- Is green ammonia a good investment?

- The short answer is yes

- The long answer is easily recognizable as a significant source of value

- Read on to learn about the microcap stock spearheading this over US$200 billion opportunity

Is green ammonia a good investment? The short answer is yes. The long answer is easily recognizable as a significant source of value.

Ammonia is the second-highest produced chemical after sulfuric acid thanks to its wide-ranging industrial use-cases. About 80 per cent of global ammonia production – 150 million metric tonnes in 2023 – goes towards fertilizer, in which it serves as an efficient means to deliver nitrogen to soil and into plants. Without nitrogen, vegetation wouldn’t be able to process nutrients and grow large enough to keep up with demand from the ballooning global population.

The other 20 per cent goes towards refrigeration and air conditioning – taking advantage of ammonia’s ability to absorb heat – as well as water purification, food stabilization, and as a base in everything from plastics, to explosives, to pesticides, fabrics and dyes.

Legacy ammonia production harms the environment

The problem with ammonia’s more than US$200 billion market opportunity is that legacy production methods extract it from hydrogen sourced from coal and natural gas, generating 450 million metric tons of CO2 emissions in 2020, which accounts for a staggering 1.2 per cent of global emissions. At present, one ton of traditionally produced ammonia emits two tons of CO2.

According to McKinsey, eliminating these emissions would be equivalent in size to 1.5 times France’s fossil-fuel emissions, or two-thirds those of international shipping, opening the door for innovators to decarbonize ammonia and capitalize on a key driver toward global net-zero 2050 goals.

Affordable green ammonia is here

A notable name unlocking value by eliminating ammonia’s carbon inefficiencies is AmmPower (CSE:AMMP), a renewable energy stock offering green ammonia technology aligned with ongoing tailwinds towards electrification and sustainability.

Green ammonia is produced with hydrogen from water instead of fossil fuels, which reduces legacy emissions by 80 per cent. The remaining 20 per cent can be avoided by using solar, wind or hydropower as your energy source.

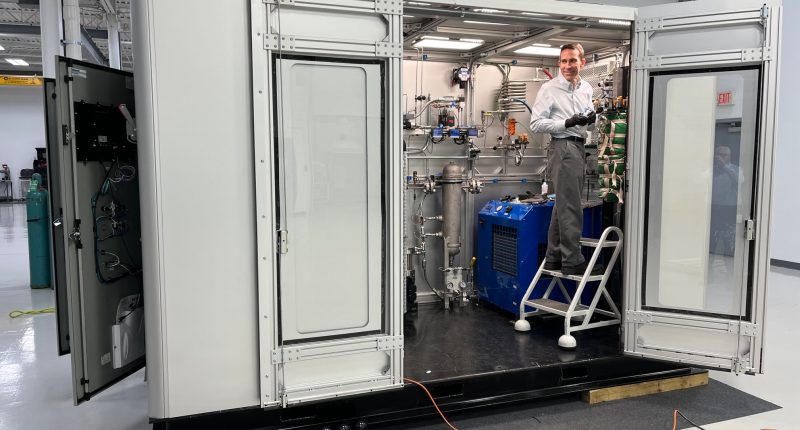

AmmPower’s innovation is known as the Independent Ammonia Making Machine (IAMM), a modular, on-site and demonstrated technology that can generate 4 metric tons of ammonia per day at a cost comparable to large-scale green ammonia projects. Thanks to its streamlined design, the company can even deliver your IAMM from its Michigan factory to your door within a year, which is 2-2.5 years sooner than industry practice.

Given traditional ammonia prices in the range of US$110-US$340 per ton, the IAMM makes green ammonia a competitive choice, considering it requires only US$360 in electricity to produce one ton of green ammonia and the United States offers production tax credits for renewable energy usage up to US$532 per ton.

With the IAMM paving the way for a more sustainable agriculture sector, and by extension, healthier produce on our plates, AmmPower is in a position to create significant shareholder value.

The market leaves the best investments for dead

Life-changing returns in the stock market are often found in quality opportunities with little in the way of financial results to justify a long-term holding. The lack of cash generation tends to depress share prices, offering investors with strong stomachs and stronger conviction the chance to buy in when the proverbial blood is in the streets and ride rising market awareness to exponential returns. Sitting at a 91.25 per cent loss since 2020, having yet to secure any revenue, AmmPower makes a strong case for rewarding investors with such an outsized outcome. Here are four green flags in support:

- The IAMM’s clear value-add compared with fossil fuel-based hydrogen extraction

- A management team with more than two centuries of experience in the ammonia industry

- Legacy ammonia production’s unjustifiable and unsustainable carbon footprint

- The eventual upswing of macroeconomic sentiment, as inflation continues to cool, and interest rates make their way down to non-restrictive territory, awakening investors to the high-risk, high-reward microcap stock space

As researchers across the world expand upon ammonia’s usefulness, including exploiting how it can contain nine times the energy of a lithium-ion battery, and how it’s 0.7 to three times more energy-dense than hydrogen, the need for environmentally friendly production will only become more pressing, making profitable zero-emission solutions like the IAMM table stakes within the industry. This means AmmPower may only need a few initial sales for its stock to blast off into a V-shaped recovery.

Join the discussion: Learn what other investors are saying about this green ammonia technology stock on the AmmPower Corp. Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.