When it comes to junior mining stocks, intelligent investors diversify across multiple commodities in long-term tailwinds to maximize their leverage to spot prices and their chances at making it from pre-revenue exploration to mineral extraction or an asset sale.

A high-potential stock to put this thesis in play is Slam Exploration (TSXV:SXL), market cap C$2.79 million, a junior mining stock poised to capitalize on the hundreds of billions in expected long-term growth across the gold, silver, copper, zinc, lithium, cobalt, nickel and lead markets, among others, thanks to a more than 51,000-hectare portfolio of polymetallic projects in New Brunswick.

The Goodwin Project

Slam’s attention is currently focused on its Goodwin Project, with a spread of 13 claims covering 3,474 hectares underlain by the Goodwin Lake gabbro, a 6,500-metre-long body of intrusive rocks hosting the Granges Discovery from 1987 and two other copper-nickel occurrences – the Farquharson Zone and the Logan Zone – both discovered in drilling programs dating back to 1960.

Goodwin is housed within the mineral-rich Bathurst Mining Camp, only 5 kilometres southwest of Trevali Mining’s multi-million-ounce Half Mile copper-zinc-silver deposit. Goodwin features a historical core interval of 5.7 m grading 1.79% copper and 1.51% nickel (GR87-55) in the Granges Zone, the primary target for the current drilling program.

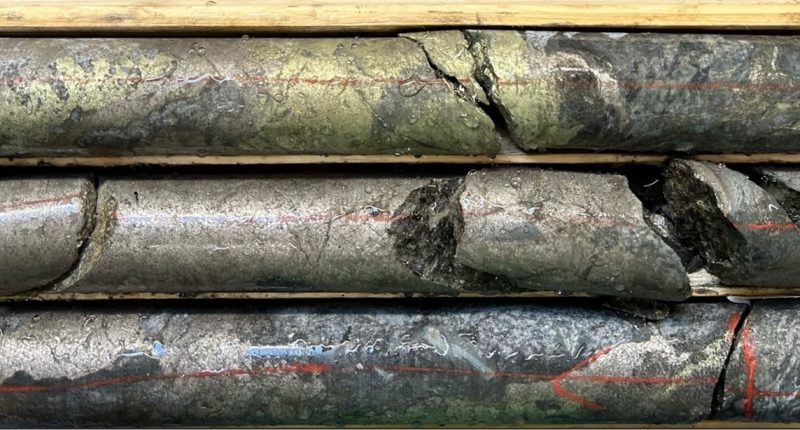

Drilling yields copper-bearing zone at Goodwin

Assays are pending from diamond drill hole GW24-01, the first in Slam’s ongoing 500-m program at Goodwin. The drill hole encountered 8.50 m of 50% pyrrhotite with copper mineralization (chalcopyrite) within a 30.55 meter core interval with 5% to 50% pyrrhotite from 24.85 to 59.40 meters.

The second drill hole (GW24-02) tested the depth potential beneath the mineral zone intersected by GW24-01 and yielded a 5.1-m interval containing 70% pyrrhotite with 5% chalcopyrite (copper mineralization), including a 0.50-meter core interval grading 20% chalcopyrite. These occur within a 31.90 meter zone of variable pyrrhotite chalcopyrite mineralization from 22.60 to 54.50 meters. Historical work has shown that pyrrhotite commonly contains nickel at Goodwin, making the new zones prospective for nickel as well as copper.

Drill hole GW24-03 was located 900 meters southeast of the first two holes and cut 3 zones of pyrrhotite mineralization, including a 23.55-meter core interval with 15% pyrrhotite from 72.90 to 96.45 meters, a 13.65 meter interval with 15% pyrrhotite mineralization from 94.80 to 111.45 meters, and a 20.85-meter zone with 15% pyrrhotite from 113.15 meters to 134.00 meters. These intervals combine for 58 meters of pyrrhotite mineralization, which, according to previous workers, generally contains nickel at Goodwin.

Slam sawed 38 samples representing 35 meters of mineralized core from hole GW24-01. The samples were delivered to ALS Chemex Inc. in Moncton New Brunswick to be analyzed for copper, nickel, silver, cobalt, bismuth, platinum, palladium and gold.

After completion of GW24-03, the drill was demobilized. Detailed logging and sampling is progressing on the core from drill holes GW24-02 and GW24-03.

Permits are in place for additional trenching and drilling at Goodwin to test for copper-nickel mineralization, as well as gold and platinum group metals. New assay results are expected to hit the wire over the coming weeks.

Slam Exploration to acquire five mineral claims for Goodwin expansion

Slam finalized its acquisition of the last five of Goodwin’s 13 mineral claims through an option agreement with Prospect Or Corp. in June. As per the agreement, Slam can acquire a 100% interest in the claims to expand known copper-nickel occurrences by paying C$60,000 in cash and issuing 1 million shares over four years.

Once Slam earns full ownership, Prospect Or will retain a 2% net smelter return (NSR) royalty – 1% of which Slam may buy back for C$1 million at any time – in addition to the right of first refusal on the remaining 1% before reaching mineral production.

Slam’s large and highly prospective portfolio

Alongside Goodwin and its multiple catalysts for exploration upside, Slam has assembled a polymetallic portfolio across New Brunswick, much of it over the past two years, that is brimming with results-driven potential. Here’s a quick breakdown to get your due diligence started:

- Slam’s flagship 12,450-hectare Menneval Gold Project boasts multiple discoveries over more than a decade of exploration work, including the high-grade Maisie vein, a 3,000-m untested soil trend ranging from 10 ppb to 683 ppb gold, and the No. 18 vein, which generated a chip sample of 3,955 g/t gold over 0.1 m and core intervals of 162.5 g/t gold over 0.2 m and 56.90 g/t gold over 0.5 m. Diamond drilling for gold is planned for later this year.

- The 14,130-hectare Jake Lee Project is notable for its 10 gold targets (slide 13) highlighted by a soil sample of 16,200 ppb gold and quartz float grading up to 39.3 g/t gold, the latter about 40 km southeast of Galway Metals’ 2.3-million-ounce Clarence Stream gold deposit. Trenching and diamond drilling for gold are planned for later this year.

- The 8,230-hectare Mine Road Project in the Bathurst Mining Camp houses seven volcanogenic massive sulphide (VMS) mineral occurrences containing zinc, lead, copper and silver. Significant historical intervals include 14.51% zinc, 5.86% lead, 0.67% copper and 139.9 g/t silver over 9 m from the Railroad Zone – which is only 7,000 m east of the 20-million-tonne past-producing Heath Steele B Zone – and 7 m of 0.9% copper on the Roche Trend about 5 km to the southwest. Prospecting, trenching and diamond drilling for zinc and copper are planned for 2024.

- The 5,125-hectare Highway Gold Project is prospective for copper, gold, cobalt, silver, zinc, tin and molybdenum across 11 mineral occurrences associated with magnetite in volcanic, sedimentary and granitic rocks. The property’s structural setting, similar to Galway’s Clarence Stream deposit 55 km to the southwest, has yielded grab sample assays as high as 12.70% zinc, 13.10% lead and 155 g/t silver, as well as 0.64% cobalt over 0.3 m in trench, with soil geochemistry offering multiple drill-ready exploration targets.

- The 4,700-hectare Ear Falls Lithium Project features 230 claim units in two groups 10 km northeast and 12 km south of a 1,000-m-long spodumene-bearing pegmatite zone discovered by Beyond Lithium (CSE:BY), which collected grab samples up to 4.54% Li2O and encountered high grades in 2023 drilling.

- The A’hearn Project (slide 30) is a VMS prospect that drilled up to 29.1% zinc, 16.6% lead, 2.26% copper and 210.34 g/t silver over 1.5 m in VMS Zone A (152 m long at surface and 366 m down plunge), in addition to 6.18% zinc, 0.16% copper, 0.75% lead and 12.4 g/t silver over 3.35 m from the Strachens East Deposit.

- The company rounds off its portfolio with extensive share and royalty (slide 5) holdings to fund future acquisitions and exploration – C$1.245 million in cash and 4.34 million shares expected between Jan. 1, 2023, and Dec. 31, 2027 – with management confident in securing new agreements over the near term.

Despite Slam’s track record of fostering shareholder value through acquisitions, project development and reliable cash flow, and its target commodities combining for hundreds of billions in global revenue over the coming decades, the junior mining stock has added only 75% since 2019, and has fallen by 30% year-over-year, last trading at C$0.035 per share, suggesting a pronounced disconnect between price and potential for resource delineation.

Investors can capitalize on this disconnect today and gain exposure to a growing collection of high-grade mineralized targets with little share-price recognition, tilting the probability for outsized returns in their favour as continued positive news flow helps the broader market recognize the value it is missing.

Join the discussion: Find out what everybody’s saying about this junior gold, copper, zinc, lithium and nickel mining stock on the Slam Exploration Ltd. Bullboard, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Slam Exploration Ltd., please see full disclaimer here.

(Top photo: Slam Exploration)