- Spearmint Resources (SPMT) has closed its financing consisting of 5,000,000 units for gross proceeds of $1,000,000

- Each unit consists of one common share to be issued as a “flow-through share”, and one-half of one non-flow-through share purchase warrant

- Proceeds will be used toward the company’s work programs on its existing Canadian properties

- Spearmint Resources Inc. is a mineral exploration company

- Spearmint Resources (SPMT) opened trading at C$0.15 per share

Spearmint Resources (SPMT) has closed its financing consisting of 5,000,000 units for gross proceeds of $1,000,000.

Each unit consists of one common share to be issued as a “flow-through share”, and one-half of one non-flow-through share purchase warrant. Each whole warrant is exercisable into one share at an exercise price of $0.30 until May 12, 2023.

A finder’s fee of $60,000 has been paid in connection with the private placement.

All the securities issued in connection with this private placement have a hold period that expires on September 13, 2021.

Proceeds will be used toward the company’s work programs on its existing Canadian properties.

James Nelson, President of Spearmint, stated,

“We are pleased to have closed this flow-through financing at a significant premium to the market, including an initial investment by certain funds managed by Sprott Asset Management LP (“Sprott”). Having Sprott participate in this financing is an endorsement to, and validates management’s vision for the future of the Company.

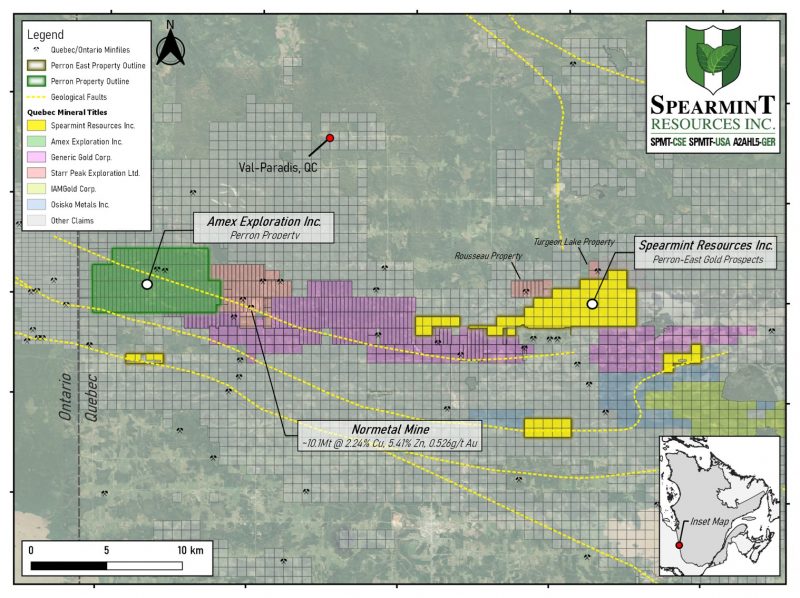

Spearmint’s primary use of the flow-through funds will be a planned drill program on our Perron-East Gold project in Quebec in the direct vicinity of Amex Exploration Inc. and Starr Peak Mining Ltd.

Spearmint is now fully funded for all planned work/drill programs in 2021 and management is optimistic about Spearmint’s short and long-term growth potential now having approximately $3,500,000 in the treasury.”

Spearmint Resources Inc. is a mineral exploration company whose principal business activities include acquiring, exploring and evaluating mineral properties.

Spearmint Resources (SPMT) opened trading at C$0.15 per share.