 2024 at all-in sustaining costs (AISC) of US$3.67 per pound of copper equivalent.

The company’s Bolivar Mine in Mexico produced 20.4 million pounds of copper over the same period at AISC of US$3.30 per pound of copper equivalent.

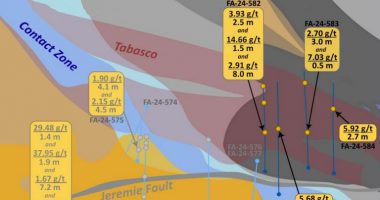

Sierra’s producing operations are complemented by numerous exploration opportunities in Peru and Mexico, including targets near existing mines and several recent new discoveries.

Despite robust operations with upside potential, the copper miner has posted cumulative net losses of more than US$130 million over the past three fiscal years. A recent return to profitability over the past three quarters bodes well for the future, should gold hold near its all-time-high.

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper production and polymetallic exploration in Peru and Mexico.

Sierra Metals stock (TSX:SMT) is down by 1.18 per cent trading at C$0.84 per share as of 9:32 am ET. The stock has added 15.07 per cent year-over-year but remains down by 56.48 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this copper mining stock on the Sierra Metals Inc. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of drilling at Sierra Metals’ Bolivar mine in Mexico: Sierra Metals)