So far, the summer 2024 is shaping up to look like the point where Trillion Energy International Inc. (CSE:TCF; OTCQB:TRLEF Frankfurt:Z62) is poised to break out of its lows and make a significant ramp up of its oil and gas production.

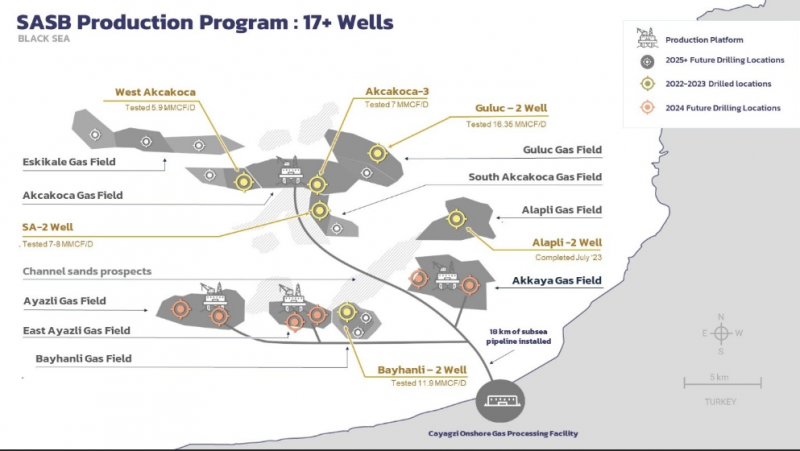

This Canada-based junior international oil and gas company is kickstarting its work program on eight wells at the SASB gas field located offshore Turkiye in the Black Sea region, where Trillion Energy has successfully drilled six offshore natural gas wells boosting its reserves and it is further planning exploration for crude oil in Southeast Turkiye.

The current program comes on the heels of Trillion Energy’s 2023 Year End Reserve Report with proved plus probable natural gas and oil reserves valued at US$420.5 million as well as generating just under US$17 million in revenue in 2023 – which is impressive for a company with a current market capitalization of just C$14.79 million.

Shares of Trillion Energy are currently trading at historic lows of $0.12, down from $1.93 last June as water loading issues adversely affected production and one of its major institutional shareholders went into receivership, causing an enormous selloff of its stock last fall. A lot has changed since then, the Company has brought on board a new COO, and is set to implement a workover program to solve water loading issues and return to production using cost-effective velocity string tubing and pumps.

At the halfway mark of 2024, investors can expect the start of an 8-well workover program for already drilled wells, which will convert gas reserves to steady cash flow for the Company. This is key as Trillion will not incur exorbitant drilling costs and will focus on improving existing production instead. Understanding this and the history of the last year, Trillion Energy becomes an enticing investment opportunity.

As Trillion solidifies itself in a strong position for 2024 and beyond, the Company is also raising a private placement funds where it has closed $1.8 million and is oversubscribed at this point.

Trillion Energy private placement details

In a press release, the Company stated it will use the funds of the private placement to:

- pay the costs and cash commissions of the offering of up to $100,000;

- pay semi-annual interest on outstanding debentures for $900,000;

- pay for investor awareness programs for approximately $250,000 and the remainder to working capital;

- save and accept settling certain debts of the Company for approximately $450,000.

Future outlook for Trillion Energy

With the Company’s operations in Europe, Turkiye specifically, the Company’s roots are vital in the region.

Turkiye is the seventh largest natural gas consumer in the world with huge domestic demand for natural gas at gas prices much higher than North America, gas sells for US$12/MCF. The Country showed stable price for the commodity in the $12 range during the past 6 months with the market tendency to heat up anticipating winter.

Over the past couple of years, Trillion has strategically raised more than $42 million and $15 million in debt to drill gas wells in the Black Sea during the height of the energy crisis gripping Europe. The Company made its drilling decisions based on solid seismic data and deep knowledge of the industry which developed into three new discoveries being made in the region resulting in six new producing wells for Trillion.

A total of five wells were drilled in 2023 (five out of five successes) while this year the Company plans for eight workovers (five from its 2023 program as well as three additional ones) for a cost of $2.7 million. By the end of the year, Trillion Energy is targeting to increase production to an 8.5 million cubic feet per day (mmcf/d) exit rate for existing wells.

In 2023, originally Trillion set out to drill 13 wells, however, the program was paused after six wells were completed. The Company is planning to get back at it in 2025, planning to pick up where it left off, adding six to seven more sidetrack wells to access identified but unproduced gas reserves at SASB, further increasing production.

Beyond production, the Company is almost complete in mapping reprocessed 3D seismic so that it can determine and propose new exploration work programs in and around the SASB block. The new reprocessing technology improved the resolution of the seismic, defined new exploration targets, and delineated new potential reserves and resources on SASB.

“If this exploration well is successful, it will derisk numerous stratigraphic exploration prospects consisting of either on-lapping blanket sands or channel-like sand deposits,” the Company said in a statement.

The investment corner

The bottom line is Trillion’s stock is heavily discounted versus its peers based on reserve values as it moves into production and subsequent cash flow.

In other words, Trillion Energy will increase its production and strengthen its balance sheet and, in turn, yield returns for investors looking for a low-cost opportunity with massive upside potential.

Now that Trillion Energy is back with a summer production work program at the SASB Gas field, investors can expect steady news flow in the short and long-term throughout the summer.

With the Company’s proven track record in the region and high reserves, Trillion Energy presents itself as a unique play with a portfolio of exploration prospects in Turkiye that could add significant reserves and production. If ever you were looking for an entry point to invest, this would be the time.

Join the discussion: Find out what everybody’s saying about this stock on the Trillion Energy Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Trillion Energy, please see full disclaimer here.

Top photo: Trillion Energy