- Valorem Resources (VALU) has closed a share-exchange agreement with Regency Mining Limited and its shareholders

- Valorem has acquired all of the issued and outstanding common shares of Regency as well as its Misisi Gold Project

- The Misisi Gold Project covers 133 sq km on three contiguous mining licences and includes the Akyanga gold deposit, which hosts an inferred resource of 3.1 million ounces of gold, averaging 2.16 grams per tonne of gold

- Valorem explores and develops precious metal properties in the Americas and the DRC

- Valorem Resources Inc. was up 18.33 per cent, trading at $0.355 at 12:33 ET

Valorem Resources (VALU) has closed a share-exchange agreement with Regency Mining Limited.

The agreement with Regency, a private arm’s length company incorporated under the laws of Seychelles, also involved the shareholders of Regency.

Under the agreement, Valorem has acquired all of the issued and outstanding common shares of Regency.

Regency owns a 99.43-per-cent interest in Casa Mining Ltd., a private arm’s length company incorporated under the laws of Mauritius, and, indirectly through its ownership of Casa, owns a 73.84-per-cent interest in Leda Mining Congo S.A a private arm’s length company incorporated under the laws of the Democratic Republic of the Congo.

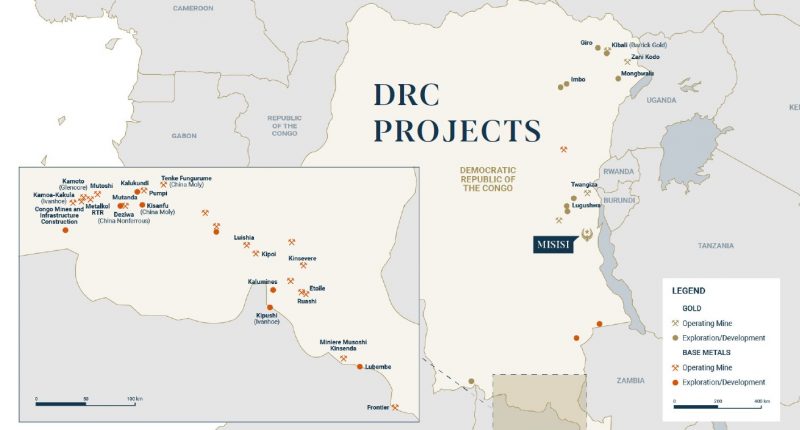

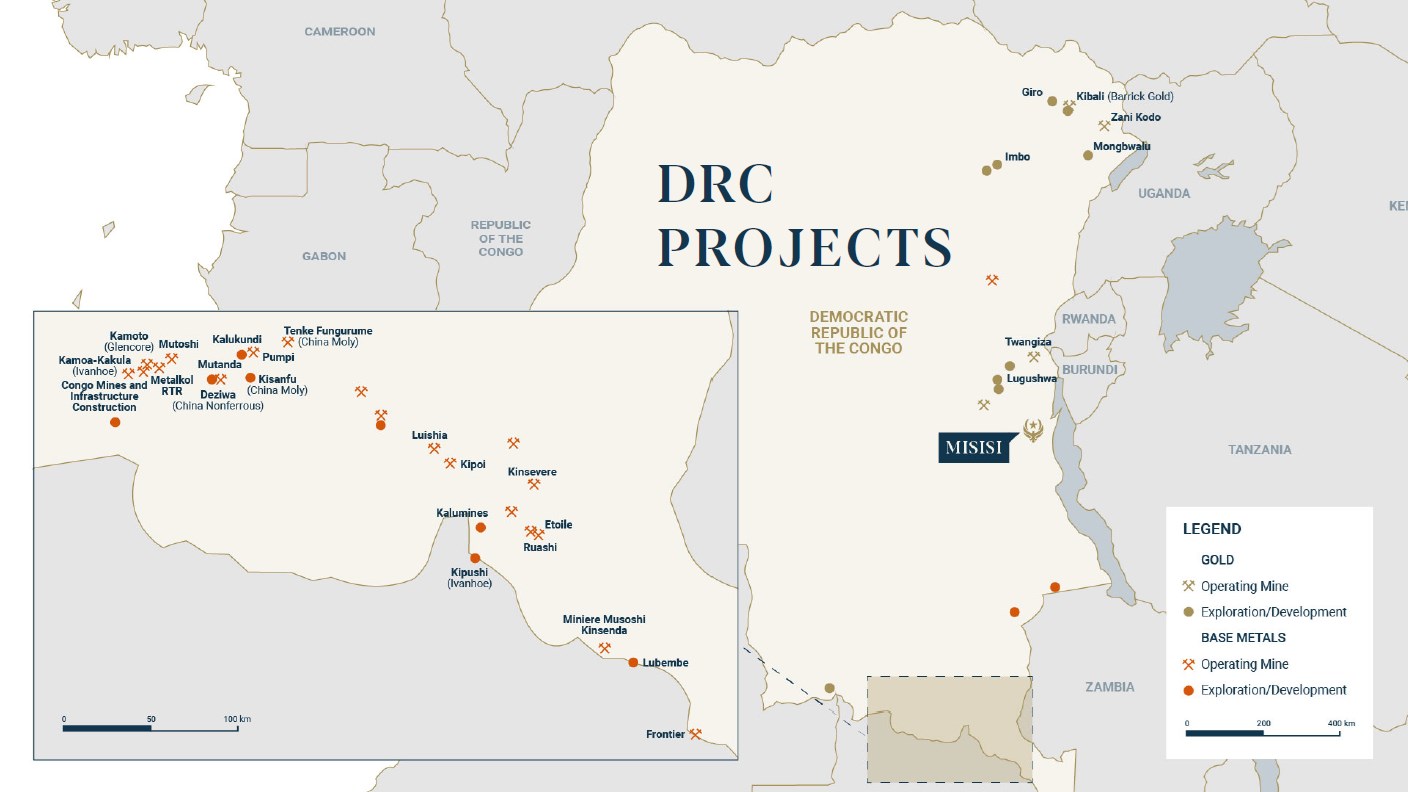

Leda owns an interest in the Misisi Gold project, located in the Fizi territory of South Kivu province, in the DRC, approximately 250 km south of Bukavu and 140 km north of Kalemie.

The Misisi Gold Project covers 133 square kilometres on three contiguous mining licences, valid until 2045 (with extension options) and includes the Akyanga gold deposit, which hosts an inferred resource of 3.1 million ounces of gold averaging 2.16 grams per tonne of gold.

Valorem acquired all of the issued and outstanding Recency shares from the Regency shareholders in consideration for, on a pro-rata basis, a cash payment of US$100,000 and the issuance of an aggregate of 16,000,000 common shares in the capital of the company at a deemed price of $0.29 per share.

The company has also agreed to issue 764,478 units at a deemed price of $0.29 per unit to a certain arm’s length debtor as full and final payment of $221,698.63 in debt, representing the principal amount and any accrued and unpaid interest thereon owing to the debtor under the terms of a loan agreement between the company and the debtor dated May 13, 2022, as amended.

Valorem explores and develops precious metal properties in the Americas and the DRC.

Valorem Resources Inc. was up 18.33 per cent, trading at $0.355 at 12:33 ET.