- Top gold stock Tudor Gold (TSXV:TUD) added to its more than 300 per cent return since 2018 after the discovery of more high-grade gold, copper and silver on its Treaty Creek property in British Columbia

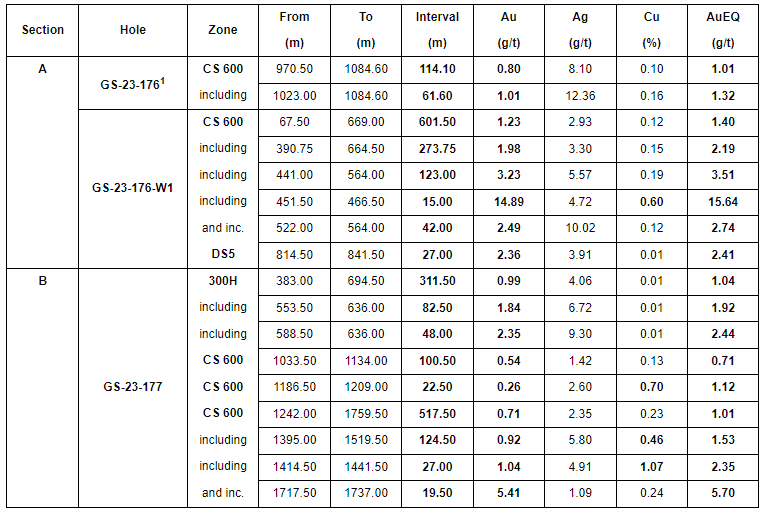

- Results are highlighted by GS-23-176-W1’s intersection of 15 metres of 15.64 g/t AuEq (14.89 g/t Au, 4.72 g/t Ag, 0.60 per cent Cu) at the core of the richest portion of Goldstorm’s CS-600 domain

- Tudor Gold is a precious and base metals exploration and development company focused on British Columbia’s Golden Triangle

- Tudor Gold stock (TSXV:TUD) is up by 4.35 per cent, trading at C$0.96 per share as of 10:01 am ET

Top gold stock Tudor Gold (TSXV:TUD) added to its more than 300 per cent return since 2018 after the discovery of more high-grade gold, copper and silver on its Treaty Creek property in British Columbia.

The Goldstorm deposit is composed of a large gold-copper porphyry system, in addition to several other mineralized zones, with an indicated mineral resource of 23.37 Moz of AuEq grading 1.13 g/t AuEq (18.75 Moz Au grading 0.91 g/t, 2.18 Blbs copper grading 0.15 per cent, 112.4 Moz silver grading 5.45 g/t) and an inferred mineral resource of 7.35 Moz of AuEq grading 0.98 g/t AuEq (5.54 Moz Au grading 0.74 g/t, 0.85 Blb copper grading 0.16 per cent, 45.08 Moz silver grading 5.99 g/t).

The three drill holes reported Wednesday represent the sixth set of results from the finalized 2023 exploration program, which was composed of 31,904 metres focused on the Goldstorm deposit and the Perfectstorm zone.

GS-23-176-W1 features 15 m of 15.64 g/t AuEq (14.89 g/t Au, 4.72 g/t Ag, 0.60 per cent Cu) at the core of the richest portion of Goldstorm’s CS-600 domain. The enriched quartz stockwork is comparable to the high-grade gold interval encountered within the CS-600 in GS-22-134, a drill hole that intersected 25.5 m of 9.96 g/t AuEq. Tudor’s technical team is examining this hypothesis, which may yield an independent high-grade system that touches on the 300H and CS-600 domains.

Including the high-grade interval, the overall larger composite of the CS-600 domain yielding 601.5 m of 1.40 g/t AuEq is comparable to GS-21-113-W2, which had a composite of 732 m of 1.60 g/t AuEq.

These intercepts may add significant indicated mineral resources to Treaty Creek during the next mineral resource update.

GS-23-177, for its part, offers an enriched core of the 300H domain with 82.5 m of 1.92 g/t AuEq within 311.5 m of 1.04 g/t AuEq.

Additionally, the composite for the CS-600 domain encountered a long intercept of 517.5 m averaging 1.01 g/t AuEq, as well as an enriched zone yielding 19.50 m of 5.70 g/t AuEq (5.41 g/t Au, 1.09 g/t Ag, 0.24 per cent Cu). Management believes these two sections will “add to the overall quantity of gold, silver and copper in the indicated and inferred categories of the next mineral resource update,” according to Wednesday’s news release.

The Goldstorm Deposit remains open in all directions and at depth.

“We are very pleased to announce the continuing expansion and definition of the Goldstorm domains in the northeastern sector of the deposit,” Ken Konkin, president and CEO of Tudor Gold, said in a statement. “Three of the largest mineralized domains, including 300H, CS-600 and DS5, reported excellent results from these latest drill holes. The highlight of the 2023 program is the remarkable continuation of higher grades of gold, copper and silver throughout the northern aspect of the Goldstorm deposit.”

“An interval of higher-than-average gold values was intersected near the end of GS-23-176-W1 that was associated with narrow quartz veinlets with minor disseminated pyrite; this is interpreted to be part of the DS5 domain, which may extend to greater depths than previously thought. If possible, we may extend this hole during the 2024 drill program to determine if there is a continuation to the lower 27 metres of mineralization that averaged 2.41 g/t AuEq near the bottom of this hole,” he added.

Drilling results for the Goldstorm deposit on Nov. 28

Tudor Gold is a precious and base metals exploration and development company focused on British Columbia’s Golden Triangle. It holds a 60 per cent interest in its flagship 17,913-hectare Treaty Creek project, which resides in an area that is host to producing and past-producing mines and several large deposits that are approaching potential development.

Tudor Gold stock (TSXV:TUD) is up by 4.35 per cent, trading at C$0.96 per share as of 10:01 am ET. The stock has lost about 15 per cent year-over-year, but has added more than 310 per cent since 2018.

Click here to read about Stockhouse’s top 5 Canadian small-cap gold stocks to buy in 2023.

Join the discussion: Find out what everybody’s saying about this top gold stock on the Tudor Gold Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.