Is the boom over in real estate? Ominous recent headlines are giving many investors second thoughts about real estate-based investments.

U.S. home sales fall for 8th month in a row in September, the longest slump since 2007

In the U.S. 74% of Americans are now expecting a housing crash “as bad or worse than the housing market’s implosion in 2008”.

Sentiment in real estate is equally grim in Canada.

Canadian Real Estate Bubble Sentiment Is Collapsing Fast: US Federal Reserve Data

The same media outlets that continuously denied (year after year) that there were housing bubbles in the U.S. and Canada are now jumping onto the bandwagon to predict the implosion of these bubbles.

The catalyst for the rupturing of these housing bubbles is simple: soaring interest rates. The same central banks that kept interest rates much too low for much too long (and created these housing bubbles) are raising interest rates at a record pace.

With housing prices at bubble levels, these rising rates have caused housing affordability to plummet lower as (potential) mortgage payments go through the roof.

This has killed demand. Home sales have already collapsed in many markets. Home prices are next.

Are high interest rates good for investing in the rental market?

CIBT Education Group Inc. (TSX:MBA/OTC:MBAIF) is a real estate stock that has been building momentum while virtually every other player in real estate is wilting-on-the-vine.

How has CIBT emerged as a counter-cyclical bellwether in the real estate sector? Its focus is on the rental housing market, specifically student rental housing.

Unlike housing sales, higher interest rates are having little to no negative impact on the rental housing market.

What do prospective home-buyers do now that they have been priced out of the market to purchase a home? They rent.

What do housing speculators do now that the opportunity to “flip” houses is evaporating – and they are sitting on a lot of inventory? They rent.

That’s a good setup for the rental housing market (and rental housing investments) in an environment of soaring interest rates.

Student rental housing is insulated from economic downturns

The fundamentals for student rental housing are much stronger still. The Market Herald has laid out CIBT Education’s strong fundamentals in previous coverage.

CIBT Education offers small-cap GROWTH and STABILITY

- Lower sensitivity to the valuation or transaction volume

- Lower sensitivity to recessionary conditions

- Minimal competition due to significant capital requirements

- Strong demand and a large addressable market

Interest rates

As noted, rising interest rates have no (direct) harmful impact on rental demands. In fact, rising rates are stimulating rental housing demand and depleting the rental housing supply.

The picture is slightly different (i.e. better) for student rental housing. Higher interest rates are more likely to restrict the new development and supply of student housing rental units – while demand remains strong from new immigrants and international students coming to Canada.

Dramatically higher interest rates create a huge barrier to entry to add new (off-campus) student rental buildings. On-campus housing such as UBC and SFU are already swamped with long waiting lists

Recession

While a severe recession may (eventually) impact the rental housing market, student rental housing is largely insulated from even dramatic downturns in the economy. Students will continue to attend schools, and parents will continue to assist their children in attaining their education.

CIBT is especially well-positioned for any recessionary conditions. Roughly 75% of its student renters are foreign students. This implies students with affluent parents.

Education is one of the last expenses to be cut from any family budget in a recession. Affluent households are even less likely to make cuts to their education budget.

During the worst of the Covid pandemic, CIBT’s occupancy rate remained strong. These foreign students were happy to stay in Vancouver for safety reasons and maintain their (Canadian) rental housing.

Minimal competition

CIBT’s biggest “competitor” in providing off-campus student housing in Canada is the provincial and local government. But the government has been forced (due to unmet demand) to step into this market in order to release the rental inventory to local renters and the affordable and social housing needs.

The government is already a reluctant competitor here because of the capital requirements to create new affordable and social housing. Soaring interest rates will dramatically increase that reluctance to compete.

Meanwhile, CIBT has a pipeline of 14 off-campus student rental housing facilities. Seven of these are already operational, with seven more to still come online. And higher interest rates and huge capital demands slam the door on new competitors moving into this lucrative niche.

Strong demand and a large addressable market

CIBT Education has a lot of new student housing units already under construction. Its current facilities boast an average occupancy rate of 99+%. Will these new units continue to be filled?

Yes.

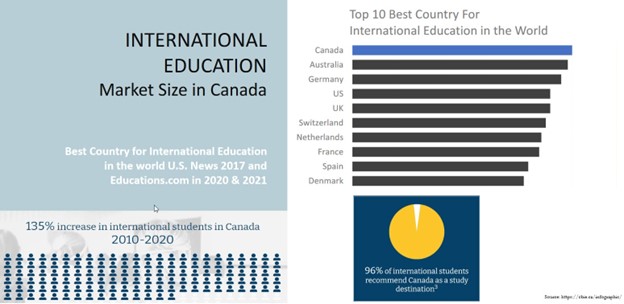

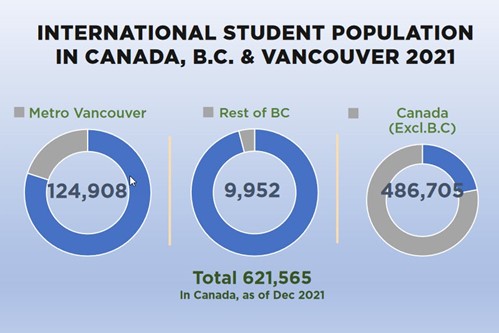

Canada has become the preferred destination globally for foreign students. CIBT’s portfolio of student rental housing is focused on Vancouver – one of the strongest segments of the Canadian student rental housing market.

The stellar opportunity in Vancouver’s student rental housing

High barriers to entry (for competitors). Rock-solid demand. Strong growth.

Dangle those fundamentals in front of investors and watch them salivate.

In CIBT’s just-released financial results for fiscal 2022, CIBT’s full-year revenue of CAD$73.235 million was a 20% year-over-year increase despite COVID impacts. CIBT’s rental revenue alone (from CIBT’s GEC housing division) jumped 88% to C$18.547 million.

Further clarification is necessary for investors who are new to CIBT Education Group. This is a fully-integrated education services company. From educating students to housing them, CIBT has deep experience and expertise – and is benefitting from these strong synergies.

It’s the growth potential for off-campus student rental housing (via GEC) that has become the primary driver for the company’s revenue and earnings growth. And CIBT’s current rental revenue numbers are just the tip of the iceberg here.

Vancouver student rental housing is a CAD$1.6 billion market.

Now let’s crunch the numbers. CIBT’s 2022 rental housing revenue of CAD$18.5 million represents slightly over 1% of this $1.6 billion Vancouver student rental housing market.

The other 99% of this market represents future growth potential. And CIBT’s largest (reluctant) indirect competitor here – government-funded university housing – would be happy to see CIBT take as much of this market share as possible.

The CIBT student rental housing advantage

CIBT Education Group is poised to increase its revenue in Vancouver student rental housing by as much as 100X (10,000%). How much growth here is realistically achievable?

To answer that question, let’s first ask another question. Where are the rest of Vancouver’s student population currently housed (apart from domestic students who live at home)?

With on-campus housing only meeting a fraction of demand and (dedicated) off-campus housing for students currently in low supply, these students are mostly forced into the general rental market for housing.

CIBT’s rental housing units are custom-designed to cater to the requirements of students. Advantages include:

- Fully furnished, including cooking utensils, bedding supplies, high-speed internet, hydro and utilities, weekly housekeeping, 24 hours check-in, on-site caretaker and stringent security

- Hideaway furniture to maximize living space

- Located near subway stations or along main public transit arteries

- Diversified student population (71 different countries)

- “Student-centric” design

- Supply accommodation service to 92 schools

CIBT doesn’t have to guess what these students are looking for in rental housing. “Education” is literally the middle name of CIBT Education Group, with the company enrolling ~10,000 students per year in its own educational facilities.

About half of CIBT’s 14 properties will continue to come online in upcoming years (representing an asset portfolio of CAD$1.4 billion when all are completed). Students will be lining up for access to these student-centric properties.

The company’s next student housing facility – GEC King Edward – will be operational at the beginning of 2023. Another strong boost to incremental revenue.

Now connect this 10,000% growth potential with CIBT’s current market cap: CAD$35 million.

That market cap is less than ½ of total current revenues. More importantly, it is less than a 2X multiple for only the company’s current student housing revenue, where spectacular future growth is staring investors in the face.

The bright future for Canadian (Vancouver) student rental housing

As trouble brews in the overall real estate sector, CIBT’s Chairman and CEO Toby Chu is seeing both more questions and more interest in CIBT Education’s student housing business model.

The questions are coming from reporters, both for newspaper articles and in recent webinars in which Chu has participated. While the CEO knows student housing like the back of his hand, for reporters covering real estate, student housing is a brand-new niche.

Their inquiries are often about “the Canadian rental market” in general rather than being focused more narrowly on student housing.

The CEO politely lays out the fundamentals for the overall Canadian rental market for these reporters as he sees them. Then Toby Chu articulates the exciting advantages of CIBT’s focus on student rental housing.

“The student rental market generates much higher rental yield for our investors, which further increases the property value upon exit. Higher turnover and labour costs are associated with higher rental yield than most conventional rental properties. To reduce our operating costs, we have a fully integrated infrastructure which includes business development, marketing, reservation, automated check-in, housekeeping, security, and daily operations. Focusing on Metro Vancouver allows us to achieve economies of scale by spreading our infrastructure costs across all properties.”

The increased interest in CIBT, as an investment, is coming primarily (at this point) from institutional investors, a.k.a. “the Smart Money.”

While many retail investors may be thinking of primarily fleeing in panic when it comes to real estate – as the broader market implodes – institutional investors generally take a more sophisticated approach.

Rather than abandon real estate as a whole (which may represent an important component of their asset management), institutional investors look for opportunities to rotate into niche markets.

The Smart Money real estate investment for TODAY

CIBT is currently standing out as “a niche market” in real estate, a counter-cyclical bellwether.

(Student) rental housing is the new real estate sweet-spot

After years of outperformance (as bubbles grew), the general real estate market has become a minefield for investors. Even sophisticated investors are being caught with their pants down.

Blackstone, a leading global asset manager, just announced it is curbing redemptions in its $69 billion REIT, which targeted high net-worth investors. Those billions are now essentially frozen as the overall real estate market goes from the penthouse to the basement. Ouch!

The old cliché in real estate is that success is governed by three words: location, location, location.

CIBT is located in the strongest student rental housing market in the world’s best student rental housing market.

Toby Chu subscribes to that cliché. However, in speaking with The Market Herald, he wanted to stress GEC’s formula for success.

“Besides locating at excellent locations, we emphasize three additional factors: high cash-flow yield, excellent building conditions, and no vacancy.”

Other real estate investments appear to have clearly peaked, with many looking at dramatic reversals. CIBT’s best years are still to come.

With a mere CAD$35 million market cap and 100X growth potential in the Vancouver student rental housing market, and proven track records, astute real estate investors will want to rotate into CIBT Education Group sooner rather than later.

FULL DISCLOSURE: This is a paid article by The Market Herald.