- Teck Resources (TSX:TECK.A) is offering a detailed look at its plans for shareholder value creation and growth to 800,000 tons of copper production per year

- The company intends to invest between US$3.2 and US$3.9 billion into four strategic copper projects to reach its production goal

- Teck is a Canadian resource company with a portfolio of world-class copper and zinc operations across North and South America, in addition to an industry-leading copper growth pipeline

- Teck Resources stock has added 30.88 per cent year-over-year and 192.84 per cent since 2019

Teck Resources (TSX:TECK.A) is offering a detailed look at its plans for shareholder value creation and growth to 800,000 tons of copper production per year.

At its 2024 strategy day, scheduled for Tuesday at 4:00 pm ET, Teck’s executive team will offer shareholders strategic insights into near-term growth plans, continuing the company’s notable progress to date, including:

- Reducing debt by C$2.3 billion in 2024 while maintaining a robust net cash position of C$1.8 billion.

- Approximately C$5.3 billion returned to shareholders since 2019, including more than C$0.9 billion in stock buybacks in 2024 with an additional C$2.3 billion of authorized buybacks ongoing.

Tech plans to invest between US$3.2 to US$3.9 billion over four years to develop four near-term copper projects, enabling it to reach 800,000 tons of copper production per year by 2030. These projects include:

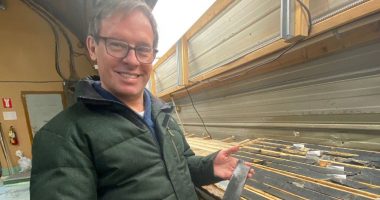

- Quebrada Blanca (Teck 60 per cent owner, Chile), which will undergo optimization and debottlenecking and offers a low-cost option to increase production by 15 to 25 per cent. Estimated capital costs: US$100-US$200 million.

- The Highland Valley copper mine (Teck 100 per cent owner, Canada), which will undergo a mine-life extension into the 2040s, reinforcing its position as the largest copper mine in the country. Operations are expected to produce 137,000 tons per year after 2024 until decommissioning. Estimated capital costs: US$1.3-US$1.4 billion.

- Zafranal (Teck 80 per cent owner, Peru), a long-life, competitive capital cost copper-gold project, which has received SEIA approval and is slated for a sanction decision by the second half of 2025. The project is estimated to produce 126,000 tons of copper per year over the first five years with considerable secondary gold production. Estimated capital costs: US$1.5-US$1.8 billion.

- San Nicolás (Teck 50 per cent owner, Mexico), a low capital cost copper-zinc project in partnership with Agnico Eagle (TSX:AEM) in a mining-friendly jurisdiction. The project is estimated to produce 63,000 tons of copper and 147,000 tons of zinc over the first five years. A feasibility study and execution strategy are in the advanced stages with a potential sanction decision envisioned for the second half of 2025. Estimated capital costs: US$300-US$500 million.

Teck projects that it will increase copper production from 297,000 tons in 2023 to between 420,000-455,000 tons in 2024, followed by 510,000-590,000 tons in 2025.

Leadership insights

“Teck is uniquely positioned in our industry, with the ability to deliver transformative near-term copper growth while simultaneously returning significant cash to shareholders,” Jonathan Price, Teck Resources’ president and chief executive officer, said in a statement. “We are executing on a disciplined strategy to grow copper production by advancing our portfolio of lower capital intensity, high-returning projects in stable jurisdictions.”

“We are focused on disciplined allocation of capital that balances value-accretive growth with continued cash returns to shareholders,” Price added, “all while maintaining a strong balance sheet through market cycles.”

About Teck Resources

Teck is a Canadian resource company with a portfolio of world-class copper and zinc operations across North and South America, in addition to an industry-leading copper growth pipeline.

Teck Resources stock (TSX:TECK.A) last traded at C$66.62 per share. The stock has added 30.88 per cent year-over-year and 192.84 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this copper mining stock on the Teck Resources Limited Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Teck employees at its Quebrada Blanca operation in Chile: Teck Resources)