- West Vault (WVM) has confirmed the Hasbrouck Gold Project’s strong economics in a new pre-feasibility study (PFS) update

- RESPEC Company LLC, based in South Dakota, completed the independent NI 43-101 study on the Nevada-based project

- Highlights include a reduced pay-back period and an increase in IRR from 43 to 51 per cent

- CEO Sandy McVey sat down with The Market Herald Canada’s Sabrina Cuthbert to discuss the new study

- West Vault Mining is focused on gold development properties in North America

- West Vault Mining (WVM) is up by 5 per cent, trading at $1.05 per share

West Vault (WVM) has confirmed the Hasbrouck Gold Project’s strong economics in a new PFS update.

RESPEC Company LLC, based in South Dakota, completed the independent NI 43-101 study on the Nevada-based project, which consists of the Three Hills and Hasbrouck deposits plus a large land package.

The report updates a September 2016 PFS to reflect current costs and metal prices. The mine plan, mineral processing, and mineral resource and mineral reserve statements are substantially unchanged.

Numerous significant and unincorporated gold intercepts on the project offer the potential for resource expansion.

West Vault intends to file the technical report on SEDAR within 45 days.

CEO Sandy McVey sat down with The Market Herald Canada’s Sabrina Cuthbert to discuss the new study.

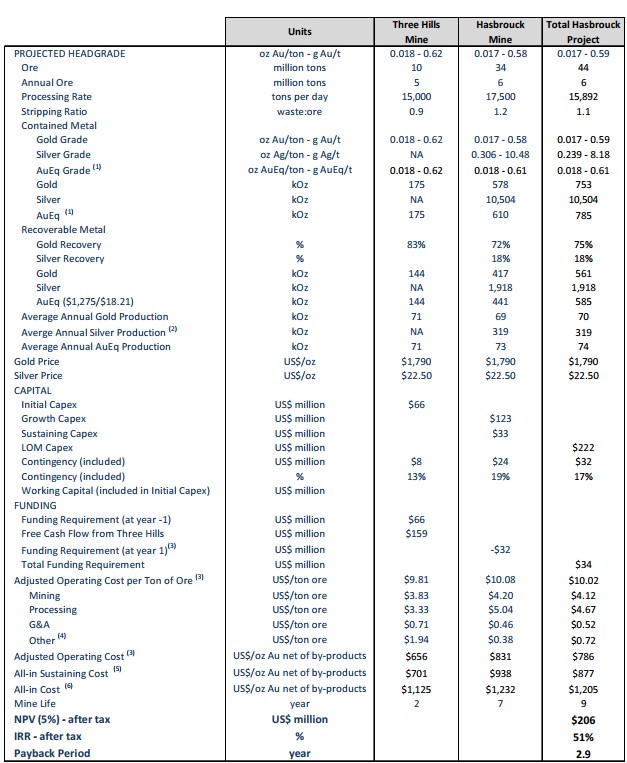

2023 technical report highlights (2016 PFS at US$1,275 gold in brackets)

| Project status | Permitted, construction-ready |

| NPV(5%) (after-tax, US$1,790 gold) | US$206 million (US$120 million) |

| IRR (after-tax, US$1,790 gold) | 51% (43%) |

| Initial capital | US$66 million (US$47 million) |

| Pay-back | 2.9 years (3.1 years) |

| Recoverable gold & silver | 561 koz gold (577 koz); 1,918 koz silver (1,163 koz) |

| All-in sustaining cost | US$877 per gold ounce net of by-product credits (US$709) |

| Geology | well-understood, +600 boreholes, all-oxide |

| Mining | low 1.1:1 strip ratio, minimal pre-strip, above water table |

| Metallurgy | 13 test programs, 75% average heap-leach gold recovery |

| Infrastructure | Water and water-rights obtained, nearby grid power, nearby highway access |

Project highlights (US$)

Hasbrouck Gold Project mineral resources

Mineral resources are reported inclusive of mineral reserves.

Hasbrouck Deposit reported mineral resources

| Class | K Tons | oz Au/ton | K oz Au | oz Ag/ton | K oz Ag |

| Measured | 6,987 | 0.019 | 134 | 0.39 | 2,752 |

| Indicated | 35,041 | 0.015 | 516 | 0.27 | 9,404 |

| M+I | 42,028 | 0.015 | 651 | 0.29 | 12,156 |

| Inferred | 5,161 | 0.011 | 56 | 0.19 | 986 |

Three Hills Deposit reported mineral resources

| Class | K Tons | oz Au/ton | K oz Au |

| Indicated | 10,423 | 0.018 | 185 |

| Inferred | 1,008 | 0.017 | 17 |

West Vault Mining is focused on gold development properties in North America. It has consolidated a significant position in southern Nevada’s Walker Lane gold trend.

West Vault Mining (WVM) is up by 5 per cent, trading at $1.05 per share as of 9:40 am EST.