Couch potato investing – also known as index investing – has emerged as an investment strategy, especially for investors looking for long-term gains without having to regularly manage their portfolios.

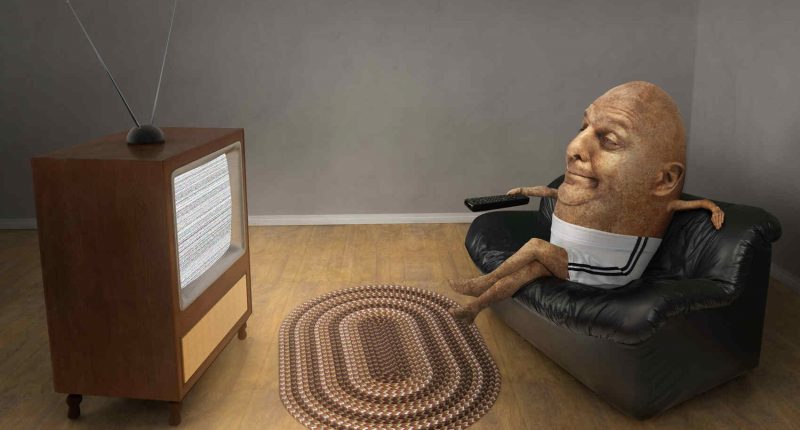

You might be thinking this strategy sounds lazy – after all, that’s what being a couch potato is all about – but there’s the old saying, “Work smart, not hard.”

If this sounds appealing – sitting back comfortably while simultaneously growing your portfolio – then this investment strategy might just be the solution for you.

All of this is to say that being a couch potato doesn’t just mean sitting around in your sweats eating chips and watching television until 2 in the morning.

Breaking down couch potato investing

Scott Burns created this investment strategy back in the early 1990s as a way for individuals to break free from portfolio managers to handle their investments.

The idea of this strategy was that investors would hold two funds split 50/50 in order to have a balanced portfolio. The goal was to have portfolios replicate returns of market indices, while investors would rebalance their portfolios on a yearly basis to maintain that split allocation.

Putting it simply, a diversified portfolio was intended to offer consistent, high returns as opposed to “active” investing with reduced risks.

In addition to having more control over investment opportunities, couch potato investing is low cost, low maintenance and doesn’t take long to set up.

When it comes to the actual portfolio, investment opportunities are usually divided between stocks and bonds.

For example, investors might choose to put money into common stock – such as stocks that trade on Canadian exchanges like the Toronto Stock Exchange, TSX Venture Exchange or the Canadian Securities Exchange – while putting the rest into bonds or mutual funds.

This strategy is particularly beneficial for investors looking for more stability in their portfolios while allowing for long-term growth.

Benefits of couch potato investing

Aside from being a relatively passive form of investing, couch potato investing is cost-effective and allows investors to literally do it themselves.

With that said, here’s a breakdown of the benefits this investing method can provide, including:

Commission-free: managing your own portfolio means you’re not paying commission fees to have someone else manage it for you. Investors can monitor their investments through apps such as Wealthsimple Trade and Questrade. Although Questrade takes a small fee, Wealthsimple does not charge a commission fee. Investors can also use mutual funds such as Tangerine Investment Funds and TD e-Series Funds

Long-term gains: Investors don’t have to keep up with the markets as frequently as other investment strategies. In other words, couch potato investing enables watching portfolios grow over time instead of pumping and dumping stocks

Portfolio diversification: Couch potato portfolios are often made up of index mutual funds and exchange-traded funds (ETFs), which each provide a broader exposure to industries and companies rather than investing in a single stock.

Reduced risk: In tandem with portfolio diversification, couch potato portfolios provide risk reduction resulting from mutual funds and ETFs. Stocks are often more risky because of volatility in the market, but mutual funds and ETFs cast a wider safety net.

Building your portfolio

Building a couch potato portfolio is quite simple and can be done on your own terms.

Putting together your portfolio takes only a few steps, including:

Opening an investment account. Using popular brokerage and trading apps such as Wealthsimple or Questrade is the first step to get your portfolio ready.

Choose how to build your portfolio. This is pretty straightforward. There’s no specific way investors should build their couch potato portfolios, but splitting between bonds, mutual funds and equities in an 80/20 or 50/50 split is common.

The bottom line

Couch potato investing is a great solution for investors looking for a low-risk, low management method.

Additionally, setting up a portfolio is relatively easy – as long as you have an internet connection – and doesn’t cost anything to do so.

Not only that, being a passive investor allows your portfolio to grow without feeling pressured to check in on it every day, allowing you to focus elsewhere while your assets continue to grow.

It’s important to remember, however, that your portfolio won’t grow overnight, so staying the course and thinking long-term is key if you plan on adapting this laid-back investment style.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.