- Stallion Uranium (TSXV:STUD) intends to acquire a 100 per cent interest in its Horse Heaven gold and antimony project in Idaho

- This marks a significant move for the miner that encompasses 699 mineral claims covering a 58.17 square kilometre land package

- The agreement outlines a structured payment plan that includes C$200,000 in cash upon signing the binding letter of intent, C$200,000 in cash on the effective date of the option agreement, C$2 million in common shares of the optionor at a deemed price of $0.18 per share on the effective date, and an additional C$200,000 in cash on the first anniversary of the effective date

- Stallion Uranium stock (TSXV:STUD) last traded at $0.05

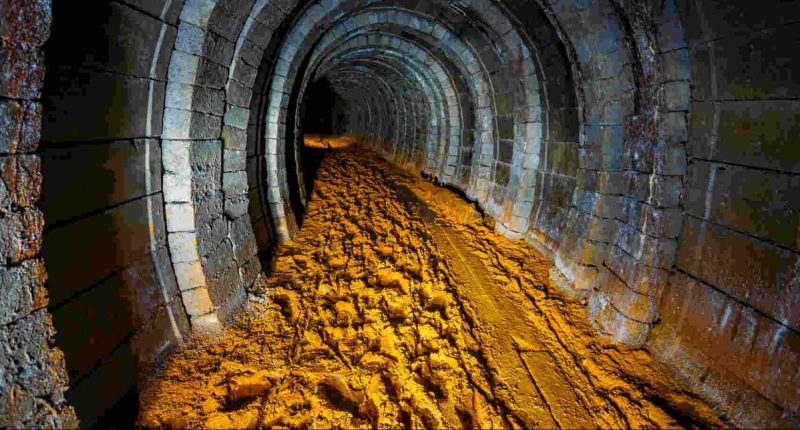

Stallion Uranium (TSXV:STUD) intends to acquire a 100 per cent interest in its Horse Heaven gold and antimony project in Idaho.

This marks a significant move for the miner that encompasses 699 mineral claims covering a 58.17 square kilometre land package in Idaho. This acquisition marks an important step in the company’s expansion in the mining sector.

Under the terms of an option agreement, Stallion Uranium’s subsidiary, 1262446 B.C. Ltd., which holds the legal and beneficial interest in the property, will be transferred to the optionor. The agreement outlines a structured payment plan that includes:

- C$200,000 in cash upon signing the binding letter of intent (already paid).

- C$200,000 in cash on the effective date of the option agreement.

- C$2 million in common shares of the optionor at a deemed price of $0.18 per share on the effective date.

- An additional C$200,000 in cash on the first anniversary of the effective date.

During the option period, the optionor will take on the role of operator for the property, allowing for streamlined management and development. Notably, the optionor is not obligated to incur any exploration expenditures to advance the project, which could facilitate a more efficient operational strategy.

Still under TSX Venture approval, this acquisition could not only enhance Stallion’s portfolio but also positions the company to capitalize on the growing demand for gold and antimony, essential components in various industrial applications. As the mining industry continues to evolve, Stallion Uranium’s strategic moves aim to bolster its presence in the competitive landscape.

“This definitive agreement allows Stallion to monetize a portion of the value of the Horse Heaven project while maintaining upside exposure through a sizeable equity ownership. Antimony scarcity, especially in the United States, where they have no domestic production, will be a key driver of value of the project moving forward,” Drew Zimmerman, CEO of Stallion Uranium, said in a media update. “Having a new company focused on advancing that project will allow that value to be realized. Stallion is now squarely focused on its vision of making the next big uranium discovery in the Athabasca basin.”

With headquarters out of Vancouver, Stallion Uranium Corp. is focused on the exploration of more than 3,000 square kilometres in the Athabasca Basin, home to the largest high-grade uranium deposits in the world.

Stallion Uranium stock (TSXV:STUD) last traded at $0.05 and has fallen 75.61 per cent since the year began.

Join the discussion: Find out what everybody’s saying about this stock on the Stallion Uranium Corp. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Adobe Stock)