- Pampa Metals (CSE:PM), an undervalued copper stock, is revealing outstanding final assay results from drill hole PIU-01 on its 80-per-cent-owned Piuquenes project in Argentina

- The company intercepted 422 metres at 1 per cent copper equivalent

- Pampa Metals is a copper and gold mining company active in Argentina

- Pampa Metals stock has given back 27.14 per cent year-over-year and 49 per cent since 2019

Pampa Metals (CSE:PM), an undervalued copper stock, is revealing outstanding final assay results from drill hole PIU-01 on its 80-per-cent-owned Piuquenes project in Argentina.

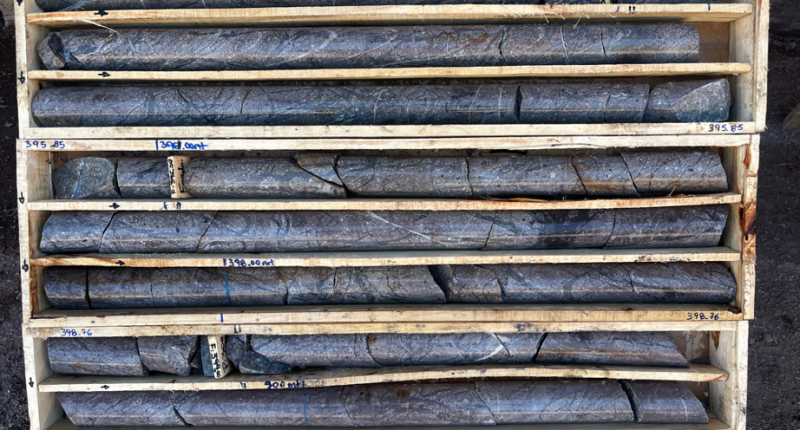

PIU-01 extended copper-gold mineralization on the Piuquenes Central porphyry’s southwestern margin to a depth of 867 metres, yielding:

- 422 m grading 0.48 per cent copper, 0.61 g/t gold and 2.9 g/t silver (1 per cent copper equivalent) from 198 m, including:

- 132 m grading 0.71 per cent copper, 0.85 g/t gold and 4.3 g/t silver (1.45 per cent copper equivalent) from 220 m

- Including 80 m grading 0.6 per cent copper, 0.77 g/t gold and 3.2 g/t silver (1.30 per cent copper equivalent) from 468 m

The drill hole intersected the mineralized intrusion at a depth of 198 m, with supergene copper enrichment observed from 220 m to 380 m overlapping with primary mineralization from 350 m. Strong primary mineralization associated with porphyry A type quartz stockwork veining is present from 350 m to 650m.

Mineralization and quartz veining continue from 650 m to 867 m at a decreasing intensity – including a zone of moderate quartz veining with lower-grade copper-gold mineralization from 650 m to 740 m – while remaining open at depth.

The Piuquenes project resides in the San Juan Miocene Belt – which is home to numerus world-class deposits – near large-scale copper projects operated by Glencore and Aldebaran Resources.

Pampa has backed up limited historical drilling on the project by Inmet Mining (acquired by First Quantum Minerals in 2013) with numerous prospective exploration efforts. These include assaying and re-logging Anglo-American’s 920.2 m-long diamond borehole from 2016, which crossed mineral zones drilled by Inmet, and follow-up drilling initiated in January 2024 that has extended mineralization, as recently highlighted by 304 m grading 1.07 per cent copper equivalent in PIU-01.

The market has rewarded Pampa’s high-potential results with a re-rating to the tune of 750 per cent since November 2023, coinciding with copper’s 14.6-per-cent price increase from approximately US$3.50 to US$4.10 per pound. With work on drill hole PIU-02 underway, and copper production expected to fall short of demand in 2024, potential investors should look for this trend to continue.

PUI-02 will test the lateral extent of Piuquenes Central porphyry mineralization near two historical Inmet holes that yielded 413.5 m at 0.47 per cent copper and 0.52 g/t gold, and 67.5 m at 0.63 per cent copper and 0.51 g/t gold, respectively.

Pampa Metals management insights

“We are very pleased to report exceptional intervals of both supergene enriched and primary copper mineralization in the first hole of our maiden drill campaign at the Piuquenes project,” Joseph van den Elsen, Pampa Metals’ president and chief executive officer, said in a statement. “The campaign is achieving its objective of testing the depth and lateral extensions of the previously reported mineralization at Piuquenes Central. Subsequent drill campaigns will also test the undrilled Piuquenes East porphyry target and other nearby targets identified on the property.”

About Pampa Metals

Pampa Metals is a copper and gold mining company active in Argentina. The junior miner is backed by a management team with decades of experience in mineral exploration and development for small-cap and large-cap companies.

Pampa Metals stock (CSE:PM) is unchanged, trading at C$0.26 per share as of 11:01 am ET. The stock has given back 27.14 per cent year-over-year and 49 per cent since 2019.

Join the discussion: Learn what other investors are saying about this undervalued copper stock on the Pampa Metals Bullboard, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.