- Target (NYSE:TGT) posted its largest earnings miss in two years, leading to a significant cut in its full-year guidance and causing shares to plummet 20 per cent

- Target now anticipates full-year adjusted earnings per share to range from US$8.30 to US$8.90, a decrease from the previous forecast of US$9 to US$9.70 shared just three months ago

- Comparable sales increased 0.3 per cent in Q3, reflecting a comparable store sales decline of 1.9 per cent and a comparable digital sales increase of 10.8 per cent. Total revenue was US $25.7 billion in Q3, which was 1.1 per cent higher than last year

- Target stock (NYSE:TGT) opened trading at US$128.00

Target (NYSE:TGT) posted its largest earnings miss in two years, leading to a significant cut in its full-year guidance and causing shares to plummet 20 per cent at Wednesday’s market open.

The retailer fell short of Wall Street’s expectations for both quarterly earnings and revenue, reporting only a slight increase in customer traffic despite implementing price cuts on thousands of items and launching an early holiday sale. Target now anticipates full-year adjusted earnings per share to range from US$8.30 to US$8.90, a decrease from the previous forecast of US$9 to US$9.70 shared just three months ago.

Comparable sales increased 0.3 per cent in Q3, reflecting a comparable store sales decline of 1.9 per cent and a comparable digital sales increase of 10.8 per cent. Total revenue was US $25.7 billion in Q3, which was 1.1 per cent higher than last year.

“We saw several strengths across the business, including a 2.4 per cent increase in traffic, nearly 11 per cent growth in the digital channel, and continued growth in beauty and frequency categories. At the same time, we encountered some unique challenges and cost pressures that impacted our bottom-line performance,” Brian Cornell, Target’s chair and chief executive officer said in a news release. “Looking ahead, our team is energized and ready to deliver the unique combination of newness and value that holiday shoppers can only find at Target, and we remain confident in the underlying strength and fundamentals of our business, and our ability to deliver on our longer-term financial goals.”

Target also expects Q4 comparable sales, also known as same-store sales, to remain approximately flat. This metric includes sales from its website and stores that have been open for at least 13 months.

Known for its affordable yet stylish offerings in clothing, home goods, and other discretionary merchandise, Target has struggled to maintain steady foot traffic and higher sales. Consumers have become increasingly selective with their spending, influenced by rising costs in food, housing, and other essentials.

To attract price-sensitive shoppers, Target announced in May that it would reduce prices on about 5,000 frequently purchased items, including essentials like diapers, bread, and milk. In October, the retailer introduced another wave of price cuts on over 2,000 items for the holiday season, targeting products such as cold medicine, toys, and ice cream. By the end of the holiday season, Target expects to have lowered prices on more than 10,000 items.

In light of the upcoming holiday shopping season, Target has also announced its store hours for Black Friday week, with doors opening early at 6 a.m. local time on Friday, November 29.

Target Corp. is a general merchandise retailer selling everyday products through its nearly 2,000 stores and online at discounted prices.

Target stock (NYSE:TGT) opened trading 20 per cent lower at US$128.00 and has lost 13.14 per cent since the beginning of the year.

Join the discussion: Find out what everybody’s saying about this stock on the Target Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

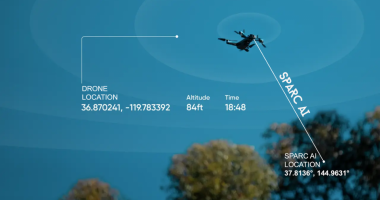

(Top image generated with AI.)