- Steppe Gold Ltd (STGO) will receive up to US$65 million debt capital to fast track Phase 2 construction at the ATO Gold Mine

- Approximately US$59.7 million has been funded through the Gold-2 National Program which is facilitated through the Central Bank of Mongolia

- The 2021 Gold-2 Loan is a special purpose covenant-light loan, with a three-year term at nine per cent interest and full prepayment rights without penalty

- Steppe Gold reached an agreement for an additional US$5 million for allocation to working capital to be funded directly from the Trade and Development Bank of Mongolia in the form of a prepaid gold sales loan

- With its Phase 2 Expansion headline numbers announced last month and construction already commenced on the expanded crushing circuit, Steppe Gold will now allocate the proceeds of the Gold-2 Loan to fast track the construction of the Phase 2 Expansion Project

- Steppe Gold Ltd. (STGO) is up 3.226 per cent and is trading at $1.28 per share at 3:18 p.m. ET

Steppe Gold (STGO) will receive up to US$65 million debt capital to fast-track the next phase of construction at the ATO Gold Mine.

Approximately US$59.7 million has been funded through the Gold-2 National Program which is facilitated through the Central Bank of Mongolia.

The 2021 Gold-2 Loan is a special purpose covenant-light loan, with a three-year term at nine per cent interest and full prepayment rights without penalty.

All interest amounts are paid monthly. The drawdown of the loan proceeds will commence later this month.

The 2021 Gold-2 Loan proceeds were advanced during the third quarter to Steppe Gold by the Trade and Development Bank of Mongolia (TDBM).

Steppe Gold reached an agreement for an additional US$5 million for allocation to working capital to be funded directly from TDBM in the form of a prepaid gold sales loan.

The TDBM Gold Loan will be repaid over a period of 12 months based on gold sales, with repayments in cash equivalent at the Bank of Mongolia gold prices.

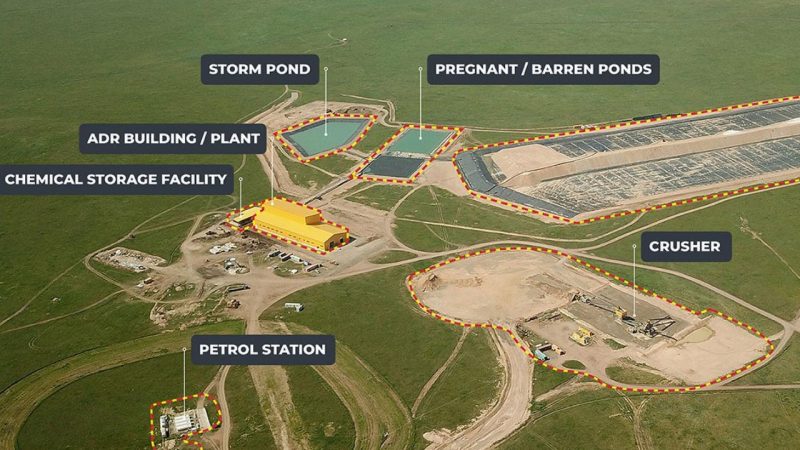

With its Phase 2 Expansion headline numbers announced last month and construction already commenced on the expanded crushing circuit, Steppe Gold will now allocate the proceeds of the Gold-2 Loan to fast-track the construction of the Phase 2 Expansion Project.

The Phase 2 Expansion will generate an additional 300 jobs and further solidify its role as one of the largest investors and employers in the region.

The expansion has all major permits to fast-track the development and construction of the expanded crushing circuit that is nearing completion.

Steppe Gold Ltd. (STGO) is up 3.226 per cent and is trading at $1.28 per share at 3:18 p.m. ET.