In the volatile world of junior mining stocks multi-bagger returns can flip into steep losses, and vice versa, over the course of one trading day. Because of this, investors should diversify across as many commodities with high expected long-term demand as their risk tolerances will allow, thus enhancing the probability of a successful outcome despite the sub-sector’s numerous hurdles, including:

- Financing as a pre-revenue company

- Resource delineation

- The unpredictability of the macroeconomic environment and its effect on commodity demand

- The more than 15 years of studies, permitting and construction it takes for a project to progress from discovery to production

While these factors make it inevitable that more than 99 per cent of mining projects will fail before extracting any ore, it’s the frightening nature of this fact that leads the broader market to undervalue junior mining stocks despite their value-accretive track records.

Q Precious and Battery Metals

Take Q Precious and Battery Metals, a junior mining stock based in the prolific Abitibi greenstone belt region of Val d’Or, Quebec. Despite consistent development within its seven-project portfolio – with the potential to host lithium, copper, nickel, cobalt, zinc, molybdenum and platinum group elements – QMET shares have given back about 99 per cent since 2019. Highlights over the period include:

- Establishing the presence of gold on its McKenzie East project in April 2021 and November 2023, both to be followed up on later this year.

- Discovering lithium on its La Corne South project in March, 2023, which yielded pegmatite rock sample results up to 622 ppm lithium in October, and is the site of an ongoing drill program to test geophysical anomalies for massive sulphide potential backed by significant copper, silver, with some zinc and gold, from historical diamond drilling.

- Acquiring the 1,409-hectare Pegalith lithium project in March 2023 for its 12 historic pegmatite showings and high silver values.

- Acquiring the 5,376-hectare Pontax lithium project in August 2023, which is surrounded by large lithium plays owned by Patriot Battery Metals, Brunswick Exploration and Li-FT Power, and features 63 soil samples indicating elevated pathfinder elements for lithium-cesium-tantalum pegmatites.

The reason for such a severe dislocation between the junior mining stock and its successful exploration and inorganic growth is impossible to pinpoint, given the market’s manic-depressive nature over the short term, but we can say for certain that value creation always prevails in the end, making Q Precious and Battery Metals’ history of solid results and prospective assets a no-brainer combo to get in on.

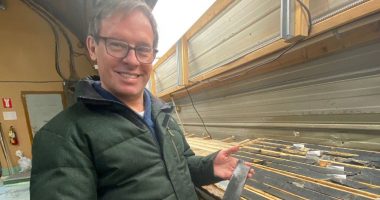

Richard Penn, chief executive officer of Q Precious and Battery Metals, spoke with Stockhouse’s Lyndsay Malchuk about ongoing drilling at La Corne South. Watch the interview here.

Shares of Q Precious and Battery Metals (CSE:QMET) last traded at C$0.015 per share.

Slam Exploration

Another junior mining stock with turnaround potential is Slam Exploration, a New Brunswick-based explorer whose high-quality exposure to gold, copper, zinc, nickel, lead, cobalt, tin and rare earth elements across a more than 51,000-hectare portfolio makes it one of the easiest ways to gain diversified exposure to the mining industry.

While Slam Exploration stock has fared far better than Q Precious and Battery Metals over the past five years, coming in at a zero per cent gain, it has given back 50 per cent year-over-year, unfairly discounting management’s multiple milestones over the period, including:

- Sampling 363 grams per tonne (g/t) of gold at its Menneval gold project in October 2020 and generating trenching assays as high as 3,955 g/t gold in December.

- Drilling up to 56.50 g/t gold over 0.51 m at Menneval in January 2022.

- The discovery of gold-bearing boulders grading up to 39.3 g/t gold at the Jake Lee project in October-November 2022.

- Acquiring the Highway gold project in March 2023, where historical work detected gold, cobalt, silver, zinc, copper, tin and tungsten in a structural setting similar to Galway Metals’ 2.3-million-ounce Clarence Stream gold deposit 55 km to the southwest.

- Acquiring the Ear Falls lithium project in October 2023, which is in the vicinity of a new 1,000-metre-long spodumene-bearing pegmatite zone reported by Beyond Lithium (CSE:BY) with grab samples up to 4.54 per cent Li2O.

- Ongoing drilling at the Goodwin project following up on its highlight interval of 5.7 m at 1.79 per cent copper and 1.51 per cent nickel, with results to date returning copper mineralization and evidence for nickel.

- Assembling a robust royalty portfolio expected to generate C$1.245 million in cash and 4.34 million shares between Jan. 1, 2023 and Dec. 31, 2027 to support future acquisitions and exploration.

As a project generator, Slam has proven itself skilled at identifying attractive assets, demonstrating their prospectivity and executing on sales accretive to shareholder value, with management expecting to negotiate new deals in 2024 to increase the portfolio’s revenue generation.

Slam Exploration stock, on the other hand, having done nothing since 2019, has failed to price in the high likelihood of cash, shares and high-grade exploration results continuing to create positive news flow into the future, setting investors up to capitalize as rising commodity demand shines a brighter light on long-term opportunities in the junior mining space.

Mike Taylor, Slam Exploration’s president and chief executive officer, spoke with Stockhouse’s Lyndsay Malchuk about the company’s plans for the Goodwin property. Watch the interview here.

Slam Exploration stock (TSXV:SXL) last traded at C$0.02 per share.

Join the discussion: Find out what everybody’s saying about these diversified junior mining stocks on the Q Precious and Battery Metals Corp. and Slam Exploration Ltd. Bullboards, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Q Precious and Battery Metals Corp. and Slam Exploration Ltd., please see full disclaimer here.

(Top photo: Adobe Stock)