Bayer shares gained around 7 per cent last week. Is this the turnaround after the stock reached a multi-year low? Altech Advanced Materials stock is also working on an upward trend. The German battery hopeful has published a promising feasibility study. Their stationary storage systems are significantly more profitable than, for example, Tesla’s MegaPacks. HelloFresh shareholders have been brought back to reality in recent weeks. After a decline of almost 80 per cent in six months, is the stock now ripe for a turnaround? Could there even be a takeover?

Altech Advanced Materials: Feasibility study for stationary storage systems is convincing

Next-generation battery technology is crucial to the success of electromobility and the energy transition. German company Altech Advanced Materials AG (GER:AMA) is working on improving storage solutions. In the future, the company aims to offer coated silicon (project: Silumina Anodes) to increase the performance of electric vehicle batteries. A pilot plant has already been built in Saxony. Letters of intent for the supply of battery materials have also been signed with German and U.S. car manufacturers and battery producers, and based on the convincing feasibility study, planning for a large-scale production facility is underway.

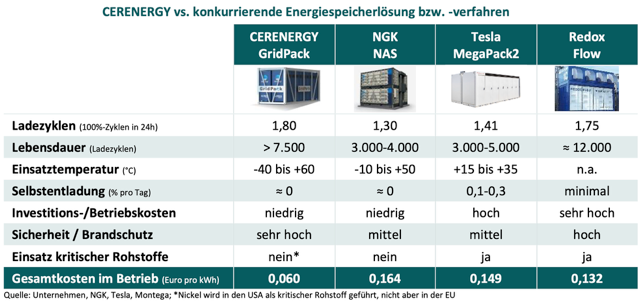

With solid-state batteries for grid storage solutions, Altech even has its sights set on a second billion-dollar market. A feasibility study was recently published for the planned CERENERGY battery plant with an annual production capacity of 120 MWh, which was also convincing. According to the calculations, the total operating costs of the sodium chloride solid state CERENERGY battery – consisting of common salt, nickel and ceramic – amount to EUR 0.06/kWh over the entire service life and are therefore significantly lower than those of conventional lithium-ion batteries. With the MegaPack2 from the Tesla Musk Group, for example, they are €0.149/kWh and therefore more than twice as high.

The economic data in the study is also impressive, resulting in an annual sales potential of €106 million at full capacity utilization. The EBITDA margin is expected to be a proud 47 per cent, and the annual free cash flow before taxes is €51 million. This results in a net present value (NPV) of €169 million. The sales potential certainly exceeds this first production facility with a capacity of 120 MWh.

The expected profitability of the CERENERGY project is very promising, and the joint venture partners Altech Advanced Materials AG, Altech Batteries Ltd, and Fraunhofer will now enter the financing phase of the project.

Are Bayer (GER:BAYX.N; OTCPK:BAYRY) shares ready for a turnaround? After the multi-year low of below €26 in mid-March, a countermovement would be anything but a surprise. Last week, there was at least a first sign of life from the stock when it gained more than 7 per cent in just a few days. The reason for this was the IPO of Boundless Bio in the United States. Around a year ago, Bayer acquired a stake in the company, which specializes in the development of innovative therapeutics against extrachromosomal DNA (ecDNA). At the successful IPO last Thursday, Boundless Bio was valued at US$356 million. Bayer holds a stake of around 6.6 per cent. However, this will have no lasting impact on Bayer shares. And the Leverkusen-based company itself is not currently providing any positive impetus for rising share prices. The breakup of the company is off the table for the time being. However, it remains unclear where the capital for growth financing will come from, among other things, to upgrade the manageable pharmaceutical pipeline. It is clear that legal disputes will continue. Even analysts have recently expressed little hope. After a positive study on the active ingredient elinzanetant, JP Morgan published an update and left its recommendation at “neutral.” The target price is €34. It is still too early to assess the revenue potential of the drug against menopausal symptoms.

HelloFresh: Will takeover speculation lead to a turnaround?

Looking at the share price, HelloFresh (GER:HFG.DE) shares are also a turnaround candidate. However, after the disastrous quarterly figures and the collapse of the medium-term margin forecast, a lot of confidence has been destroyed, and real operational impetus is needed. Analysts have consistently reduced their share price targets in recent weeks. Most recently, Societe Generale reduced the fair value of HelloFresh from €12 to €7.20. The share is trading at around €6.50. Six months ago, it was still trading at more than €30.

Could takeover speculation perhaps lead to the stock’s turnaround? The magazine Börse Online recently pointed out such a scenario. The company still maintains a strong and interesting market position. In addition, HelloFresh’s market capitalization would now only correspond to 0.15 times its annual revenue.

In summary

Altech Advanced Materials has good reasons for its share price to rise. The company is well on the way to addressing $2 billion markets in the future. Additionally, it has strong partners on board, so it does not have to finance the production facilities alone. The stock should take off at the latest with positive financing news. For Bayer, only significant pessimism seems to support rising prices. On the other hand, the market position and low revenue valuation at HelloFresh could spark takeover fantasy, but whether investors want to speculate on this is another question.

Apaton Finance GmbH conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a “Transaction”). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Apaton Finance GmbH risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.