- Military Metals (CSE:MILI) has welcomed the U.S. administration’s decision to exclude a key group of minerals from the sweeping “Liberation Day” reciprocal tariffs

- The executive order, issued under emergency authority to address “large and persistent” trade deficits, introduces broad-based import duties starting at 10 per cent, with significantly higher country-specific rates

- However, Section 3(b) of the order exempts certain critical minerals, including antimony, cobalt, nickel, indium, gallium, bismuth, and fluorspar, from these tariffs

- Military Metals stock (CSE:MILI) last traded at $0.41

Military Metals (CSE:MILI) has welcomed the U.S. administration’s decision to exclude a key group of minerals from the sweeping “Liberation Day” reciprocal tariffs announced by President Donald Trump on April 2nd, 2025.

The executive order, issued under emergency authority to address “large and persistent” trade deficits, introduces broad-based import duties starting at 10 per cent, with significantly higher country-specific rates. However, Section 3(b) of the order exempts certain critical minerals, including antimony, cobalt, nickel, indium, gallium, bismuth, and fluorspar, from these tariffs. The team feels that this exemption points to the essential nature of antimony, particularly for applications in renewable energy and the defense sector.

“It is an ideal time to be developing antimony projects. This exemption is a clear signal that the U.S. government recognizes the strategic value of antimony and other critical minerals,” Scott Eldridge, Military Metals’ CEO said in a news release. “The exemption of these minerals from tariffs reinforces the urgent need to accelerate the development of secure, reliable supply chains. This decision highlights the strategic importance of reducing dependence on China. It’s a clear signal that advancing domestic and allied sources is essential.”

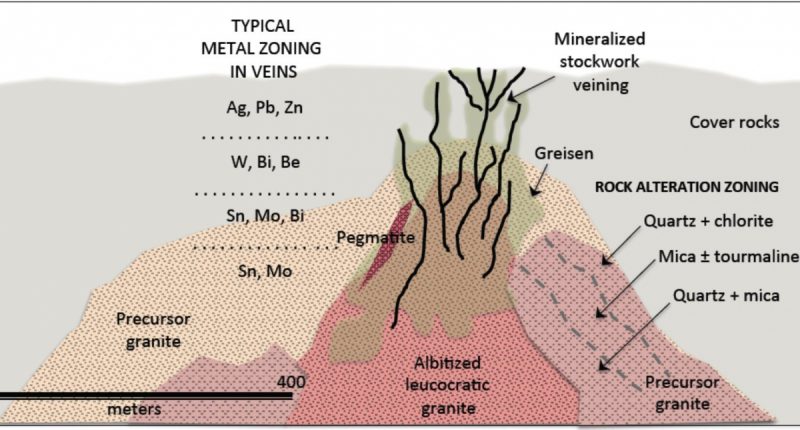

Among the strategic materials excluded from the tariff list is antimony, a core focus of Military Metals Corp. Antimony is vital for various uses, including flame retardants, semiconductors, military-grade ammunition, solar panel glass, and energy storage. Despite significant domestic demand, the U.S. currently produces no antimony domestically, relying entirely on imports from China, Russia, Tajikistan, and other foreign sources. The continued exemption of antimony from U.S. tariffs highlights the urgency of securing stable, non-Chinese supply chains.

Military Metals Corp. is a British Columbia-based mineral exploration company that is primarily engaged in the acquisition, exploration and development of mineral properties with a focus on antimony.

Military Metals stock (CSE:MILI) last traded at $0.41 and has risen 107.27 per cent since this time last year.

Join the discussion: Learn what other investors are saying about this fintech stock on the Lightspeed Commerce Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image via Military Metals Corp.)