The province of British Columbia is well known for its vast gold and copper resources and, in particular, porphyry deposits.

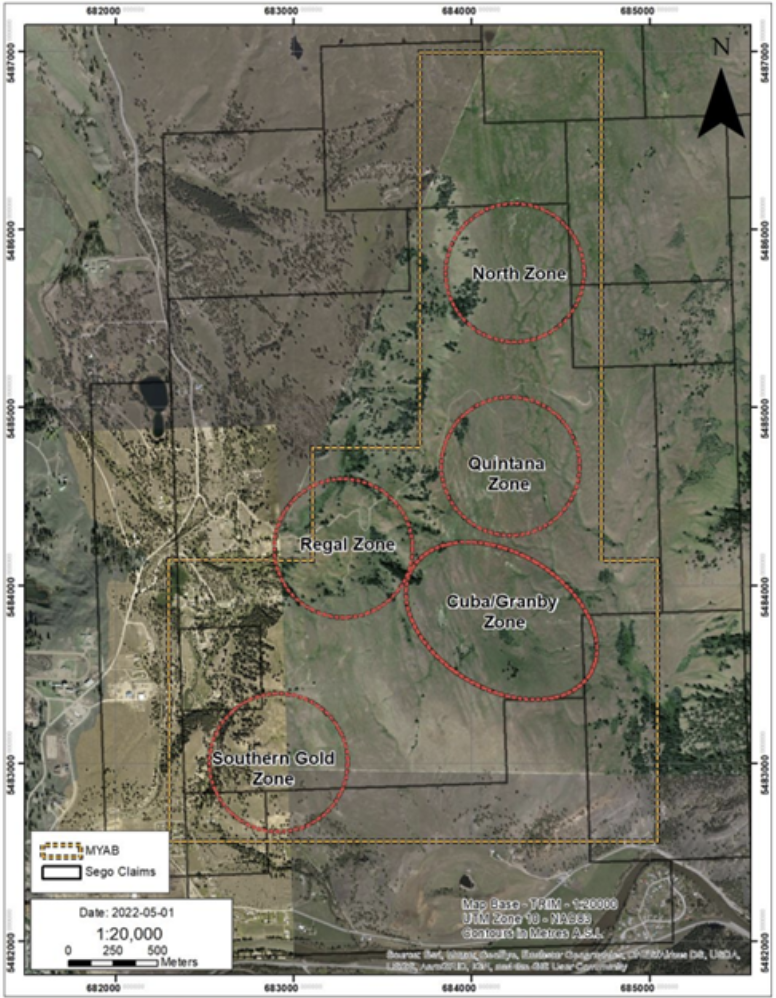

Meet Vancouver-based Sego Resources (TSXV:SGZ), a copper-gold mining company focused on its 100 per-cent-owned Miner Mountain Project which spans over 2,000 hectares and is located northeast of Princeton, British Columbia.

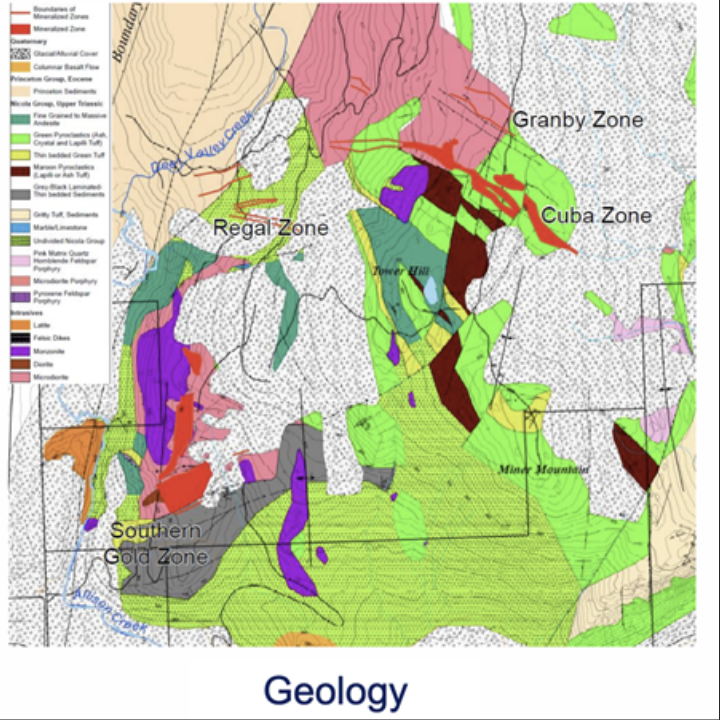

Porphyry deposits are a kind of mineral deposit that forms from large-scale hydrothermal systems associated with intrusive igneous rocks.

When it comes to Sego Resources, the company is focused on a large copper-gold porphyry system and has spent roughly $6 million on its Miner Mountain Project since optioning the project back in 2007.

Additionally, thanks to its strong relationships and agreement with the First Nations in the region as well as award-winning environmental care, Sego Resources is in an ideal position to take advantage of the strong interest in copper-gold porphyries now developing – giving it a competitive advantage to its peers in the space.

The Miner Mountain Copper Project

Located roughly 20 minutes from the town of Princeton, B.C., the Miner Mountain Copper Project boasts year-round exploration capabilities with easy road access and extensive infrastructure.

In other words, this means the company can drill during the winter months without any issues while also adding rigs that Sego Resources can service easily when it begins drilling off resources.

One area of interest at the Miner Mountain Project is the Cuba Zone, a large IP chargeability anomaly, where Sego Resources has previously confirmed higher grades early on with drill hole 19. The company intersected the hole from bedrock surface and 100 metres of 0.96 per cent copper and 0.5 g/t gold was discovered.

In an interview with The Market Online, Sego Resources CEO Paul Stevenson explained the company discovered the Cuba Zone a number of years ago of years ago after some drilling. He said the zone was part of an upper copper-gold-porphyry zone and that some holes were very high-grade.

He added that in the summer of 2023, the company went through all the previously drilled holes and discovered through its data that it was an upper portion of a copper-gold porphyry but that it was offset.

“[The company] went back and looked at [all the holes,] and realized one of the holes had gone much deeper than the flat fault,” he told The Market Online.” Some of the intersections were over 1 per cent copper.”

In a previous interview with The Market Online, Stevenson explained that during the company’s review, one hole had gone through the lower zone and back into the copper-gold porphyry, which bottomed in 11 metres of 0.6 per cent copper, 0.12 gold and contained 4 metres of 1 per cent copper with half a gram of gold.

“We also tested a 2-metre section for platinum group metals and got 0.13 palladium, and that’s an indicator for alkalic copper-gold porphyries,” he said.

In other words, the company now has a strong drill target, which Stevenson explained will be the focus of Sego Resources’ next drilling campaign which is the subject of a private placement.

“The money for now is to go underneath where it hit it and go deeper into the system,” he said.

What gives the company a unique position with the project and its location near Princeton is the relationship it has with the First Nations community and the town of Princeton itself.

According to Stevenson, Princeton is mining-friendly and the First Nations are knowledgeable about the mining industry.

“So the advantage really is not that [we’re] working with them already, but that they have the capacity to understand what [the company] is doing,” he said.

Next steps at the Miner Mountain Copper Project

At almost two months into the new year already, Stevenson said that over the course of 2024 investors can look forward to the company targeting a resource of the Southern Gold Zone, test the copper-gold target north of the Southern Gold Zone as well as deep drilling on the Cuba Zone in order to intersect the copper-gold source that may have been intersected by hole DDH 37.

Notably, the Southern Gold Zone mineralization extends approximately 280 metres from east to west and is open to the east, and 130 metres from north to south and is open at depth, with grades averaging just under 1 gpt gold.

The company has also noted that the New Afton Mine has a vertical gold zone just south of the copper deposit, which is analogous to Sego’s Southern Gold Zone. This area will also come into focus for Sego Resources this year.

“[Sego Resources] now has two strong copper-gold porphyries that we’re going to be drilling,” Stevenson told The Market Online. “I think [the company] is going to have some very, very strong news coming in the future.”

The private placement

In order to move ahead with its plans at the Miner Mountain Copper Project, Sego Resources is currently undertaking a non-brokered private placement worth C$300,000 non-flow-through units at $0.02 per unit.

According to the terms of the private placement, there is no minimum offering size for the private placement and the maximum number of units proposed to be issued is 15 million units for gross proceeds of $300,000.

With the funds, Sego Resources will first target The Cuba Zone and will use a British Columbia Instrument 45-356 that opens private placements to non-accredited investors provided the purchaser has obtained advice regarding the suitability of the investment and that advice has been obtained from a person who is registered as an investment dealer in the jurisdiction.

The management team

J. Paul Stevenson, CEO

J. Paul Stevenson has been involved in mineral exploration and development since 1965 when he began working for Amax Exploration in Smithers, B.C. Between 1968 and 1978, Stevenson worked for a range of exploration syndicates. Stevenson entered the junior company landscape as a project manager in the 1980s with a strong focus on porphyry copper exploration and development.

By 1995, Stevenson had become the CEO of Pacific Booker Minerals. After taking the company’s Morrison Project to a preliminary economic assessment, Stevenson left the company and founded Sego Resources in 2005.

James Allan Hilton, director

James Allan Hilton has been active in mineral exploration and public markets for over 40 years. Notably, Hilton has been president of Hiltec Exploration and Development since 1979 and has served as director of Booker Minerals between 1993 and 1995, director of Consolidated Logan Mines between 1999 and 2005, and director of Solitaire Minerals in 2002.

Hilton has been credited with the discovery of the Samatosum Mine, a past-producing silver mine located near Adams Lake, B.C. Hilton has also been a promoter of Sego Resources and has been a non-independent director for Sego Resources since August 2005.

Jean-Pierre Colin, MBA

Jean-Pierre Colin is a corporate strategy consultant to high-growth publicly-listed mining companies. He is a recognized senior securities industry executive and investment banking professional providing financing and mergers and acquisitions services to numerous prosperous mining issuers in Canada. Colin holds an MBA from the University of Western Ontario and a law degree from the University of Ottawa.

The investment corner

As of the time of this writing, Sego Resources has a market cap of $2.95 million and a share price of just $0.02.

Given its ideal location near Princeton, B.C., support from the region and strong relationships with the First Nations community in the area, Sego Resources is undoubtedly undervalued and has the potential to be a game changer in the copper and gold porphyry space.

Within the broader copper space, while Chile is the world’s largest producer of copper, the domestic supply of the metal is becoming more and more crucial, and Sego Resources is in a prime position to benefit from that.

Case in point, the province of B.C. is Canada’s top producer of copper and coupled with Sego Resources’ position in the southern region of B.C., Stevenson believes the future of copper mining in the province is bright.

As activity at the Miner Copper Mountain Project ramps up, investors won’t want to miss out on this unique opportunity that has a major bargain for its buck.

Join the discussion: Find out what everybody’s saying about this stock on the Sego Resources Inc. Bullboard forums, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Sego Resources, please see the full disclaimer here.