Preparation. Intensity. Focus. Those are the three key words that underline the 2022 Exploration Program of Blue Star Gold Corp (TSX-V:BAU) (OTCQB:BAUFF). When these three cohabit, the outcome is usually predictable.

Announcing its summer exploration program a few days ago, the gold exploration and development company disclosed that the program will involve a multi-dimensional exploration work program across its Ulu, Hood River, and Roma projects. The program will have two key areas of concentration namely: on one hand will be infill and expansion drilling; on the other hand, will be pipeline target review and development throughout its highly prospective landholdings.

The program will be funded by a recently-announced $6,000,000 private placement. The company has stated that over 75 per cent has already been arranged based on firm expressions of interest and will see the company’s Nunavut projects fully funded through this year. This should be welcome news to current and potential investors.

What other key markers should interest investors in Canada’s far north? Nunavut has four active producing mines, twenty-three active gold projects, and one base metals project. A decade of growth has seen the value of mineral production exceed the NT’s. Blue Star is in a mining-friendly jurisdiction and operates over one of the last highly prospective and under explored frontiers.

Blue Star Gold’s 2022 Program Highlights:

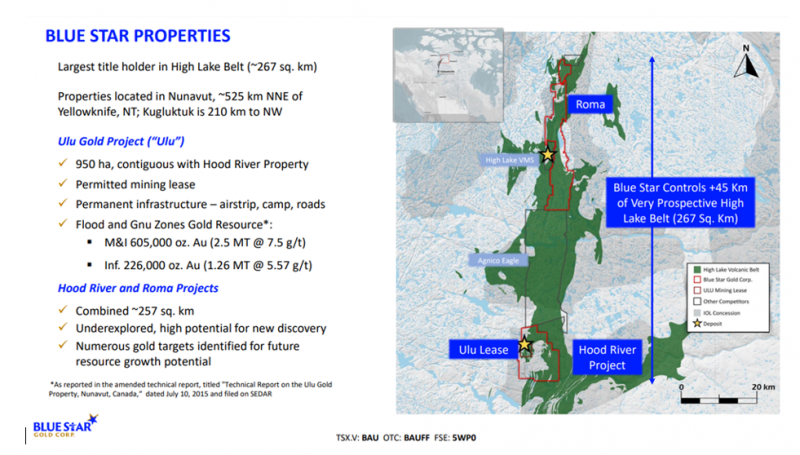

- Blue Star is the largest title holder in the highly prospective and underexplored High Lake Greenstone Belt in Nunavut, controlling +45 km of the Belt.

- The company holds a 100 per cent interest in three projects namely the Ulu Gold project, the contiguous Hood River project, and the Roma project.

- The Ulu project hosts the Flood Zone deposit, where a significant high-grade gold resource has been outlined.

- Excellent resource expansion potential exists in a number of identified targets over the company’s extensive landholdings.

- The first ever compilation and systematic desktop review of +100 historical exploration targets was recently completed; abundant discovery potential exists in the pipeline of prospects with drill-ready targets.

Grant Ewing, Blue Star’s CEO, stated:

“The current program will build off the knowledge acquired in prior programs with respect to new mineralisation styles, potential geochemical and structural controls, as well as the systematic compilation of the targets in the historical dataset.”

Exploration Program Summary

To enhance targeting, Blue Star engaged Precision GeoSurveys Inc. of Langley, BC to undertake a comprehensive high resolution heli-borne geophysical survey utilizing Precision’s proprietary four-sensor magnetic gradient system to refine the structure, lithology, and alteration prior to mapping and prospecting programs.

The geophysical program for 2022 consists of 1,690-line km at 50 – 100m line spacing over the entire Roma landholdings that were not covered in the 2021 survey, and 1,365-line km at 50 m line spacing over the entire Ulu lease and Hood River concession that was not previously flown in the 2021 survey.

In addition, the recently discovered Gnu zone polymetallic vein that returned 5.34 m of 3.7 g/t gold in drill hole 21BSG020 and 8.15 m of 20.8 g/t gold in drill hole 21BSG007 during the 2021 program will be evaluated further using a magnetics / VLF-EM system. Parallel structures within this 700 m x 150 m target area will also be assessed.

Blue Star has engaged NorthTech Drilling Ltd. of Yellowknife, NT to carry out the company’s drilling program focused on resource expansion and priority target evaluation. A balanced program of +3,000 m of infill, follow-up, and initial evaluation drilling is currently scheduled with opportunities to expand through the season.

Blue Star will also be undertaking a regional sampling program using Portable PPB Pty Ltd’s detectORE patented low-level gold by pXRF technology in addition to traditional mapping and prospecting programs.

Blue Star Gold Corp. shares have been recording an impressive outing in the stock market. In the last six months, the stock has gained 33.33 per cent, rising from $0.48 on December 13 to $0.64 on June 10. Since April 26 to date, the stock has not sold for less than $0.60 per share.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.