To find success in small-cap and micro-cap stocks, investors need to develop a sense of the contrarian, enabling them to identify a company’s ability to create value in the future despite its present unprofitability.

This is because so many emerging companies must first fight for and establish durable market share through growth, research or exploration results before net income can turn reliably positive.

Sifting through these seemingly unattractive gems is easier said than done, because retail investors have access to the same publicly available information, and might not possess the wherewithal (or emotional fortitude) to extrapolate the dire pictures it paints into the conviction required to hold on through volatility and benefit from long-term compounding.

To illustrate exactly what I mean, let’s introduce two junior gold miners and a Bitcoin stock Stockhouse spoke with over the past week, each of which have underperformed their potential and recent development.

Canagold Resources

Take our first junior gold stock, Canagold Resources (TSX:CCM), market cap C$42.53 million, which is advancing its 100-per-cent-owned New Polaris project in British Columbia, Western Canada’s highest-grade gold project.

New Polaris offers exposure to a mineral resource estimate of 1.035 million ounces of gold indicated and 213,000 ounces inferred – up from 541,000 and 440,000 in 2019, respectively – in an environment where gold has added more than 71 per cent since 2019 on the back of global inflation and recession fears. Though the project’s value in the ground has risen by more than US$542 million from 2019, the market has rewarded the company’s ability to add value with a measly 35 per cent return, suggesting that inflationary fears have yet to loosen their grip on investors’ risk appetite.

Canagold is advancing New Polaris through a feasibility study that, once finalized, might serve as the catalyst investors need to pile in with eyes on the company’s well-funded exploration plans and management team well-versed on the pathway from exploration to production.

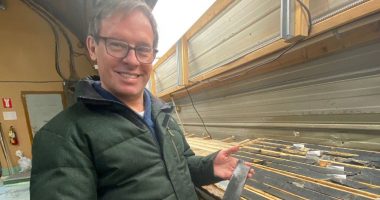

Catalin Kilofliski, Canagold’s chief executive officer, sat down with Stockhouse’s Ryan Dhillon to shed light on these exploration plans and what investors can look forward to in the near future.

Bitcoin Well

Our next contrarian stock pick is Bitcoin Well, market cap C$21.02 million, whose decade-long history centres on Bitcoin, so-called digital gold, a cryptocurrency and development network that enables payments and services across an almost US$2 trillion market capitalization.

Bitcoin Well operates a cash-flowing network of more than 200 Bitcoin ATMs across Canada that charges between a 10-20 per cent transaction fee, in addition to an online banking services portal available in Canada and the United States (1 per cent transaction fee) with more than 18,000 members that surpassed ATM revenue in February 2024.

Growth has been volatile, as is to be expected with a speculative asset such as Bitcoin, but is overall up by 3.75 times from C$14.45 million in 2019 to C$54.53 million in 2023 with consistent gross profitability, though net income has been elusive as the company expands into its full-service approach (slide 13) to differentiate itself from the competition.

Noting that shares of Bitcoin Well (TSXV:BTCW) have given back 75 per cent since inception in July 2021, and that Bitcoin is up by 83.4 per cent during the period, we can see a clear disconnect between the company and the asset at the heart of its business, even though it held 173 of them on its balance sheet as of Q1 2024. This disconnect is masking Bitcoin Well’s leadership position in Canada as a conduit to Bitcoin in the traditional finance space, making it a strategic M&A target should the cryptocurrency establish itself in the global financial system over the long term.

Adam O’Brien, Bitcoin Well’s founder and chief executive officer, joined Lyndsay Malchuk on our sister publication, The Market Online, to discuss the company’s value proposition.

Liberty Gold

Last up in our look at contrarian stocks is Liberty Gold (TSX:LGD), market cap C$127.57 million, a junior gold miner exploring and developing two open-pit oxide deposits in the Great Basin of the United States, one of the most prolific gold-producing regions in the world stretching across Nevada, Idaho and Utah.

Its Black Pine project in Idaho houses a large, highly prospective mineralized oxide gold system backed by past production of 435,000 ounces and multiple drilling campaigns. The project’s 2024 mineral estimate details more than 3.2 million ounces of oxide gold indicated and 325,000 ounces of oxide gold inferred, and stands a fair chance at further growth, considering that management has almost doubled the indicated resource since 2021 and drilling will continue later this year.

Liberty’s Goldstrike project in Utah holds an oxide gold resource that also benefits from extensive past production, including silver, and a 2018 mineral resource estimate of 925,000 ounces of gold indicated and 296,000 ounces inferred. Goldstrike’s 2018 preliminary economic assessment supports expanding scale and scope, offering investors upside from the report’s US$129 million net present value at a gold price of US$1,300 per ounce, well below the current price of US$2,320 as of 3:49 pm ET.

We can also add the TV Tower project in Tukey, a high-sulphidation epithermal and porphyry gold-copper property under joint venture with Teck Resources (TSX:TECK.A), which has yielded a 2014 resource estimate in excess of 1.3 million ounces of indicated and inferred gold equivalent and six gold deposits all open for expansion.

The multi-billion-dollar promise behind Liberty’s properties, demonstrated by its exploration results, stands in contrast to its stock’s 20.24 per cent loss since 2019, gifting investors an asymmetric data-driven chance at making it to mineral production or an asset sale.

Cal Everett, Liberty Gold’s chief executive officer, spoke with Stockhouse’s Lyndsay Malchuk about the company’s recent progress with exploration activities at Black Pine.

Join the discussion: Find out what everybody’s saying about these Bitcoin and junior gold stocks on the Canagold Resources Ltd., Bitcoin Well Inc. and Liberty Gold Corp. Bullboards, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Canagold Resources Ltd., Bitcoin Well Inc. and Liberty Gold Corp., please see full disclaimer here.

(Top photo, generated by AI: Adobe Stock)